FOMC Communication: What a Long, Strange Trip It's Been

“Since becoming a central banker, I have learned to mumble with great incoherence. If I seem unduly clear to you, you must have misunderstood what I said.” Federal Reserve Board Chairman Alan Greenspan, September 22, 1987 (The Wall Street Journal, as cited in Geraats).

“More recently, in the 1980s, policymakers, myself included, were concerned that being too explicit about short-run targets would make such targets more difficult to change, impeding necessary adjustments to evolving market and economic conditions.” Federal Reserve Board Chairman Alan Greenspan, October 11, 2001.

Following their January 2019 meeting, the Federal Open Market Committee (FOMC) came in for intense criticism. Instead of a truculent President complaining about tightening, this time it was financial market participants grumbling about a sudden accommodative shift. In December 2018, Fed policymakers’ suggested that, if the economy and market conditions evolved as expected, they probably would raise interest rates further in 2019. Faced with changes in the outlook, six weeks later they altered the message, suggesting that going forward, monetary easing and tightening were almost equally likely.

We find the resulting outcry difficult to fathom. The FOMC’s perceptions of the outlook may have been incorrect in December, in January, or both. There are myriad ways for economic and market forecasts to go wrong. But, to secure their long-run objectives of stable prices and maximum sustainable employment, isn’t it sometimes necessary for policymakers to change direction, and when they do, to explain why?

The point is that the recent turmoil arises at least in part from the Fed’s high level of transparency. Indeed, on top of the statement that followed the FOMC’s January 30, 2019 meeting, Chairman Jerome Powell answered reporters’ questions for about 45 minutes, kicking off the FOMC’s new practice of holding a press conference after every scheduled meeting. This doubling of the frequency is just another step in the long road of increasing Fed transparency.

In this post, we summarize the evolution of Federal Reserve communication policy over the past 30 years, and discuss the importance and likely impact of these changes. While transparency is far from a panacea, we conclude that the evolution has been useful for making policy more effective and sustainable, and remains critical for accountability and democratic legitimacy.

Our starting point is the chairmanship of Alan Greenspan, which began on August 11, 1987. At that time, there were no statements following FOMC meetings, no published minutes, no release of any FOMC materials, and certainly no press conferences. In other words, the FOMC never disclosed changes in policy. People outside the system had to figure things out by other means. That process of “policy discovery” was costly and inefficient.

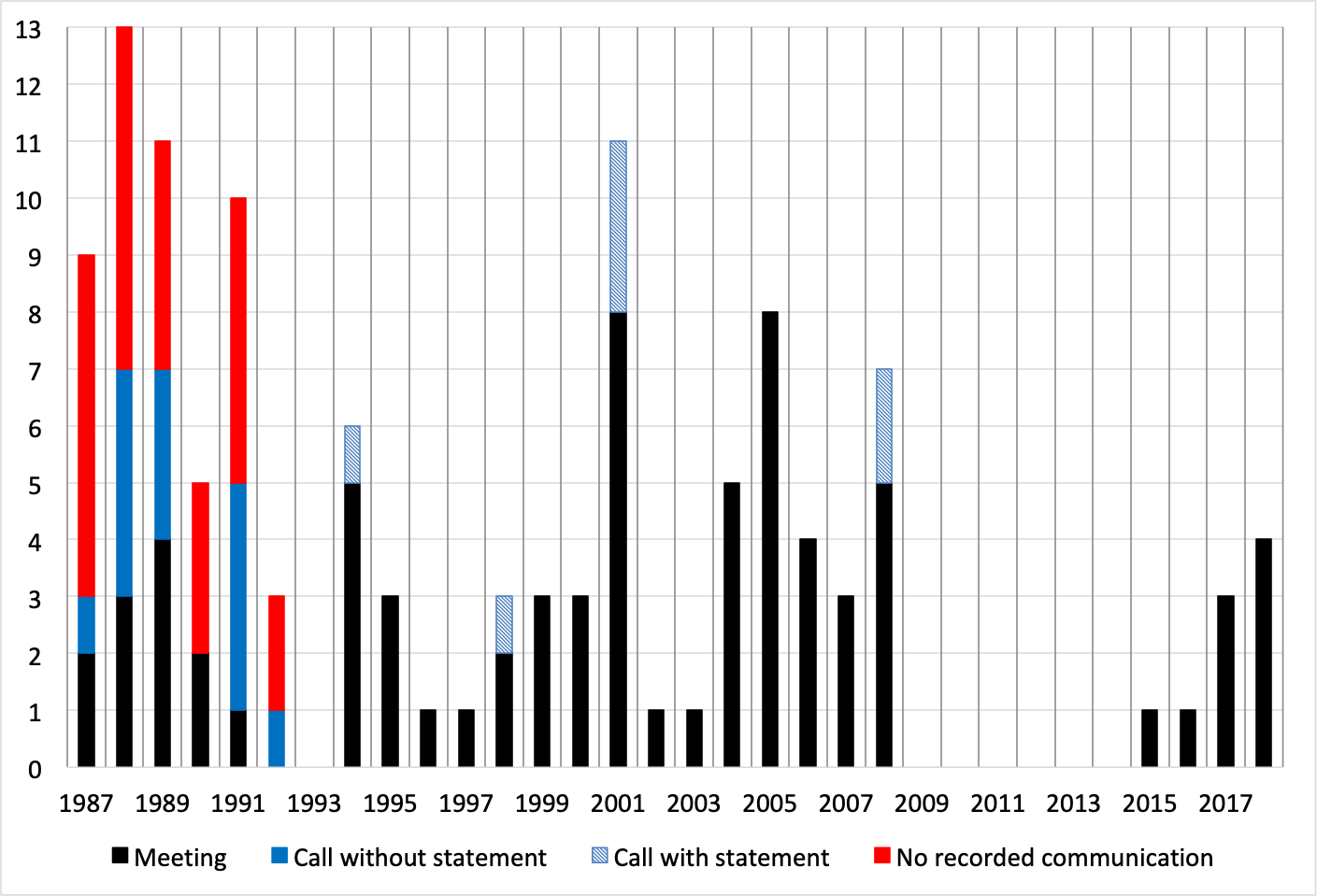

Opacity did not mean that the Fed kept policy stable. In fact, while the focus of operational policy in the late-1980s was more on reserve levels than interest rates, there were interest rate targets of a sort, and these changed frequently. The following chart shows a simple count of the number of federal funds rate target changes from 1987 onward. In 1988, Greenspan’s first full year in office, the target changed 13 times. Of these, however, only 3 changes occurred at or around the time of one of the 8 scheduled FOMC meetings (black bars); 4 were announced to the FOMC, but not to the public, on impromptu conference calls (dark blue bars); and the remaining 6 were not associated with any recorded FOMC communication (red bars). Put differently, it is not even clear when and how the FOMC members other than the Chair learned of nearly half of the changes. (Beginning in 1994, all changes were publicly announced, including those that took place following inter-meeting calls, so everyone inside and outside the Federal Reserve knew about them immediately.)

Number of changes in the federal funds rate target, 1986-2018

Source: Table 1 in Thornton and Federal Reserve.

Since 14 of the 22 changes between August 1987 and May 1989 were smaller than 25 basis points, we suspect some these were technical adjustments designed to keep reserve markets at the desired equilibrium. Regardless, from today’s perspective, three things stand out: changes occurred frequently; the bulk of the decisions to make the changes did not occur at a formal FOMC meeting; and, on many occasions, the Chair did not appear to consult FOMC members prior to the policy implementation. Put differently, the FOMC Chairman really did control monetary policy. (For the comprehensive official history of FOMC communication in the last quarter of the 20th century, see here.)

The early 1990s occasioned major changes in FOMC practices, including both decision-making and communications. Two events stand out. First, in 1993, the FOMC began publishing minutes of its meetings. (Initially released 3 days after the following meeting, the current practice of issuing minutes 3 weeks following a meeting began in 2004.) Second, on February 4, 1994, the FOMC released the first immediate, post-meeting, announcement of a policy change:

“Chairman Alan Greenspan announced today that the Federal Open Market Committee decided to increase slightly the degree of pressure on reserve positions. The action is expected to be associated with a small increase in short-term money market interest rates.

The decision was taken to move toward a less accommodative stance in monetary policy in order to sustain and enhance the economic expansion.

Chairman Greenspan decided to announce this action immediately so as to avoid any misunderstanding of the Committee's purposes, given the fact that this is the first firming of reserve market conditions by the Committee since early 1989.”

For the next few years, the FOMC released statements in the aftermath of policy shifts. These were equally succinct, albeit including announcements of discount rate changes. Starting in July 1995, statements explicitly mentioned a numerical target for the federal funds rate; by 1996, they no longer referred to Chairman Greenspan; and in 1997 the statements began to include more than a one-sentence justification for the action. The current practice of issuing a statement following every meeting—regardless of whether the interest rate target was changed—began in February 1999. Only in March 2002 did these statements reveal members’ votes. In other words, the statements we have come to expect are a recent innovation.

This move to public announcements marks a clear shift in the power structure of the FOMC. While the Chairman retains substantial influence over the direction of policy―controlling information and the tone of discussions in a way aimed at garnering a consensus for their desired outcome―the Chair’s discretionary authority to change the interest rate target between meetings disappeared.

The publication of the statements also represents an unprecedented increase in policy transparency. As we indicated earlier, prior to 1994, market participants would look for hints of policy changes in signals they scraped together from open market operations (OMOs) and reserve data―a process that required substantial technical expertise and the passage of time (to observe OMOs). With the start of these announcements, there is no turning back. Since 1994, observers no longer ask whether policy has changed, but whether it will change. The debate is now completely forward looking.

Central bankers in the 21st century see the ability to communicate clearly and effectively to their governments, to markets and to the public at large as an essential part of their jobs. As then-Chairman Ben Bernanke describes, the days of pre-World War II Bank of England Governor Montagu Norman’s reputed dictum “Never explain, never excuse” are clearly over. There is no longer a premium on mumbling. Instead, we have vast amounts of detail on how and why U.S. monetary policymakers do what they do. In addition to the statements and press conferences following every meeting, the FOMC issues economic and policy forecasts quarterly, publishes longer-term objectives annually, and releases minutes three weeks following each meeting. Members also periodically testify before Congress and give frequent public talks. With enormous fortunes at risk, market participants watch intently for any sign of changes in FOMC members’ thinking.

Policymakers and monetary economists both believe in the value of transparency. They see it as a way to create credibility, improving the effectiveness of monetary policy and overcoming the inevitable time consistency problem that central banks face (see our primer). But release of information does have some limits for at least two reasons. First, laying decision-making open for all to see can damage the deliberative process. For example, we seriously doubt that live-streaming of FOMC meetings would improve policy decisions or their effectiveness. Instead, letting everyone watch would almost surely lead to an extremely formal gathering, possibly full of sound and fury but signifying nothing. Second, with more communication, one runs the risk of sending confusing signals. That is, instead of resolving policy uncertainty, a flood of words could create it.

This all leads us to ask whether the past changes in communication policy have had a measurable impact on uncertainty. The following chart plots the Survey of Professional Forecasters (SPF) forecasts for 10-year consumer price inflation, quarterly, from 1991 to 2018 (the maximum period for which the data are available). We include the median forecast (solid black), the 25th and 75th percentiles of the forecast distribution (dashed black), and the interquartile range (solid red). The vertical lines represent the three biggest changes in FOMC communication policy in the past quarter century: the announcement of policy changes beginning in 1994; the shift to statements following every meeting in 1999; and the publication of longer-run objectives starting in 2012, followed by quarterly FOMC economic and policy projections and press conferences. The dispersion of long-run inflation forecasts―a measure of uncertainty―trends gently downward (dashed red line). By this measure, uncertainty about long-run inflation has declined by 25 basis points per decade since 1991. Of course, the decline in the dispersion has limits, which we may have reached.

10-year CPI Forecast: Median and Dispersion, 4Q 1991-2018

Source: Survey of Professional Forecasters, Federal Reserve Bank of Philadelphia.

So far so good. A slow shift to adopt aspects of an inflation-targeting framework has paid off. What about broader measures of uncertainty? To get a rough sense, we had a look at three indicators, the CBOE’s S&P 100 volatility index (VIX), the Bloom-Davis Economic Policy Uncertainty Index (EPU) and the absolute value of the change in the constant maturity two-year Treasury rate. We asked whether FOMC meetings themselves are associated with increases or decreases in any of these, and whether the impact of meetings changes with the evolution of FOMC communication. Looking at weekly data starting in 1986, the answer is no. As the FOMC has become more transparent, these measures provide no evidence of a change in the impact on uncertainty around the time of the meetings.

We can hear the late Allen Meltzer—author of the definitive Fed history—saying: “What did you expect? Be grateful that meetings don’t make things worse!” However, before we advocate for a world with inflexible policy rules, we should point out that there are a number of much more charitable interpretations for what appear to be negative findings. In many ways, shifts in FOMC communication policy reflect changes in both the external environment and the audience. Today, global financial markets are far larger than they were in 1990. This alone makes it difficult to detect a gradual evolution in very noisy, high-frequency volatility data. Second, globalization means that stresses and strains emanating anywhere are quickly transmitted everywhere. In such an environment, keeping volatility in check is a success.

It’s also likely that greater transparency helped to discipline policy. The Montagu Normans of the world preferred opacity in order to maximize discretion: they feared impediments to policy changes if decision makers had to confess to a changing outlook (see the second opening citation). Today, the lessons of time consistency make it clear that confession is not just good for the soul: a framework of transparency enhances policy effectiveness by diminishing the incentive to renege on key commitments. That credibility is almost certainly why professional forecasters (as well as financial market indicators) anticipate a long-run inflation rate very close to the Fed’s official target.

Perhaps most important, the audience for central bank communication is not just financial markets, but the public at large. To be effective, monetary policy must be sustainable. But sustainable policy also must be accountable policy, and that requires explaining what you do and why you do it. On this basis, the Fed is far more effective today at communication than it has ever been. No less important, it is far more conscious of the need for continuous refinement of its practices—reflecting both the changes in the policy challenges and the ongoing evolution of communications technology.

“Sometimes the light's all shinin' on me,

Other times I can barely see.

Lately it occurs to me what a long, strange trip it's been.”

Truckin’, The Grateful Dead.