The Yin and the Yang of Shadow Banking in China

By almost any measure, China saves more than virtually any country in the world. Over the past decade, gross national savings has amounted to about one-half of GDP. And that phenomenal rate continues: only Qatar and Macau save more (see chart). There are many good reasons to save. At the top of the list in China has been the high marginal return on capital that naturally accompanies rapid economic growth.

Gross Savings Ratio (Percent of GDP) in 2012

Source: World Bank. Savings are calculated as gross national income less total consumption, plus net transfers.

Despite this, households in China until recently have had few attractive avenues for saving. In particular, regulatory caps severely limit deposit rates to a level far below the growth rate of the economy. This was part of a strategy whereby the government – through the large state-controlled banks – funneled an outsized proportion of savings to favored borrowers, typically state-owned enterprises (SOEs), at low interest rates (again, relative to the pace of economic growth). Chinese authorities could count on households to save due to powerful precautionary motives: as the "iron rice bowl" of welfare and employment guarantees eroded, households faced increased income volatility along with prospective new spending needs for education, health care, housing, and retirement.

To see the size of the distortion, we can compare the one-year deposit and lending rates in China and United States with their respective nominal GDP growth rates since 2000 (see table). On average, Chinese banks earned a spread over deposit rates of 3.3 percentage points, or roughly twice that of U.S. lenders. Nevertheless, the ultimate borrowers in China, typically SOEs, could obtain loans at a cost less than half the country’s average growth rate! That’s a huge wedge. Even relatively weak firms could earn a sizable profit if they borrowed and invested a lot.

| Average since 2000 | China | United States |

| Deposit rate | 2.6% | 2.7% |

| Lending rate | 5.9% | 4.4% |

| Nominal GDP growth | 13.0% | 4.0% |

| Note: The U.S. deposit rate is the 12-month LIBOR rate, while the U.S. lending rate is the 1-year adjustable mortgage interest rate. Sources: PBOC (via CEIC), World Bank, and FRED. |

This brand of financial repression distorts the allocation of capital and slows economic growth. In the case of China, combining artificially low interest rates with officially directed lending delays the shift of resources away from less productive SOEs toward more productive private businesses. It also diminishes the welfare of households who receive a low return on their savings. Not surprisingly, economic reformers in China have long called for a liberalization of the financial sector as a way to sustain long-term growth prospects. They also have advocated that SOEs pay dividends corresponding to something closer to the market cost of capital. These changes would both nudge the firms to be more productive and benefit the households that (indirectly) own them.

Enter shadow banking. In 2008, as the global economy tanked, China sought to energize domestic demand, partly by relaxing the supply of credit. To attract funds, regulators allowed banks and others to offer savings products that looked a lot like short-term deposits, but with much higher interest rates – often in excess of 10 percent – far above the average cap on one-year deposit rates of 3% since 2008. These instruments included “wealth management products” at banks, accounts at trust banks, and more recently, money market funds. Investors, with a hunger for returns closer to those consistent with economic growth, flocked to these products.

One way to view shadow banking in China is as a backdoor liberalization of household finance. That’s the yin. The yang is that this liberalization is occurring in the shadows of a financial system that is still plagued by soft budget constraints on the part of both lenders (the banks and other intermediaries) and borrowers (especially SOEs and local government financing vehicles – LGFVs). This, plus the lack of clarity about who bears the risks of failure, leads many people (including us) to worry about financial stability.

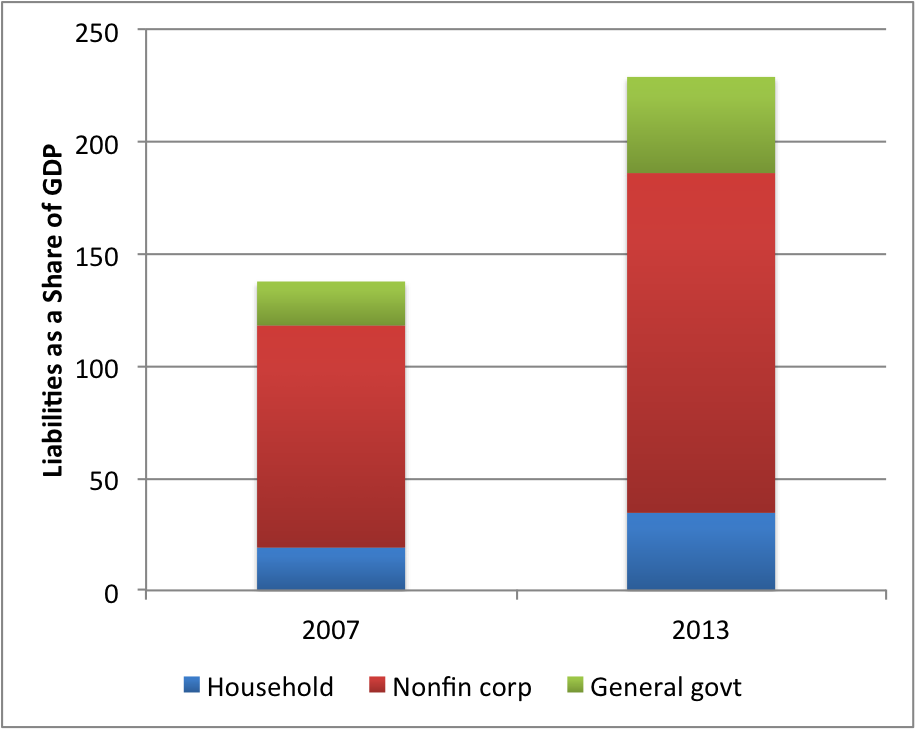

Credit booms like the one China is experiencing are the fuel for financial crises. “Total social finance,” a broad measure of the provision of funds in China, has grown at an average annual rate in the high teens since the end of 2007. Within that aggregate, less traditional lending, including trust loans and “entrusted loans,” has expanded even more rapidly. As a result, the ratio of overall credit to GDP has soared to more than 200% of GDP (see chart). Relative to GDP, nonfinancial corporates in China are now the most indebted among all the countries for which we have accurate data.

Furthermore, a significant portion of the credit in China has flowed through off-balance sheet finance to municipal real estate-related projects. According to one estimate, as of 2012, by accounting for LGFVs in a broader definition of general government, the level of general government debt rises by more than 20% of GDP, while the fiscal deficit climbs toward 10% of GDP.

China: Liabilities as a Share of GDP, End-2007 and End-2013

Source: BIS.

Fortunately, the Chinese central government’s finances still appear sustainable (see here). Even various measures of contingent liabilities do not appear large by international standards. Consequently, when nonperforming loans increase, as they have this year, the government can marshal the resources to step in – as it has in the past – to clean up the large banks’ balance sheets and, if necessary, recapitalize them.

For a few years, then, the government can forestall a financial crisis even as loans go bad and financial capital erodes. But over time, bailouts and regulatory forbearance undermine the discipline needed to make the financial system efficient. Absent market forces – including the trauma of borrower failures and creditor losses – there is little incentive to limit or even monitor risk taking. And, the allocation of capital will continue to be inefficient, inhibiting economic growth. Indeed, these are the same poor incentives that led to zombie firms and zombie banks in Japan, along with more than a decade of economic stagnation, after the land and equity asset bubbles of the late 1980s burst.

The challenge for China’s authorities is to save the yin of shadow banking and bury the yang. Rather than hold deposit and lending rates down, and direct credit to inefficient users of funds, authorities need to allow market forces that promote efficiency and reward savers, while using narrowly-drawn regulation to secure financial stability. Success will allow a transition to a regime of higher consumption and lower national savings combined with high growth.

The recent global crisis shows that this is a tall order for any country. For China, it may be especially so. Some of the country’s most stunning successes – especially its rapid infrastructure development – reflect the government’s virtually unrestrained use of its powerful authority. In contrast, building a large and efficient financial system requires curbing that authority. It remains to be seen how feasible such government self-restraint will be in China.