An Open Letter to the Honorable Randal K. Quarles

Dear Mr. Quarles,

Congratulations on your nomination as the first Vice Chairman for Supervision on the Board of Governors of the Federal Reserve System. We are pleased that President Trump has chosen someone so qualified, and we are equally pleased that you are willing to serve.

Assuming everything goes according to plan, you will be assuming your position just as we mark the 10th anniversary of the start of the global financial crisis. As a direct consequence of numerous reforms, the U.S. financial system—both institutions and markets—is meaningfully stronger than it was in 2007. Among many other things, today banks finance a larger portion of their lending with equity, devote more of their portfolios to high-quality, liquid assets, and clear a large fraction of derivatives through central counterparties.

That said, in our view, the system is not yet strong enough. In your new role, it will be your job to continue to fortify the financial system to make it sufficiently resilient.

With that task in mind, we humbly propose some key agenda items for the first few years of your term in office. We divide our suggestions into five broad categories (admittedly with significant overlap): capital and communications, stress testing, too big to fail, resolution, and regulation by economic function.

Capital and communications. First, and foremost, we hope that you will take on the job of explaining to legislators, the public and financial market participants the rationale for controlling systemic risk and for further raising bank capital requirements. In our view, there is a misconception that higher levels of bank capital impede lending. In fact, quite the opposite: well capitalized banks lend more and they lend better.

Of course, as every banker will tell you, for them, equity financing is expensive. From their parochial perspective, they are right. However, the presence of the government backstop (with an estimated 62 percent of the financial sector covered by the official safety net) provides the incentive for U.S. banks and other financial intermediaries to take on too much leverage. Even without this backstop, banks do not take full account of the impact of their behavior on others. This classic economic externality makes it in shareholders’ self-interest to render their banks undercapitalized relative to what is best for our economy.

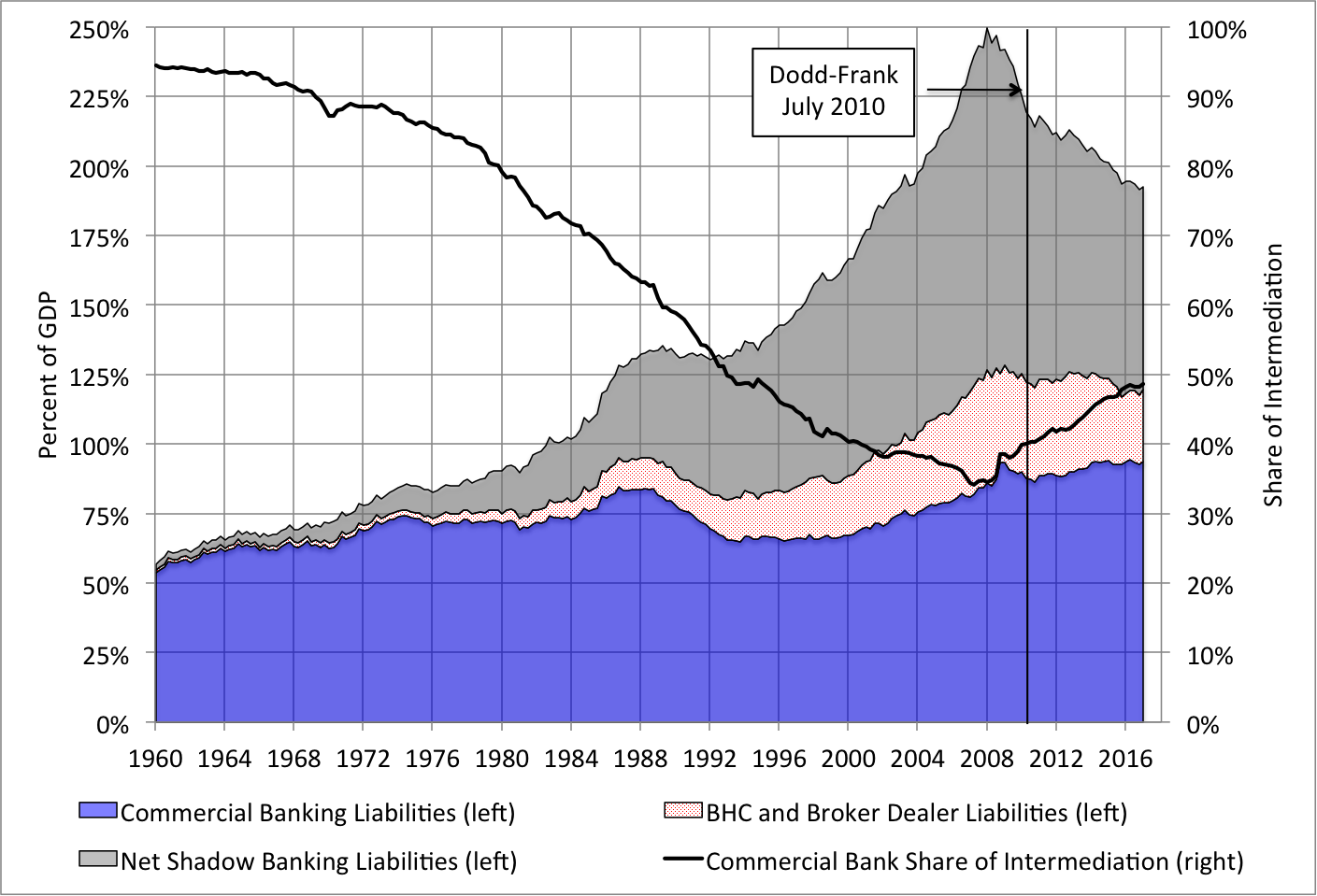

Not to belabor the point, but we see little evidence that post-crisis financial regulation has impeded bank lending. Nor, as far as we can tell, is there any sense in which the substantial upgrading of bank capital over the past decade has inhibited economic growth. In fact, as we wrote last month in discussing the U.S. Treasury’s report on regulatory reform, bank lending has risen faster than GDP in recent years. More broadly, bank intermediation has risen as a share of overall U.S. intermediation since the implementation of Dodd-Frank (see chart).

Sources of financial intermediation in the United States, 1960-2017

Source: Updated version of Figure 1 from Zoltan Pozsar, Tobias Adrian, Adam Ashcraft and Hayley Boesky, “Shadow Banking,” Federal Reserve Bank of New York Staff Paper No. 458, revised February 2012.

In that connection, we are concerned by the views you expressed in a commentary published on March 31, 2016 in The Wall Street Journal. In addition to arguing that higher capital requirements raise the cost of bank lending, you claimed that a large portion of the $41 trillion in credit to the economy must be provided by wholesale funding. However, most of this nonbank funding reflects non-runnable liabilities like marketable longer-term corporate bonds and mortgage-backed securities (MBS). While there is some short-term non-bank funding, by our reckoning, it makes up at most 10 percent of total credit to households and nonfinancial firms. Furthermore, as the above chart shows, over the past decade, net shadow banking liabilities have shrunk from a massive 120% of GDP in mid-2008 to less than 75% of GDP. And, since the crisis, internal risk management procedures and regulation have prompted banks to extend the maturity of their liabilities, reducing the risk of bank runs. All of this has happened without any decline in the supply of bank lending. Moreover, to the extent that a larger fraction of some key assets—like federally-backed MBS—are now held directly by less leveraged investors (say, through U.S. mutual funds and ETFs, rather than through banks), the risk of a run on the financial system is materially lower.

Stress testing. Second, we hope that you will extend the regulatory trail blazed by former Governor Dan Tarullo, who guided the Fed through the arduous reform process from 2009 until his recent departure. Most importantly, Governor Tarullo helped set up the credible stress-testing apparatus that has become the de facto capital planning regime for U.S. systemic banks. To a great extent, we view banks’ complaints about the stress tests as evidence that the system is working. While we support efforts to improve post-test transparency, it is essential that we retain the most important feature of current stress testing: namely, that the scenarios are not revealed in advance (see our discussion here.)

In this context, we note our concern about the 2017 stress test results: we doubt the latest Comprehensive Capital Assessment Review (CCAR) set the standards high enough. As a result, the most systemic U.S. banks are being allowed to distribute nearly $100 billion through dividends and share-buybacks. This is equivalent to roughly 10 percent of the top-tier capital in the eight largest U.S. banks. From their inception in 2009 and until this year, the stress tests served as an effective device to make the U.S. financial system more resilient by building up a capital buffer against bad times. It is far too early to declare victory in that long-run process of establishing resiliency. We hope that ensuring sufficiently demanding stress tests will be high on your agenda.

Too big to fail. In our view, a small number of very large, complex, interconnected intermediaries should be required to finance a much larger share of their assets through common equity than they are under current rules. As an example, the Minneapolis Plan to end too big to fail would include 13 institutions with more $250 billion in assets in this class. To be sure, size is by no means an adequate proxy for systemic risk. Nevertheless, the institutions posing the greatest systemic risk are all very large. And, noting that banks’ equity prices have recovered (so that the price-to-book currently is above one), this is a propitious time to build equity rather than to boost payouts.

Resolution. The next item on our list is the complex challenge of ensuring a robust resolution regime. Here, we hope that you will champion Dodd-Frank Title II, which establishes the Orderly Liquidation Authority (OLA) and the Orderly Liquidation Fund (OLF). To be sure, we support changes in the bankruptcy code that will make bankruptcy a more credible resolution procedure for SIFIs, as Dodd-Frank Title I prescribes. We encourage you and the FDIC to use Dodd-Frank’s living wills to facilitate a virtually automatic recapitalization in bankruptcy. We also hope that a reformed bankruptcy code will allow bank regulators to initiate the resolution process for SIFIs, something that is lacking in the Financial Institutions Bankruptcy Act (FIBA) that the House recently passed.

Importantly, we share the view that a reformed bankruptcy code is a complement, not a substitute, for the administrative procedures in OLA or the backstop funding provided by OLF. In the case of a SIFI operating internationally, foreign regulators are unlikely to find a bankruptcy-only U.S. resolution process sufficient to restrain them from a grab race for the assets of the failed intermediary. And, in a crisis affecting several SIFIs at once, only the government can provide the temporary financial resources needed to resolve them. Rather than reducing the likelihood of a crisis, eliminating that temporary OLF backstop would raise it.

Regulation by function. Finally, we hope that you will take on the challenge of shifting from regulation based on the legal form of an organization to regulation by activity and economic function. While this is not something over which you will have direct authority, your influence will be crucial if we are to change our approach, reforming the legal framework underpinning U.S. financial regulation.

As an example of what we are talking about, consider the case of money market mutual funds (MMMFs). These institutions are banks without capital, deposit insurance or access to the Fed’s discount window: that is, they offer liquid runnable liabilities backed solely by longer-term, less liquid, assets. Many other non-bank intermediaries also engage in the liquidity, maturity and credit transformation that is the traditional job of commercial banks, fostering risks of runs and fire sales. To the extent that they do, these bank-like institutions should be subject to bank-like regulation. Otherwise, efforts to make banks more resilient will simply shift systemic risks beyond the regulatory perimeter.

Consistent with regulation by economic function rather than legal form, we hope that you will back the Financial Stability Oversight Council (FSOC) process for designating select nonbanks as systemically important financial institutions (SIFIs) or—in the case of payments, clearing and settlement firms—as financial market utilities (FMUs). Not only does such designation ensure appropriately rigorous and consolidated supervision, but in the case of solvent FMUs it allows for Federal Reserve lending in a crisis. Should this process atrophy, either from disuse or insufficient legal defense, the financial system would become much weaker as systemic risk-taking migrates outside the banking system.

Conclusion. In closing, let us reiterate how pleased we are that the President has chosen for this key appointment—one of the most important jobs in the Federal Reserve System—someone with your experience and qualifications. We look forward to watching and, where we can, supporting your important work in ensuring the vigor, dynamism and resilience of the financial system both domestically and globally.

Sincerely yours,

Stephen G. Cecchetti and Kermit L. Schoenholtz