Replacing LIBOR

“Come on feet don’t fail me now.” Edwin Starr et al, Twenty-Five Miles

“[R]egardless of how you choose to transition, beginning that transition now would be consistent with prudent risk management and the duty that you owe your shareholders and clients.” FRB Vice Chair for Supervision Randal K. Quarles, Speech to the ARRC Roundtable at NYU Stern, June 3, 2019.

Publication of LIBOR―the London Interbank Offered Rate―will likely cease at the end of 2021. This is the message U.K. Financial Conduct Authority (FCA) CEO Andrew Bailey sent in 2017 when he announced that, after 2021, the FCA would no longer compel reluctant banks to respond to the LIBOR survey. Given the small number of underlying LIBOR transactions, and the reputational and legal risks banks face when submitting survey responses based largely on their expert judgement, we expect that most banks will then happily retreat. In just over two years, then, the FCA could declare LIBOR rates “unrepresentative” of financial reality and it will vanish (see, for example, here).

Most financial experts know this. Yet, LIBOR remains by far the most important global benchmark interest rate, forming the basis for an estimated $400 trillion of contracts (as of mid-2018; see Schrimpf and Sushko), about one-half of which are denominated in U.S. dollars (as of end-2016; see Table 1 here). While the use of alternative reference rates is increasing rapidly, to beat the LIBOR-countdown clock, the pace will have to quicken substantially. In the United States, the outstanding notional value of derivatives linked to the alternative secured overnight reference rate (SOFR) jumped from less than $100 billion to more than $9 trillion in just the past year (see SIFMA primer). Yet, this amount still represents a small fraction of outstanding dollar-LIBOR-linked instruments.

In this post, we examine the U.S. dollar LIBOR transition process, highlighting both the substantial progress and the major obstacles that still lie ahead. The key goal of the transition is to ensure that the inevitable cessation of LIBOR does not trigger system-wide disruptions. Unfortunately, at this stage, count us among those that remain deeply concerned.

Before proceeding, let’s take a step back to consider the systemic risk posed by the cessation of LIBOR. We see two key issues. The first arises from the legacy contracts referencing LIBOR. When publication of LIBOR stops (or is expected to stop), contracts that lack adequate fallback provisions may plunge in value. To the extent that large, leveraged intermediaries are exposed, the resulting losses could impair their capital, leaving us in the dark about which institutions are healthy and which are not. And, what about the entire system? We know from painful experience that uncertainty about the well-being of key intermediaries, combined with concern about the capitalization of the financial system as a whole, can lead to a freeze in funding markets, diminishing the supply of credit to healthy borrowers. The second issue is whether, when LIBOR ceases, there will be an adequate substitute that allows intermediaries both to fund themselves in a liquid market and to provide credit.

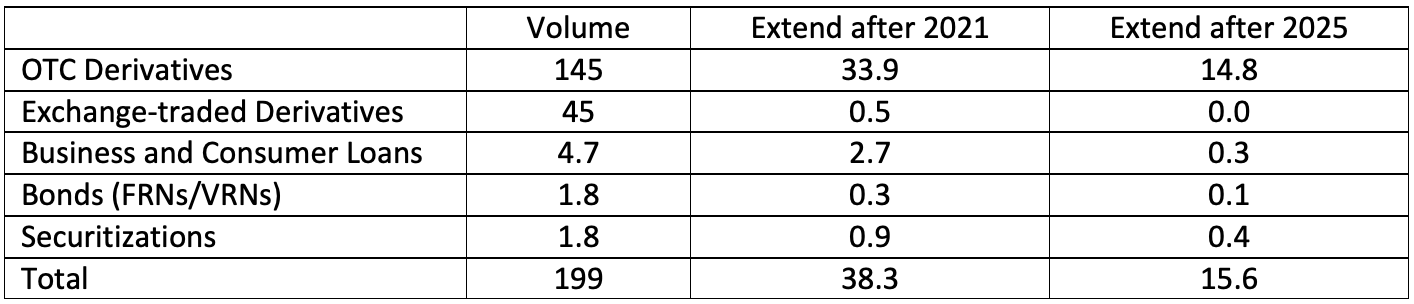

So, where do things stand? First, there remain plenty of dollar LIBOR legacy contracts outstanding. According to the Alternative Reference Rates Committee (ARRC), some $38 trillion of existing contracts (as of end-2016) extend beyond 2021 (including $15 trillion that extend beyond 2025). The details are in the table below. But, because the latest available data are nearly three years old, and the industry continues to create LIBOR-linked contracts, we strongly suspect that these numbers understate the challenge.

U.S. Dollar LIBOR-linked contracts (Trillions of U.S. dollars, notional value), End-2016

OTC over the counter. FRN floating-rate note. VRN variable-rate note.

Source: Based on Table 1, ARRC Second Report, March 2018.

Second, there is no central repository providing information about what, if any, fallback language exists in these contracts. Without LIBOR, what happens? Inadequate fallback language fosters uncertainty about the value of the assets, and could trigger a wave of lawsuits when the losers (and winners) eventually are revealed. FRBNY General Counsel Michael Held has called this a DEFCON 1 litigation event.

Fortunately, to address the challenge posed by the stock of existing derivatives—by far the largest component of the LIBOR footprint—the International Swaps and Dealers Association (ISDA) is at work developing fallback language that dealers and customers could adopt voluntarily. In addition, the ARRC has recommended fallback language for business loans, floating rate notes (FRNs), and securitizations; and it is consulting on language for adjustable rate mortgages (ARMs). Unfortunately, we do not know the extent to which firms are adopting the ARRC language for new loans and bond issues. We also do not know the pace at which firms are re-negotiating legacy contracts that lack adequate fallback language. Past experience with the rote usage of boilerplate in debt contracts highlights how slowly such change may occur when relying solely on market forces and court actions (see, for example, Choi, Scott and Gulati on the pari passu clause in sovereign debt contracts).

Third, while the process of creating a satisfactory replacement for dollar LIBOR is well advanced, it is far from complete (see the opening citation from Edwin Starr). After selecting SOFR as its preferred benchmark in 2017, the ARRC has actively and successfully encouraged its use. Historically, reference rates arise through an extended process of trial and error in which counterparties eventually adopt a benchmark that enhances market depth and liquidity (see, for example, Duffie and Stein and Kroszner). In the current circumstance, in order to ensure that there is a meaningful alternative to LIBOR by the end of 2021, there is little time for such testing. As a result, while market forces dominate, we still need a considerable degree of coordination involving the private and public sectors across numerous markets and jurisdictions.

The good news is that SOFR meets a range of criteria that a robust benchmark must satisfy. This includes the key standard that LIBOR lacks: a deep, liquid market. As we show in the following chart, the daily value of underlying SOFR transactions now routinely exceeds $1 trillion, and continues to rise. In contrast, the median daily value of dollar LIBOR transactions is languishing in the range of only $2 to $3 billion (see Figure 1 here).

Value of underlying SOFR transactions (Billions of dollars), 1 Jan 2015 – 20 Aug 2019

Source: FRBNY.

Somewhat surprisingly, despite LIBOR’s lack of underlying liquidity, it still dominates SOFR. For example, while SOFR futures trading has increased rapidly on the Chicago Mercantile Exchange, as of early August 2019, the average daily volume and open interest of the CME Eurodollar futures contract (the price of which varies inversely with three-month LIBOR) was nearly 65 times larger than that of SOFR futures. The expectation is that SOFR swaps will follow (not precede) the evolution of SOFR futures. But, when? Similarly, in the bond market, SOFR is just gaining steam, with new issuance records set almost every month (see, for example, here and here).

“Path dependence” is probably the dominant force behind the sluggish transition: having used LIBOR since the mid-1980s, everyone is comfortable with it. At this writing, we have had SOFR for a mere 17 months. Moreover, switching to an alternative reference rate is costly. This includes the cost of writing new contracts; working out new investment and risk management strategies, including developing new software for implementation; training personnel; and informing and educating clients, investors and regulators. Not all firms are equally motivated to pay these transition costs. For some, LIBOR still appears to offer two advantages: there are 10 maturities out to 12 months for dollar LIBOR, compared to one for overnight SOFR. And, unlike SOFR, LIBOR incorporates a bank credit risk premium, so that LIBOR-linked assets naturally incorporate some hedge for bank funding risk. Finally, despite the warnings of regulators, some market participants may simply doubt that LIBOR will cease to be usable after 2021, diminishing their incentive to prepare.

The ARRC’s “paced transition plan” anticipates the creation of a term SOFR rate by the end of 2021. However, to ensure that the end of LIBOR does not lead to systemic disruption, financial firms and their clients cannot wait for a term SOFR. In theory, lenders could use SOFR futures to calculate a term SOFR rate. In practice, however, the depth of the term SOFR markets—underlying and derivatives—is likely to evolve in parallel. This is just one of the “chicken and egg” problems that accompanies the switch to a new benchmark. Ultimately, the more widely that a benchmark is used, the greater the value of using it. That suggests the existence of a usage threshold beyond which the transition will accelerate.

As for a proxy for their own (bank) credit risk when borrowing on an unsecured basis, lenders will have to look elsewhere. To be sure, unsecured funding has declined sharply, but it has not disappeared (see Schrimpf and Sushko). Ultimately, we suspect that there will be a variety of ways to hedge unsecured funding risk. Large banks might use internal models to compute risk premia to add to SOFR, while smaller institutions may prefer some market-based rate (Ameribor and the ICE Bank Yield Index seem like possibilities). However, because its liquidity dwarfs other potential dollar-LIBOR alternatives, at least for the short time that LIBOR still exists, SOFR will remain the key alternative.

So, what to do? Fortunately, regulators in the United States and elsewhere are well aware of the risks of delay and are now pushing hard for LIBOR users—especially financial institutions and markets under their supervision—to prepare for a world without LIBOR (see the opening citation from FRB Vice Chair Quarles). The Fed is ramping up inquiries—especially with the largest banks—regarding their exposure and preparedness. The major regulators, including the CFTC, FDIC, and the SEC, all participate in the FRBNY-convened ARRC—an extremely welcome case of public-private cooperation.

Going forward, we see at least four very important roles for government officials. First, the greater the certainty about the end date, the faster the LIBOR transition will be (see, for example, here). At the very least, authorities can further intensify warnings about the imprudence of relying on LIBOR, while promoting timely disclosure of LIBOR-related risks (see, for example, the recent SEC staff statement).

Second, supervisors must ensure that all systemically important banks and financial market utilities are fully prepared. These institutions need to know (and share with their supervisors, creditors and investors) the LIBOR-related risks they face (including any LIBOR-linked contracts they hold and the associated fallback language), and have risk management systems that allow them to update these risk measures rapidly whenever desired. For systemically important firms, authorities must hold the managers accountable so that, following the inevitable loss of liquidity in LIBOR-linked assets, none face a meaningful threat to their capital or their operations.

Third, there remains a remarkable absence of up-to-date data on LIBOR-linked instruments. The aggregate numbers in our table date from the end of 2016. In the course of monitoring institutions and markets, regulators should gather and publish data showing the evolution of LIBOR exposure at least quarterly. Importantly, that information should include the extent to which intermediaries are incorporating adequate fallback language in existing and new LIBOR-linked contracts.

Fourth, because the LIBOR transition will directly affect many households and small businesses with LIBOR-linked debt, it is important for authorities (including the Consumer Financial Protection Bureau) to promote public awareness of the changes underway. As a proxy for public knowledge, the frequency of web searches for “SOFR” and “LIBOR” suggests little, if any change, following the FCA’s 2017 announcement of LIBOR’s likely end (see chart). Should households be poorly informed about the LIBOR transition, even in the absence of remaining legal uncertainties, political risks could affect the value of LIBOR-linked mortgages.

U.S. search frequency: “LIBOR” vs. “SOFR” (October 2008 “LIBOR”=100), 2004-August 2019

Source: Google Trends (accessed August 22, 2019). Updated from slide 9 of the July 2019 LIBOR Transition working group report.

The bottom line: the transition from LIBOR is “an unprecedented global financial engineering project of massive scale that will require extraordinary coordination and cooperation across institutions, markets and jurisdictions” (see here). The excellent work of the ARRC exemplifies what a public-private partnership can achieve. Nevertheless, as the clock on LIBOR runs out, the risk of serious disruptions to the financial system remains.

Acknowledgements: Without implicating them, we thank our friends and colleagues Kathryn Judge and Susan Wachter, who led the LIBOR Transition working group of the Financial Research Advisory Committee (FRAC) of the Office of Financial Research. Much of this post is based on joint work by one of us with them, including the working group’s July 2019 report to the FRAC. We also thank our friend and Stern colleague, Richard Berner, for his thoughtful suggestions.