The euro area's debt hangover

The ongoing difficulties in Greece – combined with the ECB’s dramatic actions to ward off deflation – are distracting attention from what may be the euro area’s biggest and most pervasive problem: debt.

You wouldn’t know it from the record low level of government bond yields, but much of Europe lives under a severe debt burden. Nonfinancial corporate debt exceeds 100 percent of GDP in Belgium, Finland, France, Ireland, Luxembourg, Netherlands, Portugal, and Spain. And, gross government debt (as measured by Eurostat) is close to or exceeds this threshold in Belgium, France, Greece, Ireland, Italy, Portugal and Spain.

Debt levels this high have important long-run consequences. As we have written recently, they are a drag on growth. High debt means that households have more difficulty maintaining consumption when income falls; firms may be unable to keep up production and investment when revenue dips; and governments are in no position to smooth expenditure when revenue falls. More economic volatility means lower growth.

Beyond that, high levels of debt reduce the effectiveness of central bank stimulus. Monetary expansion influences the economy in part by encouraging lenders to lend and borrowers to borrow. But someone who already faces a heavy debt burden is neither interested in, nor the best candidate for, yet another loan. The apparent over-indebtedness of many European households, firms and governments cannot be remedied with more borrowing.

Granted, zero (or even negative) interest rates postpone the day of reckoning, potentially for years. But as growth returns, we expect interest rates to rise and the burden of servicing the debt will rise with it. So, the time will ultimately come when waiting is no longer an option.

So, what is the euro area to do? We see three paths out of this predicament: (1) breathtaking supply reforms that trigger an investment boom; (2) inflation; or (3) a mix of asset sales and debt relief.

The first option is the best. The alternatives would threaten the survival of the euro, undermine the fiscal credibility of major governments, or both.

Supply reforms make the debt sustainable by raising the future income out of which debt payments can be made. In some countries, increased labor force participation could be a significant part of this. For the most part, however, long-run income prospects (and the euro-area standard of living more generally) depend primarily on how efficiently capital and labor will be utilized in the future.

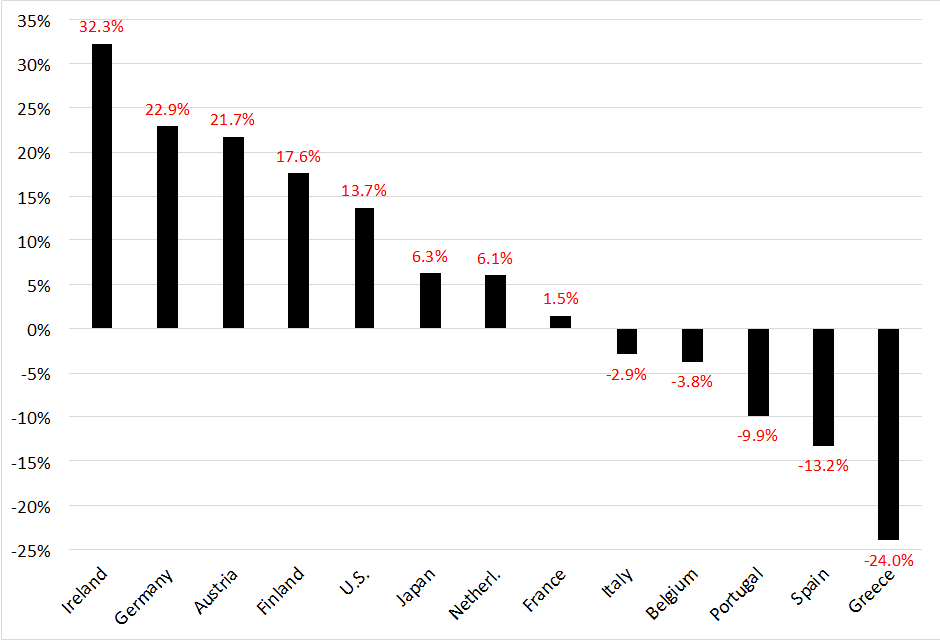

Economists call the measure of this efficiency total factor productivity (TFP). TFP sums up the myriad forms of technological advance. The following chart plots the cumulative change in TFP from 1990 to 2013 for the 11 largest euro-area countries (Portugal is the smallest member state we consider), along with Japan and the United States. So, for example, over the 23 years we examine, U.S. TFP grew by a total of 13.7% (that’s a compound annual growth rate of 0.56%) while Japanese TFP grew by 6.3% (a compound annual rate of roughly 0.27%).

Total Factor Productivity: Cumulative percent change from 1990 to 2013

The performance of euro-area countries ranges from good to awful. The first group includes Ireland, Germany, Austria, and Finland; all of which have been performing quite well. The Netherlands probably belongs in this group as well. (We are suspicious that the Irish data is contaminated by the impact of the pre-crisis financial and construction boom.) But then we have the rest. They range from virtually no growth in France to an almost unimaginable plunge of 24% in Greece. The five countries on the right-hand side of the chart experienced what we might label “technological regress.” That is, they became significantly less efficient over a period of nearly a quarter century! [Of course, some portion of this retreat probably reflects a crisis-related shortfall of aggregate demand, rather than supply.]

The difference between the 23% cumulative TFP growth in Germany and the declines in the other countries gives us some sense of the gap that could be closed. In principle, supply reforms in Italy could raise the level of GDP by more than 25%, and reduce Italy’s government debt from its current 132% of GDP to 106%.

In practice, nothing of the sort is likely to occur. Euro-area countries have shown little appetite for reforms on a scale that would be needed to have a material impact on their debt ratios. The same reform fatigue is evident virtually throughout the advanced economies, but not all countries face the euro area’s debt burden. (In Japan, which has an even bigger public debt problem, supply reform is the “third arrow” of Prime Minister Abe’s efforts to stimulate growth, but the least impressive in terms of achievements thus far.)

So, what about inflation? While a big inflation would help borrowers, it would undermine the monetary union that is built on a foundation of price stability. It is doubtful that countries with a long reputation for keeping inflation low – the former Deutsche Mark bloc – would choose to stay in a euro area that purposely boosted inflation sufficiently to bring these debt burdens down to Maastricht levels. (And, as research here shows, using inflation to reduce public debt is harder than most people think.)

So, if the goal is to save the monetary union, some mix of asset sales and debt relief would seem to be the only viable alternative.

Starting with asset sales, we don’t have reliable information regarding the size of governments’ marketable nonfinancial assets. Using estimates from the IMF and OECD, some of which are more than a decade old, and including all buildings, land and the value of state-owned firms, the numbers can exceed 100 percent of GDP. However, potential buyers may be skeptical about their property rights when purchasing a nation’s heritage, so the bulk of these assets would be difficult, if not impossible, to sell. If so, the potential proceeds from asset sales probably are modest.

We are left with the final option: debt write-downs. This is an extreme alternative that governments usually turn to when they run out of other choices – usually only after investors have shunned their debt. The reason is that write-downs do major damage to fiscal credibility, so governments wait until that damage already appears in market prices. Fiscal credibility can only be restored by implementing institutional safeguards – debt straightjackets – sufficient to deter a future debt blow-up and write-down. The euro area’s 2011 reforms to the Stability and Growth Pact, known as the “Sixpack,” are unlikely to meet this standard. Even now, regional policymakers (including the ECB) act as if most of the region’s sovereign debt is free of default risk.

Without productivity-enhancing reforms or asset sales, how big might write-downs have to be for European countries to satisfy the Maastricht criterion that gross general government debt not exceed 60% of GDP? To get some idea, we did a simple calculation, starting with the value of debt and GDP for each country. We separate out the debt holdings that sit on the balance sheets of commercial banks, because any write-down will leave a hole in the capital of the banking system that needs to be filled. The next chart shows these two parts of euro-area countries’ government debt as a fraction of GDP. The red portion of the bar is the portion of general government debt held by banks.

Euro Area: Gross general government debt (percent of GDP) and estimated debt write down to meet Maastricht debt criterion (60% of GDP)

Source: Data are for 2014 from Eurostat, the ECB and author's calculations.

We can now answer the following question: How big a write-down would each country need for their government to be left with debt equal to 60% of GDP after recapitalizing the banks to current (in our view, still inadequate) levels? The answer is the yellow diamonds in the figure. To illustrate, in the case of Greece, the current total debt ratio is 176% of GDP, with banks holding government debt equal to 13% of GDP. To get to the Maastricht criterion, with banks capital unchanged, Greece would have to write down debt equal to 125% of GDP. At the opposite extreme, Finland, with debt already below the 60% threshold, requires no write-down at all.

Another way to understand the scale of these write-downs is to examine the losses that current holders of the debt would face. The next chart shows that these losses would range from a peak of 83% in Italy down to 0% in Finland.

Euro area: Estimated write-downs as a percent of face value of general government debt

Source: Data are for 2014 from Eurostat, the ECB and author's calculations.

We find the case of Italy the most instructive. As mentioned above, Italy has a debt of 132% of GDP. This amounts to €2.13 trillion, one-third of which is held by banks. To meet the Maastricht criterion, Italy would have to write this debt down to €362 billion, or by more than 80%. This would create a hole of €608 billion on banks’ balance sheets. Borrowing to fill that would leave the Italian government debt at €970 billion, or 60% of Italy’s €1.6 trillion GDP. (Even if Italy were miraculously able to cut its debt to 90% of GDP through a combination of supply reforms and asset sales, because of the bank holdings, the country would still need a write-down of more than half of the face value to meet the 60% of GDP Maastricht criterion.)

For Greece, the write-down is 71% of face value; for Spain, 63%; and for France 50%. Taken as a whole, meeting the 60% Maastricht criterion (while maintaining bank system capital) would require that these countries’ combined debt of €9.36 trillion be written down by a total of €5.07 trillion.

As extreme as this sounds, it is, in fact, insufficient. Many euro-area governments also face significant unfunded pension liabilities. The case of Italy is again instructive. Because of the aging of its population, estimates of the present value of these liabilities exceed 100 percent of GDP (see here). This, too, needs fixing.

Despite record low yields on euro-area government debt, the region clearly has a debt hangover. Even with asset sales and supply reforms, we see this as an enormous challenge. Absent radical reforms, some euro-area governments are unlikely to meet the promises they have made to their borrowers and to their citizenry more broadly. The sooner they own up to this, the better for their long-term growth prospects.