China's Awkward Exchange Rate Regime: an Update

As 2016 draws to a close, it’s natural to look back over the year’s posts. With all the swirling concerns about China-U.S. relations—including the selection of the protectionist co-author of Death by China to head a new White House National Trade Council—we wondered whether our February doubts about China’s exchange rate regime remain intact.

The answer is yes, but for reasons radically inconsistent with President-elect Trump’s promise to declare China a currency manipulator on his first day in office. Like any country with a fixed exchange rate, China’s central bank intervenes actively to maintain its (evolving) currency target. But, for the past two years, the People’s Bank has been intervening to prevent (or at least to slow), rather than promote, the depreciation of its currency versus the dollar. That is, the RMB remains overvalued compared to what it would be in the absence of official intervention.

And, despite the secretive instincts of China’s authorities, the evidence is there for all to see. The country’s foreign exchange reserves, which neared a world-topping $4 trillion at the peak in June 2014, are poised to fall below $3 trillion, the lowest level since early 2011 (see first chart). And, while China’s currency has depreciated versus the dollar by more than 11 percent (from Y6.24/US$ to Y6.95/US$) over the past 2½ years; on a real broad effective basis, it appreciated by as much as 15 percent, and remains 7 percent above its mid-2014 level (see the second chart).

China’s Foreign Exchange Reserves (Trillions of U.S. Dollars), 2005-November 2016

Yuan/US$ exchange rate and China’s real broad effective exchange rate, June 2014-December 2016

Note: A rise in the nominal exchange rate (the blue line) indicates a depreciation while a rise in the real effective exchange rate (the red line) indicates an appreciation.

Sources: BIS, FRB, and Bloomberg.

Far from reflecting the strength of China’s economy, this broad-based appreciation reflects Chinese policymakers’ efforts to stem the decline versus the appreciating U.S. dollar, while tolerating a rise versus other currencies. Partly as a result, over the past six months, the currency has been roughly stable versus the 13-currency CFETS index that the People’s Bank announced a year ago as the yardstick for assessing the value of the RMB.

The performance of China’s economy and financial system provides little reason to warrant this real appreciation. Amid a prolonged economic slowdown, temporary episodes of economic revival have reflected bursts of credit growth, including a round earlier this year that fueled a renewed boom in real estate prices. This rapid expansion of credit is viewed at home and abroad as unsustainable, especially with regard to the nonfinancial corporate sector, whose nonperforming loans weaken the balance sheets of China’s intermediaries.

The result has been large sustained capital outflows that, as we suspected in February, the authorities have resisted by broadening and strengthening capital controls. In recent months, for example, new restrictions have surfaced on large foreign corporate acquisitions, on sizable corporate cross-border transfers, and on gold imports (see, for example, here and here).

Yet, so long as the prospects remain for dollar appreciation versus the yuan, the incentives to circumvent capital controls will remain high. As of January 1, for example, both market participants and policymakers will be watching to see how quickly households exploit their 2017 quota to move up to $50,000 out of China. After 2016 policy efforts to prevent the use of friends’ quotas, and with the Federal Open Market Committee having just strengthened its plans to normalize interest rates in 2017, there may be pent-up demand to get funds out of the country soon.

Again, as expected, these controls seem likely to just delay the inevitable. While their reserve holdings remain the world’s largest, even China needs to be concerned about the pace of decline (see, for example, Setser). And, unless the economy displays an ability to expand without relying on a new burst of credit, doubts about the financial system and the sustainability of growth likely will intensify.

Perhaps the best way for China to counter President-elect Trump’s outdated claims of manipulation would be to let the currency float. In the short run, however, that would almost surely trigger a plunge versus the U.S. dollar. Given China’s strong penchant for market intervention—including its unfortunate role in the 2015-2016 stock market boom and bust—Chinese savers may simply rush for the exit, fearing that anxious policymakers will slam the gate quickly.

In the end, there is no way to make such a fixed exchange rate regime less awkward without risking a bout of instability. Over the long run, capital controls won’t solve the problem; instead, they will further diminish the efficiency with which the country’s savings are used. For a large economy like China that is integrated into the global trading system, the global norm is a floating currency. Absent a trade war (and perhaps even with one), that’s still probably where we are headed within a few years. And, it’s increasingly a question of when, not if.

Reproduced below: our February 22, 2016 post

China’s Awkward Exchange Rate Regime

A recent op-ed in a major Chinese English-language newspaper, The People’s Daily, asserts that George Soros “has declared ‘war’ on China, claiming he had sold short Asian currencies.” For those who observed firms like those of Mr. Soros profiting from the collapse of the British pound in 1992, a speculative attack on China’s currency, the RMB, merits close attention.

There are surely parallels to that earlier episode where Soros’s firm is reputed to have made $1 billion in a couple of days. Like the United Kingdom in 1992—when the pound was linked to the Deutsche Mark through Europe’s Exchange Rate Mechanism—today, China’s currency is tied to one (the U.S. dollar) of a country that is in a stronger phase of its business cycle. Like the doubts about the U.K. Government under new Prime Minister John Major, there are questions about the effectiveness of Chinese economic policy management, both in connection with the leveraged stock market bubble of 2014-2015 and the exchange rate regime itself.

Yet, it would be difficult to overlook the enormous differences. In 1992, the United Kingdom was a relatively small economy that had run external deficits for nearly a decade. Today, China is the largest economy in the world, and it has maintained external surpluses for more than 30 years. As a result, at $3.2 trillion, China’s foreign exchange reserves represent about 150% of the country’s annual imports – 10 times what Britain had a quarter century ago. Furthermore, consumer price inflation in China is running at a very modest 1½%, well below the 4¼% U.K. pace in 1992.

Perhaps most important, the United Kingdom was committed to maintaining the free flow of capital across its borders. This is in stark contrast to China, where policymakers have been tightening capital controls in recent months. One example is the shift in practice from a daily limit for currency withdrawals abroad—Chinese nationals could take out up to $10,000 per day from a foreign bank outside China—to an annual limit, now $50,000 per person per year.

So, why is there so much talk about a large devaluation of the RMB?

We see three reasons. First, China’s reserves (excluding gold) have dropped by more than $760 billion since peaking in mid-2014, and have recently been declining at a pace of roughly $100 billion a month. Clearly, this decline is unsustainable.

Second, there is a widespread belief that high leverage in China’s economy, combined with slowing economic growth, will precipitate a banking crisis and compel policymakers to devalue in an effort to restore growth. China is certainly leveraged and its banks are exposed. According to the BIS, as of mid-2015, credit to the private nonfinancial sector reached 201% of GDP in China, more than double what might expect for a country with China’s per capita income (see figure below). Moreover, since 2009, credit has surged by 54% of GDP, second only to Hong Kong among jurisdictions in the BIS data. Absent some combination of government assistance and high inflation, and given the heavy reliance on real estate as collateral, it is reasonable to expect significant defaults.

Credit to the nonfinancial private sector (pct. of GDP) versus GNI per capita (PPP, current international dollars)

Note: The filled red circle denotes China. Each empty square represents a different reporting jurisdiction. Sources: BIS (credit) and World Bank (GNI per capita).

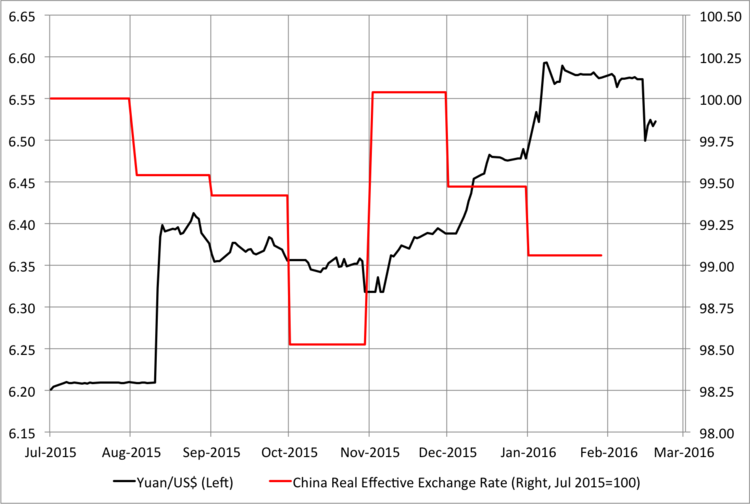

Third, the way China’s policymakers have managed the exchange rate since last August has created substantial uncertainty. At the time, authorities initiated a series of small adjustments that cumulatively lowered the value of the RMB by about 5 percent versus the U.S. dollar (see figure below). As we wrote when the devaluations began, it is difficult to see how the expansionary benefits of a small devaluation could outweigh the cost to China’s long-term policy credibility. Indeed, as the RMB fell, many of China’s Asian trading partners allowed their currencies to depreciate, too. As a result, on a trade-weighted basis (adjusting for inflation), China’s currency is down by less than 1% since July. That is one reason why many investors believe the gradual devaluations thus far eventually will lead to a much larger decline versus the U.S. dollar.

Yuan/US$ exchange rate and China's real broad effective exchange rate, July 2015-February 2016

Sources: BIS, FRB, and WSJ.

Our point is that, considering the country’s leading economic role in Asia, China would need a very large depreciation versus the U.S. dollar to obtain even a moderate depreciation against its trading partners. Put differently, the RMB has become the key currency for trade within Asia and, with the exceptions of the Indian rupee and the Japanese yen, is at the center of one of the world’s three large currency blocs.

So, what are the alternatives? First, let’s not rule out a free float, which may still be China’s most attractive policy option (even if it looks like a win for the speculators). Over the long run, China would almost certainly be better off with a floating currency that can help absorb the kinds of shocks that are driving its reserve levels sharply up or down. Today, many in Britain view the September 1992 day when they were forced to give up the fixed exchange rate as “White” rather than “Black” Wednesday. Aside from the international frictions that a sizable depreciation would trigger, the most important reason to doubt an RMB float is the evident discomfort of China’s policymakers with market volatility (the most recent example being the imposition of an excessively tight stock market circuit breaker that tripped twice in its first week, before being removed).

Second, if China does have to re-capitalize its banks, as many suspect, the most likely response is a government bailout that need not trigger monetary easing. The last time the government recapitalized the banks—beginning in 1999—nonperforming loans in the banking system and asset management companies eventually surpassed 35 percent of GDP (see Table 1 here). Could China now shoulder an increase of public debt sufficient to meet a similar challenge? As of mid-2015, credit to the public sector stood at a relatively manageable 43% of GDP. Unless this figure conceals large implicit liabilities (such as a need to bail out unprofitable state-owned enterprises), the government can probably issue significantly more debt without compelling the kind of large-scale monetary finance that would weaken the currency.

The third option is that policymakers could further tighten capital controls. As we have argued here and here, this is incompatible with China’s desire to internationalize the RMB. Yet, having just joined the IMF’s elite SDR club (which previously included only the U.S. dollar, euro, Japanese yen, and British pound), there appears little additional pressure from abroad to open China’s capital account. Indeed, BoJ Governor Kuroda has called on China to restrain capital outflows to support its currency.

Can tighter capital controls really constrain outflow? They would have to be very tight to work. Firms and households generally see a one-way bet on the yuan/US$ exchange rate. Raising Chinese interest rates sufficiently to offset this would seem to be incompatible with the country’s cyclical position and could even backfire, inciting greater capital outflow (much like the 1992 effort to defend the British pound). The problem is the classic reason that fixed exchange rates fail: conventional mechanisms to defend the currency are unsustainable, so they lack credibility (think “time consistency”).

Capital controls would have to address the dollar demand from three groups. First, with China’s current account surplus growing again, there are the exporters who receive dollars in payment and prefer not to convert them to domestic currency when they fear devaluation. Second, there are the Chinese firms seeking to repay more than US$1 trillion in dollar-denominated debt. And, finally, there are the households that still legally shift substantial funds abroad. In theory, the Chinese authorities can bring enormous pressure to bear on each of these players. Of course, like temporary fingers in the dam, capital controls usually spring leaks that also would need to be plugged.

From a long-run perspective, tighter capital controls are likely to be very costly. By diminishing the incentive to allocate capital efficiently, they will retard the shift of resources away from low productivity (and low productivity growth) activities in the manufacturing, construction, and state-owned sectors. The result will be further slowing in China’s growth. (Controls on capital outflows eventually diminish inflows, too: foreign willingness to invest depends on the credibility of the government’s promise to allow future repatriation.)

So, what should we expect over the course of the coming year or two? Today, China’s current exchange rate regime is too awkward to operate for much longer without some modification. If foreign exchange reserves continue to plunge, the most likely path is a further tightening of controls, well before any large-scale devaluation or a currency float.

Still, capital controls only kick the policy can down the road. Ultimately, China will have to choose between a truly rigid fixed exchange rate and a floating one in which the authorities lose control. A small economy like Singapore can and does manage an exchange rate regime in between these two poles. But in a stable global economic and financial system, the largest economy of the world cannot.