The Fed's Balance Sheet and the Stance of Monetary Policy

U.S. monetary policy is tightening, as everyone who pays even the slightest attention to the financial news knows. But when and how? Here, the discussion is focused on two complementary aspects of Federal Reserve policy: interest rates and the balance sheet. The first of these concerns policy of the old-style conventional type. The second is about the consequences of quantitative easing. At $4.23 trillion, more than 5 times the 2007 level, the size of securities holdings raises a series of questions: When will the Federal Reserve’s Open Market Committee (FOMC) start to shrink its balance sheet? How will they do it? How far will they go? And, most importantly, what will be the consequences for the stance of monetary policy?

On the first two―when and how―the minutes of the March 14-15, 2017 FOMC meeting provide the answers: later this year, the FOMC expects to instruct the open market operations staff at the New York Fed to stop reinvesting the proceeds from maturing securities. Consistent with the policy normalization principles published in September 2014, there is no hint that they will actively sell securities.

The key uncertainty is how far they will go. At this stage, there is little indication of a consensus on how big or small the balance sheet should be at the end of the process. More on this shortly.

Even if this uncertainty is clarified, however, any additional impact from balance sheet policy on the stance of policy probably will be limited. As with much of economic policy, it is the announcement that matters. Insofar as changes in the size and composition of the Fed’s balance sheet influence financial conditions, altering the future supply or demand for securities of various types, we have probably seen the key impact. Not only that, but when the minutes from the March 2017 FOMC meeting were published on April 5, neither interest rates nor the equity market moved. In other words, the impact of the policy on financial markets—to the extent that there is any impact at all—has been present in yields and asset prices for some time.

To put it as clearly as we can—in the absence of outright bond sales—the balance sheet policy clarifications yet to come are unlikely to tighten financial conditions further, and will not substitute for a conventional interest rate increase. Instead, when the FOMC chooses to tighten over the course of the remainder of this year, they will do so by continuing to raise the target range for the federal funds rate (as we describe here).

For the remainder of this post, we examine each of these issues in more detail: when, how, how far, and to what effect. Starting with when, consider the following quotes from the minutes of the March meeting:

"Provided that the economy continued to perform about as expected, most participants anticipated that gradual increases in the federal funds rate would continue and judged that a change to the Committee’s reinvestment policy would likely be appropriate later this year.”

“An approach that ended reinvestments all at once, however, was generally viewed as easier to communicate while allowing for somewhat swifter normalization of the size of the balance sheet.”

“When the time comes to implement a change to reinvestment policy, participants generally preferred to phase out or cease reinvestments of both Treasury securities and agency MBS.”

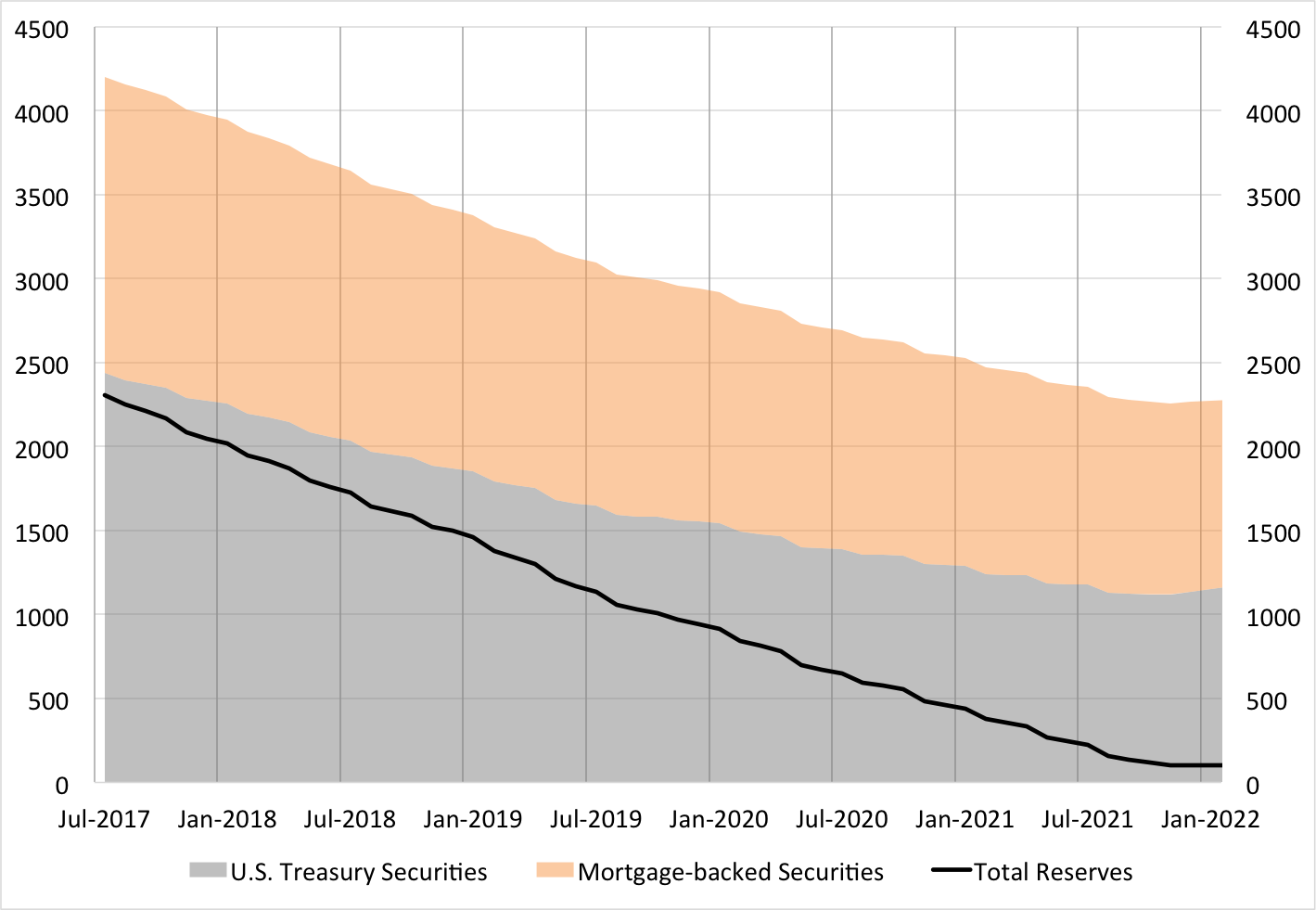

To see what this policy means for the balance sheet, we turn to a Federal Reserve Board staff publication called Fednotes. Posted in mid-January, “Confidence Interval Projections of the Federal Reserve Balance Sheet and Income” provides information on the path of securities holdings under the assumptions implied by the FOMC statement: that reinvestment of proceeds is stopped for both Treasury securities and MBS. Using these data, we have constructed the following chart under the assumption that the new policy begins in July 2017. (Beginning later, say in October, would simply shift the dates by several months.)

Federal Reserve Balance Sheet: Securities Holdings and Reserve Levels (Billions of U.S. dollars)

Fed staff projections show that a policy in which reinvestment stops implies that the balance sheet falls by roughly $600 billion per year for the first two years, $400 billion in the third year and $300 billion in the fourth year. In their publication, the Fed staff authors assume that reserves slowly fall and then remain at $100 billion—a level that is hit in roughly 4½ years. That is, if the FOMC were to start the balance sheet shrinkage in July 2017, using the procedure that we infer from what they have said and written, total reserves in the banking system (the black line in the graph) would fall to $1 trillion by October 2019 and hit the pre-crisis equivalent two years later. (We note that the Fed staff’s calculations assume currency in circulation will continue to increase gradually over the next four years, reaching more than $2 trillion by 2021. This accounts for most of the balance sheet at that point.)

It is worth noting that the staff projections used to construct the chart envision that, at the end of the process, the Fed will hold roughly equal quantities of Treasury debt and MBS. That is, over the four-plus years during which the portfolio is shrinking, Treasury holdings will fall by $1.3 trillion while MBS holdings shrink by less than half as much.

In our view, the predictability that is inherent in the combination of the Fed staff projections and the FOMC minutes is essential to ensure that financial markets can digest the securities they will have to hold and that the banking system can manage the reduction in reserves it will be holding. To the greatest extent possible, to maintain economic and financial stability, officials are striving not to surprise people.

This policy has obvious implications for U.S. Treasury auctions. When the Fed stops rolling over its holdings, replacing maturing bonds with newly issued ones, the private sector will have to purchase more. We don’t see this as a problem, as intermediaries are likely to simply take the reserves they were holding and exchange them for Treasury securities. (Existing liquidity regulations give them an incentive to do this.) But even so, it will be important for smooth market function to know when and by how much this is likely to happen. Transparency is important.

That said, there is one piece of information the FOMC has not yet made public: the ultimate size of the balance sheet. At the end of the process, will reserves be $100 billion, as in the staff projection exercise? Or, following suggestions made by some observers, will the FOMC choose to leave many more reserves in the system?

Much of the Kansas City Fed’s 2016 Economic Symposium was devoted to discussions of the potential benefits of retaining a large balance sheet. Two arguments emerged, one concerning financial stability and the other emphasizing monetary policy transmission. Ben Bernanke provides an excellent summary that we will not repeat here. What we will say is that the arguments for retaining a large balance sheet have substantial merit on theoretical grounds: when the Fed owns large quantities of securities, it has more options both during normal and stress times.

Is what makes sense in theory politically practical? Can we envision the Federal Reserve keeping a balance sheet in which reserves are close to their current $2.24-trillion level? Last month, we noted that the policy of paying interest on excess reserves has been the subject of Congressional criticism at least in part because the lion’s share of the payments is going to a combination of foreign and large domestic banks. Advocates of a large Fed balance sheet would surely note that there is little difference between having the Fed own U.S. Treasury securities and paying interest to the banks, and having the banks own the securities themselves (although the interest rate on excess reserves has been modestly higher than the Treasury bill rate). The first comes with a large balance sheet, and the second with a small one. So, if the large balance sheet has desirable properties, shouldn’t that be the choice?

We reiterate: in theory, this Treasury substitution argument is correct. There is little difference in terms of the revenue to the various parties. (And, so long as the Fed shifts its holdings entirely to Treasury securities, the distribution of financial risks is similar as well.) But the optics are different. In the current political environment, there are sufficient risks to Federal Reserve independence that another one would be very unwelcome. This favors a small balance sheet, not a large one.

Where does all of this leave us? Policy today remains very accommodative. Interest rates are especially low considering current economic conditions. The labor market seems to have normalized, with jobs growing at roughly the 100,000 per month needed to keep it there. Real growth has been running at close to most people’s view of the sustainable level. And inflation is approaching the FOMC’s 2 percent target. So long as this does not change, we expect that policy will follow the path implied by the March Summary of Economic Projections, and we will see as many as three rate increases in the remainder of this year. That is, by the end of 2017, the federal funds rate target range could be as high as 1½ to 1¾ percent.

Now, everyone knows that conditions may change. It is fairly easy to think of downside risks to the global financial system over the next year or so: an election surprise in France, an Italian exit from the euro, and a disruption in China’s financial system, to name just three of the biggest. There is also the possibility that U.S. economy will grow more quickly or more slowly than envisioned in current projections. In all these cases, and more, we would expect to see adjustments in Fed policy. Both the expected future path of interest rates and of the balance sheet could change from the current baseline. But, barring that, at this point, the baseline path is fairly clear: as the year progresses, the Fed’s balance sheet will start to shrink, and while it does, interest rates will go up. Since this is now widely known, current financial conditions today presumably reflect it.