Financial Exposure to Russia

The Group of Seven is very upset with Russia for its treatment of Ukraine and its annexation of Crimea. So far, Europe and the United States are responding with various economic sanctions.

Sanctions can impose substantial pain on a country, cutting it off from the global economic and financial system. Such isolation would matter for Russia, which is a reasonably open economy. For example, its goods and services imports and exports are 22% and 29% of GDP, respectively.

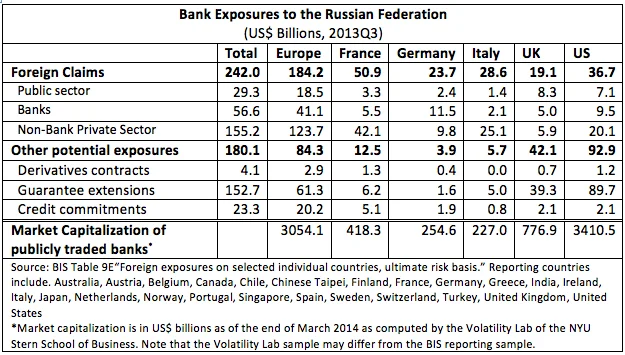

Cross-border financial transactions with Russia are larger still. According to the Bank for International Settlements (see table), foreign bank claims on Russia last September exceeded $240 billion, of which roughly three-fourths were held by European firms. Other potential exposures of these same banks reached $180 billion. That is as of the end of September 2013, banks in the 24 countries whose cross-border activities are included in the BIS data have made loans to Russian borrowers, or hold securities issued by Russians, in the amount of $242 billion. And, these same banks have $180.1 billion in potential exposures arising from loan guarantees, credit lines and the like.

Now, Russian GDP is about $2 trillion, so these are not huge numbers from their perspective. But relative to the capitalization of some of these countries' banking systems, the numbers seem more substantial. For example, at nearly $51bn and $21bn, French and Italian banks’ claims on Russia (as of end-September 2013) represent more than one tenth of their current stock market value (as of late-March 2014).

These numbers will loom larger if the Group of Seven’s sanctions diminish Russian borrowers’ ability and willingness to repay.