E Pluribus Unum: single vs. multiple point of entry resolution

“The turmoil that followed the failure of Lehman and the decision to rescue AIG … underscored the absence of a third alternative to the options of bailout or disruptive bankruptcy.” Daniel K. Tarullo, October 18, 2013.

Addressing the calamity posed by the failure of large, global financial intermediaries has been high on the post-crisis regulatory reform agenda. When Lehman Brothers―a $600 billion entity―failed, it took heroic efforts by the world’s central bankers to prevent a financial meltdown. The lesson is that a robust resolution regime is a critical element of a resilient financial system. Authorities can and should ensure that intermediaries have sufficient capital to make insolvency rare, but they cannot reduce the likelihood to zero. Consequently, to make credible the promise not to bail out the largest, most complex intermediaries, a system for resolving them safely (even in a crisis) must be in place.

Experts have been hard at work implementing a new mechanism so that banks can continue operation, or be wound down in an orderly fashion, without resorting to taxpayer solvency support and without putting other parts of the financial system in danger. To enhance market discipline, the shareholders that own an entity and the bondholders that lent to it must face the consequences of poor performance. Over decades, many countries have fashioned effective bankruptcy regimes for households, nonfinancial companies and small banks. But, for institutions of the size and complexity of the largest global banking groups (like J.P. Morgan Chase, BNP Paribas, HSBC, Deutsche Bank, or Mitsubishi UFG), with trillions of dollars in assets and thousands of subsidiaries worldwide, insolvency is far from straightforward. And, since parts of these global systemically important banks (G-SIBs) are providing essential services to large swaths of the economy, their failure wreaks havoc globally.

How can we ensure that healthy operating subsidiaries of G-SIBs continue to serve their customers even during resolution? Authorities have proposed a solution that takes two forms: “single point of entry (SPOE)” and “multiple point of entry (MPOE).” A key difference between these is that the former allows for cross-subsidiary sharing of loss-absorbing capital and cross-jurisdictional transfers during resolution, while the latter does not. The purpose of this post is to describe SPOE and MPOE. We highlight both the relative efficiency of SPOE and the requirements for its sustainability: namely, adequate shared resources, an appropriate legal framework and a credible commitment among national resolution authorities to cooperate. (For a discussion of alternative mechanisms for resolving large banks, including the proposal for the addition of a Chapter 14 to the U.S. bankruptcy code, see our earlier post.)

Before we get to the details, recall that under the Basel III standards global banks are required to have Total Loss Absorbing Capacity (TLAC)― common equity and TLAC-eligible subordinated debt combined—equivalent to 16 to 20 percent of their risk-weighted assets. In a resolution, the authorities have the option to convert TLAC debt to equity to recapitalize the bank. Since the Total Common Equity requirement (see TCE in our glossary) itself is 8 percent, the TLAC requirement means that a bank typically will issue TLAC-eligible debt that equals or exceeds its equity. In the event that a bank sustains losses that are just enough to wipe out its equity capital, conversion of the TLAC debt would allow authorities to recapitalize the bank fully.

Andrew Gracie of the Bank of England summarizes the rationale for requiring issuance of TLAC debt: financial institutions will not voluntarily issue subordinated liabilities that authorities can easily write down in the event of an insolvency. If the resolution authorities are determined, in a period of distress, TLAC debt becomes a closer substitute for equity than for non-TLAC debt. From the bank’s perspective, provided that investors believe that resolution authorities are willing to convert TLAC debt to equity, issuing TLAC-eligible bonds is more expensive than issuing other debt.

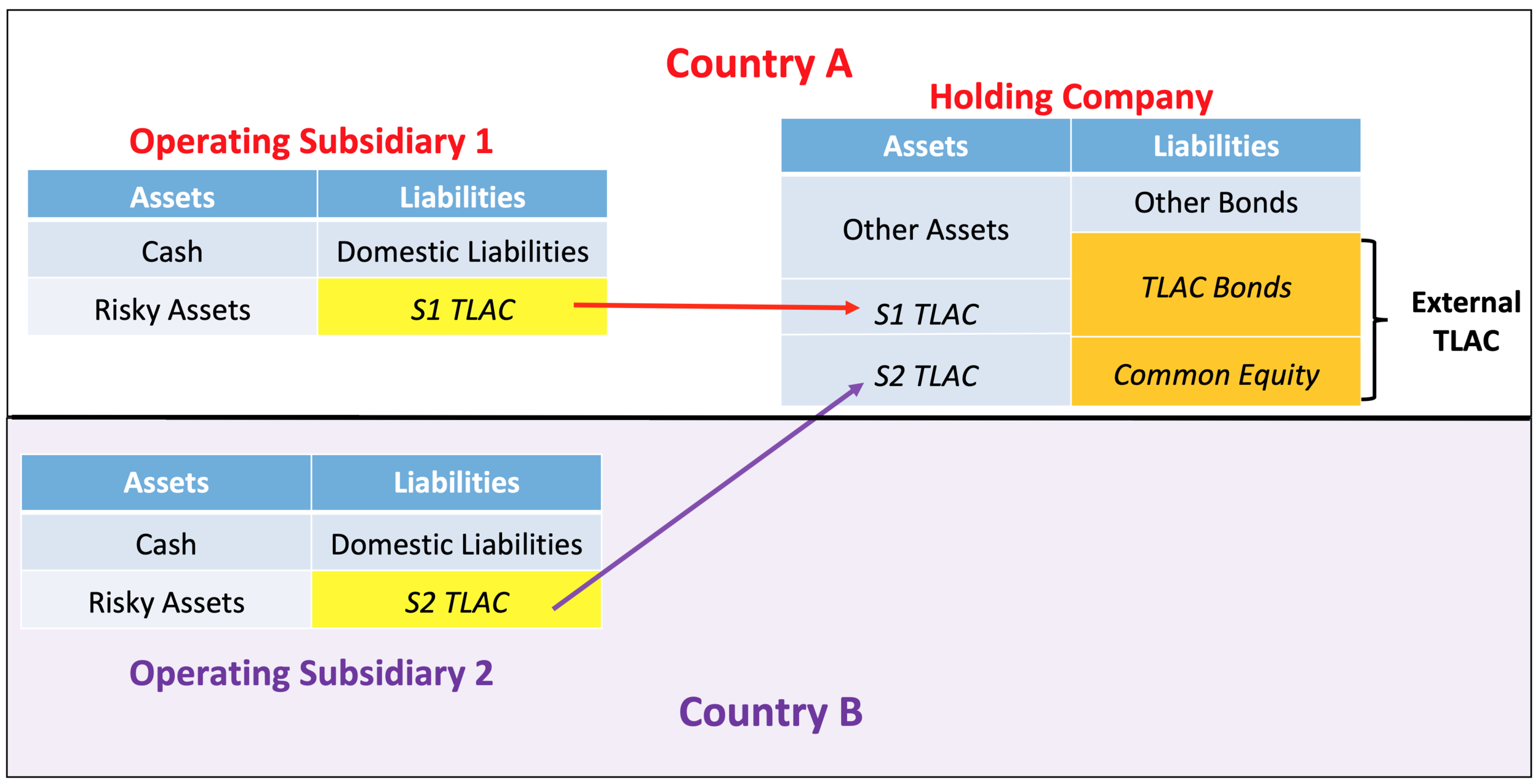

Turning to resolution itself, we start with single point of entry (SPOE). The following diagram displays the key features of an SPOE mechanism. The banking group is composed of a single holding company and two subsidiaries. The holding company and one subsidiary are in country A (above the dashed horizontal line), while the second subsidiary is in country B. Supervisors call country A the “home” and country B the “host.” Each subsidiary has two classes of assets, safe (cash) and risky (securities and loans), and two types of liabilities, domestic and those owned by the holding company (labeled as S1 TLAC and S2 TLAC). The last of these are “internal” TLAC: no outside investor holds them. Each subsidiary faces regulation in the country where it operates, so local authorities determine both the overall size of internal TLAC and its division between equity and debt. (Unsurprisingly, these influence managerial incentives in the organization. See here.)

Single Point of Entry Resolution: Simplified Banking Group Balance Sheets

Turning to the holding company, its assets include ownership of the subsidiaries—both the equity and the TLAC debt—and possibly other things. Importantly, the holding company’s liabilities are a combination of common equity, TLAC bonds and other bonds. Because the holding company issues its TLAC-designated liabilities into the market, we label them “External TLAC.” This external TLAC must be at least as large as the sum of the internal TLAC issued to the holding company by the subsidiaries. Furthermore, it is essential that the holding company not enter into any financial contracts―such as repurchase agreements or derivatives―that are subject to default if a subsidiary fails or the holding company were to enter resolution. (For a further discussion of the holding company structure, see here.)

Now, imagine that one of the subsidiaries sustains losses in the form of loan defaults or declines in the prices of securities that are marked to market. These losses translate directly into losses in the S1 or S2 TLAC assets of the holding company, which in turn mean losses in the holding company’s common equity. In other words, regardless of where the subsidiary operates, this structure automatically pushes operating losses up in the group structure.

Suppose that the subsidiaries’ losses are sufficient to wipe out the common equity of the holding company, leading to insolvency of the group. Under SPOE, the home-country authority (Country A) places the holding company into resolution, allowing the domestic and foreign subsidiaries to continue operating while maintaining the ownership structure of the banking group. To recapitalize the subsidiaries without having them go into default, the resolution authority can use all of the holding company’s liabilities—potentially converting all of its bonds, even beyond those that are TLAC-eligible, into equity. The immediate implication is that all of the subsidiaries’ creditors are senior to all of the creditors of the holding company. Importantly, since all of the capital and debt in the group is available for recapitalization regardless of which of the subsidiaries incurs losses, SPOE is a capital-efficient mechanism.

Yet, as Bolton and Oehmke emphasize, the willingness to implement SPOE, exploiting its efficiency, depends on the extent to which there must be a significant transfer of resources cross border. To understand the point, consider a case in which the two subsidiaries in our simple example simultaneously suffer losses sufficient to wipe out their internal TLAC and that together this exceeds all of the TLAC liabilities of the holding company. In this circumstance, the recapitalization requires that Country A supervisors write off the holding company’s TLAC debt and force a conversion of some its “Other Bonds” (see Tucker’s description here).

Will the incentives of Country A’s supervisors be compatible with this procedure? Given their mandate to safeguard their own national system, Country A’s supervisors will favor Operating Subsidiary 1, and may be reluctant to transfer resources cross-border to Operating Subsidiary 2 in Country B. Knowing this, the authorities in Country B will have a tendency to trigger an early recapitalization of their subsidiary—writing down its internal TLAC and imposing premature losses on the holding company.

In game-theoretic terms, the anticipated defection of Country A from the cooperative SPOE arrangements prompts Country B to defect first, resulting in an inferior non-cooperative outcome. This constitutes precisely the kind of “grab race” that effective bankruptcy regimes will forestall. (See here.)

To address this problem of competing insolvencies in multiple jurisdictions, a viable SPOE framework that relies on cross-border supervisory cooperation must satisfy three conditions. First, there must be adequate (internal) TLAC at the level of the subsidiaries. Second, the foreign operating subsidiary must issue its TLAC bonds under the law of the country where it resides. And third, there must be trust between the host- and home-country supervisors that arrangements to facilitate and implement the cooperative resolution will be carried out. The host-country authorities (Country B) must be secure that the authorities in Country A are willing and able to conduct a group-level resolution of the holding company that protects both domestic and foreign subsidiaries equally. And, since Country B’s supervisors have a call on the capital of the holding company, the home country supervisors must trust them to only exercise the option when they have no other choice.

Absent these conditions―without sufficient resources, an appropriate legal framework, and a credible commitment to cooperate among the authorities in the various countries supervising a banking group—a cooperative SPOE resolution regime will not be viable. Instead, supervisors will turn to the noncooperative solution: multiple point of entry (MPOE).

To understand MPOE, look back at the above diagram and imagine that, along with the holding company, there is only one operating subsidiary and it is in Country A. The country’s supervisors are now in charge of the resolution, and there is no incentive problem. We can easily make the example more complicated by adding additional subsidiaries, or by allowing Operating Subsidiary 1 to have its own subsidiaries. What is critical is that the group is resolvable within the borders of the country. While it is possible to imagine MPOE for any subsection of the original entity, even large ones, the process splits the banking group along national boundaries.

MPOE has a number of unattractive properties. It requires national ring-fencing of assets as well as a structure in which no essential services are shared across borders. On the first, while the top-tier entity will still raise capital externally―the holding company issues publicly traded equity and holds the equity of the subsidiaries―each subsidiary must issue its own external TLAC bonds in the full amount required by local authorities. This means that, when one subsidiary requires recapitalization, authorities in that jurisdiction cannot call on resources anywhere else in the world, as loss-absorbing resources will be trapped in healthy subsidiaries.

The inefficiencies of MPOE can extend far beyond TLAC allocation. Importantly, each of the country-level resolution proceedings results in the conversion of domestic bonds into domestic equity of a newly created company. That is, MPOE results in the breakup of the banking group into a set of institutions with new owners. For each of these to be viable, a banking group’s shared resources must be organized in a manner robust to the insolvency of any or all parts of the original entity.

To see what we mean, consider the following figure. As in the previous diagram, we again consider the simplest possible case in which there are two countries, two subsidiaries and a single holding company. Importantly, there are common resources among these three entities (the central, shaded triangle). These can include customer information, asset holdings, collateral arrangements, risk management, compliance and legal functions, trading systems, and the like. These shared resources—with large fixed costs—contribute significantly to a global firm’s economies of scale and scope.

Stylized Banking Group Structure

Now consider the consequences of any part of the group losing access to these shared services in resolution. In the case of Lehman, where the firm was placed into separate bankruptcy procedures in each jurisdiction, this is exactly what happened. Larry Ball describes the outcome in his book (page 77):

Flows of money among [Lehman Brothers Holding Inc.] and its subsidiaries stopped on [September] 15th as the different units entered separate insolvency proceedings. In addition, Lehman’s global accounting system shut down. [Bryan Marsal, manager of the LBHI bankruptcy estate] says:

[O]ne of the dangers of a global entity is that these walls go up and you really don’t have access to your basic financial information. We didn’t know for 90 days who we owed money to or what assets were ours, what loans were ours, as we tried to reconstruct.

The Financial Stability Board emphasizes that a robust resolution regime allows authorities to “resolve a failing firm in a manner that maintains continuity of its critical functions.” There are three ways to do this: with services provided within the failed entity, by an intra-group service firm, or by a third-party provider. Regardless of the method used, the setup must be such that there is no chance in an MPOE resolution of repeating what happened in the Lehman calamity. Such a setup may well reduce the economies of scale and scope of G-SIBs.

In closing, we note the relationship between different resolution regimes and the financial trilemma: financial stability, cross-border financial integration, and national financial policies are fundamentally incompatible. As Schoenmaker describes, the implication is that in the absence of a joint fiscal backstop that guarantees burden sharing across borders, countries may choose to either force their banks to shrink or require a move to MPOE. For all but the largest countries, global banks may be too big to save.

Acknowledgments: We thank our friends Paul Tucker and Larry Ball for their help in understanding resolution and the Lehman episode.