Investing in College

Most Americans want a college education, but it is expensive. On average, a four-year school costs about $25,000 per year, or $100,000 for a degree. That’s roughly half the median house price – a substantial investment. If you have to borrow to finance a college education – just like you borrow to own a house – is it really worth it?

The answer is yes for most people. But the outcome is not free of risk, especially for those students who borrow heavily relative to their future income prospects.

How should we do the analysis? The house price analogy is a useful place to start. You need a place to live, so your choice is to buy or rent. To buy, most people need to borrow. This means you compare the rent for a residence with the sum of the mortgage payments, homeowner’s insurance, maintenance costs, and forgone investment income on your down payment needed to buy it. That’s a straightforward comparison that many people perform every time they think about moving.

For investing in college, the analysis is complicated by the fact that you need to compute the difference between expected income with and without going to college. People have done that, and the answer is that the payoff usually remains quite attractive, but it depends on where and what you study, and whether you complete your degree.

On average, the returns are high for those who stay the course: one study estimated the present discounted value in 2010 of a college degree net of tuition at more than $500,000 for men and $300,000 for women. For students who get a degree from a highly-rated school and for those who gain skills that are in demand, the returns are especially high. For example, one website estimates that people who go to MIT can expect to make $831,000 in additional wages beyond the earnings based on a high-school education over the first 20 years of their working life. If you foot the entire $225,000 MIT bill yourself, this implies an average annual return of 8.2%. (Note: the website calculation is based on the educational cost and on the wage distribution across age cohorts all at time t, so the reported return can be thought of as real, rather than nominal.) So long as the interest on any loans is below this 8.2%, the education will have resulted in a positive net return on the investment. Going to a state school also yields reasonably high expected returns as well. For example, Ohio State with its $23,000 annual all-in cost, has an estimated real return of 7.2%.

You can find expected return estimates for more than 1,300 4-year colleges here. The median real return is 5%, which exceeds the real interest rates on these loans, which are usually in the range of 2% to 4%.

Okay, so the unsurprising conclusion is that a college degree typically pays off.

What about paying for college? Well, most people don’t have the luxury of simply writing checks for tens of thousands of dollars each year for four years. As a result, they borrow. And in recent years, they have borrowed an enormous amount. Since 2006, the total volume of student loans has increased from $500 billion to $1.25 trillion. According to the 2013 Survey of Consumer Finance, 20 percent of households have education loans outstanding, with the median loan amount of nearly $17,000. (For comparison, 33 percent of American households have mortgages, with a median debt of a bit less than $85,000.)

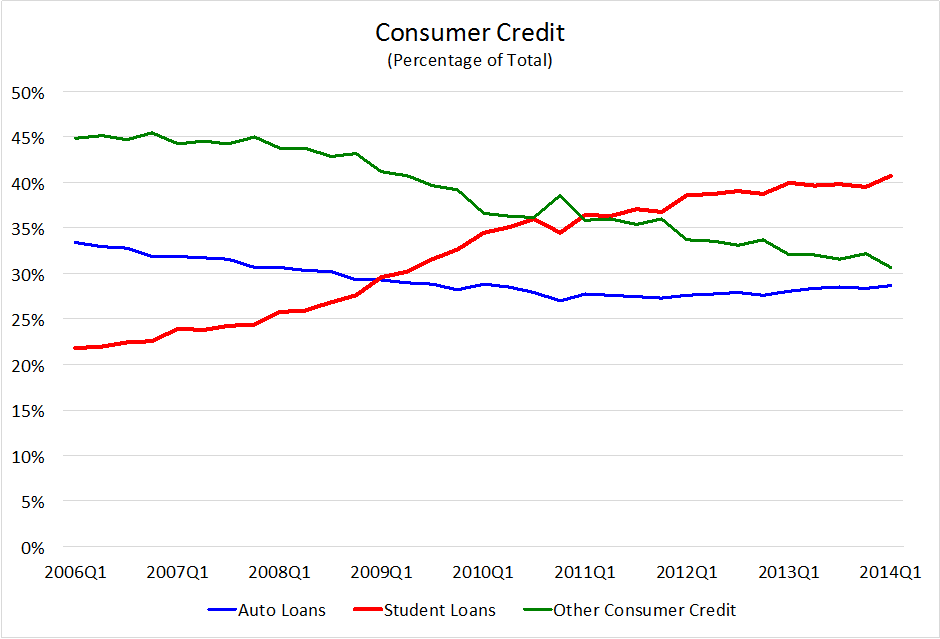

Student loans currently account for 40% of consumer credit (see the chart below), and more than 10% of aggregate household debt including mortgages. Looking at student loans relative to personal income, they have gone from 4.6% in 2006 to 8.6% today.

Consumer Credit (Percentage of Total)

Source: Federal Reserve Board Flow of Funds.

Why is it that the number of student loans exploded in the last eight years? There are probably several causes, including the rising cost of schooling and the possibility that the returns to a college education have risen (for evidence, see a recent survey of the academic literature here). But two notable reasons are the expansion of for-profit colleges and a 2005 change in the bankruptcy code.

Since 2006, enrollment in for-profit institutions of higher education has more than doubled. These colleges are tuition driven, and a disproportionate number of their students rely on student loans.

As for the changes in the law, since 2005 most student loans cannot be discharged in personal bankruptcy, indirectly encouraging the supply of credit. Unlike most other debts, including most mortgages, it is nearly impossible to get out from student loans without paying them. In the parlance of the law, lenders have recourse to all of the current and future assets and earnings of a student loan recipient. Student loan obligations are in the same class as alimony and child support – courts will simply not allow you to walk away from this debt.

This fact that people can’t escape their student loans has some pretty unsavory consequences. For example, a recent government study showed that 700,000 Americans over 65 years old carry student debts totaling $18.2 billion – debts that can result in a garnishing of their social security checks! Given that a person living in Florida can exempt their house, regardless of value, from bankruptcy, we face the specter of the very rich finding ways to shield a significant fraction of their wealth through bankruptcy, while the relatively poor must still make payments on student loans incurred decades earlier.

So, should we encourage people to borrow to go to college? The expected returns to a college education clearly say yes. And, our natural bias as university faculty members is to be very supportive. But, we are obliged to caution that what may be true in most cases will not be true in all. (For those trying to decide what to do, the Consumer Financial Protection Bureau provides a guide.)

Loans to study at for-profit institutions appear to be at greatest risk. According to the federal Department of Education (DoE), for-profit colleges account for 13 percent of students and 31 percent of student loans. The DoE estimates that, of student loans that entered repayment in 2010, nearly one half of those at for-profit institutions will default, far above the weighted average default rate of 18%.

Not surprisingly, this year the government announced plans to tighten eligibility requirements at schools where default rates or loan-to-earnings burdens are high. That basic lending principle – using past default experience to guide future lending practice – also will be a helpful guide to students, who have limited knowledge about their future earnings capacity at the start of their higher education. Because federal loans and guarantees account for the bulk of student lending, the government’s practices are key.

We also have some concern about the most indebted students. The distribution of student debt is highly unequal. According to an FRBNY staff analysis, at the end of 2012, the majority of 39 million student borrowers owed less than $25,000, but nearly 4 percent carried loans in excess of $100,000. While MIT engineers may comfortably shoulder this higher debt, not everyone can (especially those who fail to complete their degree).

No one should burden students with loans throughout their lives that they are unlikely to repay. Re-directing federal student loans to those schools (and, eventually, to specific programs within schools) with the best payback records probably would benefit students and taxpayers alike.