Residential real estate in China: the delicate balance of supply and demand

When President Nixon and Chairman Mao shook hands in Beijing in 1972, only 17% of the 862 million Chinese lived in urban areas and the entire stock of housing was state owned. Today, more than half of China’s 1.4 billion residents live in cities, while 9 out of 10 households own their homes. Unsurprisingly, this housing revolution has brought with it a property price boom. Over the past decade, urban land prices have risen more than four-fold, with high flyers like Beijing surging by a factor of more than 10 (for the data, see here).

Will China follow the same path the U.S. took in the last decade? Will China’s boom turn into a bust?

Because of the country’s scale, the answers to these questions matter greatly not just for China, but for the global economy as a whole. Today, China accounts for 13% of global GDP at market exchange rates (about 60% of U.S. nominal GDP). So, despite the recent slowdown in annual economic growth from 9% to about 7% annually, China remains the leading contributor to global expansion. In addition, swings in Chinese demand have become a principal determinant of global commodity prices. At home, construction drives a significant share of activity: China reportedly used more cement in the first three years of this decade (2011 to 2013) than the United States did in the entire 20th century! Real estate prices also matter for the health of China’s financial system: municipalities, which rely on land sales for revenues, borrow extensively from the shadow banking system to finance infrastructure investment.

So, which direction are China’s housing prices headed? The truth is that no one really knows. On the upside, rising incomes and advances in urbanization promise support for housing demand, while policy constraints limit supply in select cities. But there are reasons for concern. Housing prices are high by comparison to both rents and incomes, and the opportunity cost of holding real estate is rising. Indeed, as China eases caps on bank deposit and lending rates, the rise in the effective discount rate poses a particular threat to high asset prices.

So, what are the fundamental facts? Let’s start with residential real estate prices. The next chart shows end-2014 price-to-rent ratios in Chinese cities (for details of the data construction, see Wu, Gyourko, and Deng). The average is nearly 32, with seven cities currently over 40.

Price-to-rent ratios for Chinese cities, 2009 and 2014

Source: Y. Deng, J. Gyourko, and J. Wu, "China's Housing Markets: What We Know and What We Need to Know," mimeo, The Wharton School, University of Pennsylvania, 2015.

The flow of rent on a home or apartment is much like the flow of dividends from owning equity, so we can interpret these price-rent ratios as we would the price-dividend ratios on corporate stocks. Using a simple dividend discount model (see here), high price-rent ratios – like those for Chinese cities – can be justified by some mix of a rapid projected rise in rents (analogous to the growth in dividends) and a low discount rate.

But high price-rent ratios exhibit knife-edge sensitivity to changes in both projected rent growth and the discount rate. To see this, imagine a price-rent ratio of 50 based on a projected rental growth rate of 4% and a discount rate (including both the risk-free rate and the housing risk premium) of 6%. Either a one-percentage point drop in the expected rate of rental growth to 3% or a one-percentage point rise in the discount rate to 7% would slash the warranted price by nearly one third. Alternatively, a one-percentage point rise in the growth rate of rents or an equivalent decline in the discount rate would roughly double the warranted price.

What are the prospects for rents in China? It depends on how sensitive the demand for floor space is to the mix of rapid urbanization and rising per capita incomes, and how aggressively policies limit supply.

Urbanization has been a key feature of modern economic growth since the beginning of the Industrial Revolution. Urban workers are generally more productive than farmers, so migration from rural areas to cities is usually accompanied by faster economic growth and rising per capita income.

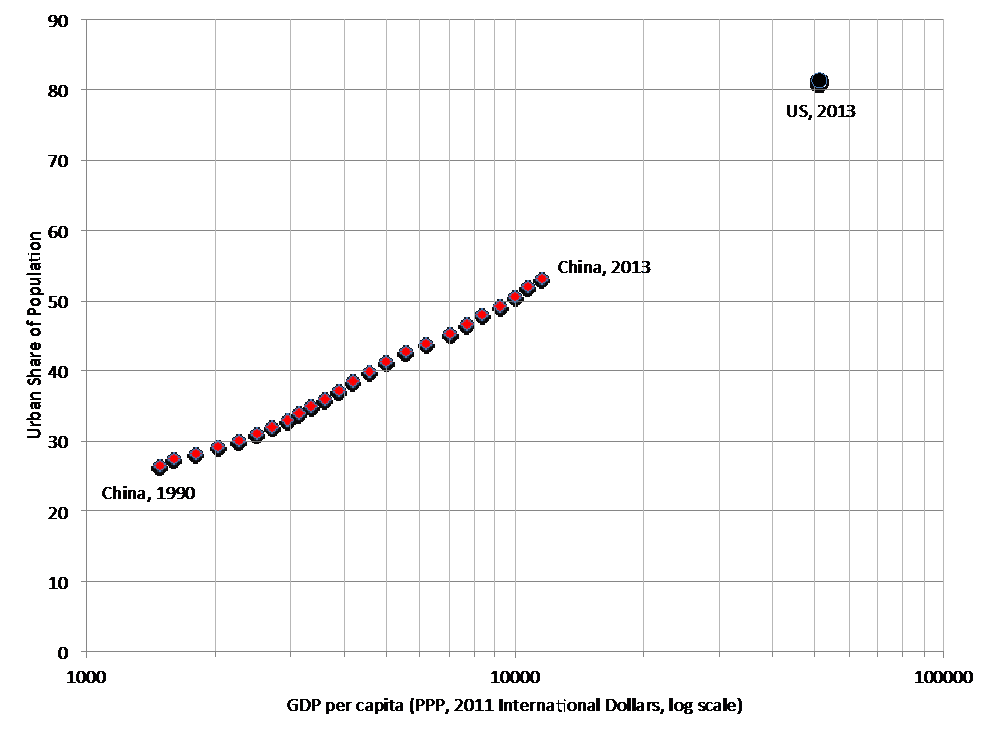

As the next chart shows, China’s urban share reached 26% in 1990 and then doubled to 53% by 2013. At the same time, per capita income growth in China soared. By one measure, real per capita income (adjusted for purchasing power parity) doubled from 1970 to 1990. Then, from 1990 to 2013, the World Bank estimates that real per capita income rose by a factor of nearly eight (see chart)!

China and the United States: Urbanization rate versus GDP per capita (1990-2013)

Source: World Bank.

Yet, compared to advanced economies, China still has a long way to go – both in terms of urbanization and income per capita. That “distance to the frontier” provides a solid underpinning for increases in residential real estate demand. The urban population share in the United States, which represents the median for the Group of Seven advanced countries, was 81% in 2013, or 28 percentage points above China’s (see the previous chart). If the rapid urbanization since 1990 continues apace, it would take until 2028 for China to surpass the 2013 U.S. urban population ratio. If the Chinese population largely steadies over this period – as seems likely – its urban population would still rise by something on the order of 400 million people! This seems likely to support prices and rents.

How about the impact of income prospects on housing demand? China’s growth has already slowed and seems likely to slow further. But even if the growth of real income per capita were to average only 4.5% over the next 15 years – half of the World Bank’s estimated annual average of 9% since 1990 – it would still nearly double by 2028. Again, this would seem to provide a solid underpinning for housing demand.

On top of these impressive demand fundamentals, policies that constrain supply in some of the super-cities are adding to upward price pressures. Chinese policymakers favor migration to smaller urban areas rather than to “Tier 1” megalopolises like Beijing and Shanghai, or “Tier 2” concentrations in provincial capitals and along the coast. (It is worth noting that these “small” cities are small only by the standards in China, where there are 40 cities with populations over one million.) Such policy-driven supply constraints are quite common around the world, and their price effects are well-known: think, for example, of the impact on house prices of zoning rules in San Francisco or New York.

Together, these demand and supply factors may justify expectations of rental growth sufficient to warrant today’s high price-to-rent ratios. Yet, there is still good reason to be cautious. In the short run, one consideration is that floor space under construction has slowed markedly: in the U.S. boom, quantities weakened before the prices collapsed, so that raises concerns whether prices (and supply) have temporarily overshot.

Perhaps the most important concern is the likely rise in the discount rate that households use to assess the benefits of holding assets of any kind, including housing. For decades, China severely limited the return to holding bank deposits. That financial repression made housing ownership a key instrument for personal savings. The rapid expansion of shadow banking since 2008 amounted to a partial relaxation of these restrictions. And policymakers continue to move in this direction with the introduction of deposit insurance next month. If (and when) banks are able to pay a competitive market rate on deposits, housing will face far more serious competition for household savings.

Perhaps the impact of a rising discount rate will prove limited. Some observers believe that demand for housing in China is price-insensitive for cultural reasons. Among other things, housing is viewed as a “status good” for those wishing to get married. Another favorable factor is the preparedness of Chinese policymakers to intervene and support housing markets should they soften. Then there is the possibility that central bank policy will be adjusted in a manner designed to further support real estate lending.

Yet, there remain grounds for skepticism. The role of big-city home ownership as a status good in Japan did not prevent the massive and destructive land and housing price boom and bust in the 1980s. And, government actions to support China’s housing prices will be fighting an uphill battle if private expectations of capital gains weaken. Not only that, but the day may come when China sees the need to implement a tax on property, if only to provide a better underpinning for municipal finances. This would almost surely drive prices down quickly. Finally, the government’s other objectives of liberalizing the financial system (as a step toward internationalizing the renminbi) and increasing housing supply to meet the needs of a migrating population may prove incompatible with supporting high house price-to-rent ratios.

The bottom line: some growth stocks eventually pay off when they become household names, but many don’t. When it comes to housing in China, the key question is whether households’ implicit expectations for large rental gains and a low cost of funding are warranted. On that issue, the jury is definitely out.

Note: The authors benefited greatly from the excellent presentations and panel discussions at the NYU Stern April 17 conference on China’s Real Estate Markets. We are indebted to all the conference contributors, with special thanks to Jennifer Carpenter, Joseph Gyourko, Harrison Hong, Paul Romer, Michael Spence, and Stijn van Nieuwerburgh.