GDP-linked Bonds: A Primer

“We call for further analysis of the technicalities, opportunities, and challenges of state-contingent debt instruments, including GDP-linked bonds.” G20 Finance Ministers & Central Bank Governors, 23-24 July 2016, Chengdu, China

Gross government debt in advanced economies has surpassed 105% of GDP, up from less than 75% a decade ago. Some countries with especially large debts—including Greece (177%), Italy (133%) and Portugal (129%)—are viewed not only as a risk to the countries themselves, but to others as well. As a result, policymakers and economists have been looking for ways to make it easier to manage these heavier debt burdens.

One prominent suggestion is that countries should issue GDP-linked bonds that tie the size of debt payments to their economy’s well-being. Proponents point to two major advantages. First, these bonds reduce the likelihood of explosive paths for sovereign debt, lowering default risk. This would increase the maximum level of sustainable debt, and provide greater capacity for countercyclical fiscal policies (see here and here). Second, GDP-linked bonds offer investors a low-cost way to diversify both domestically and internationally. Within a country, bonds with payoffs tied to GDP provide exposure to fluctuations in returns to labor as well as capital. The two are only weakly associated, with the correlation between growth in U.S. labor income and capital income over the last half century less than 0.2. Internationally, a portfolio of GDP-linked bonds allows diversification of idiosyncratic, country-specific risks. (For a description of the diversification benefits of holding foreign equities, see our earlier post here.)

We find this idea attractive, and see the expanding discussion of the viability of GDP-linked bonds both warranted and useful (see here and here). However, the practical issues associated with GDP data revision remain a formidable obstacle to the broad issuance and acceptance of these instruments.

Before getting to the key challenge of data revisions, let’s start with a brief description of the technical aspects of GDP-linked bonds. The recent interest in these instruments can be traced to the work of Robert Shiller, who introduces them in his 1998 book Macro Markets and in a more recent paper here. The idea is that governments should sell long-term bonds with a coupon equal to a constant fraction of nominal GDP. Shiller calls them trills, suggesting that their annual payment be one-trillionth of a years’ nominal GDP. (For the United States, that would mean a current payment in the range of $18.75.) Trills could either have a principal payment that is also indexed to GDP, or they could be perpetuities. While Shiller observes that governments would find the stabilizing properties of trills attractive, his primary focus is on their potential as a vehicle for retirement savings. What better way to insure your standard of living in retirement than to buy a share of your country’s (or, even better, multiple countries’) GDP?

Since Shiller’s original work, two types of GDP-linked bonds have been proposed. The first mimics the structure of standard inflation-indexed bonds. We call these GDP-principal-indexed bonds; they have a specific maturity and pay a coupon equal to a constant fraction of a principal that is indexed to GDP. To make this concrete, suppose that on 1 January 2015, the U.S. Treasury issued a $100 face value bond with a 30-year maturity and a 2% coupon. At the time of issue, the bond has a reference level for nominal GDP. The proposal is that GDP levels be measured with a six-month lag, so the reference level is the end-2014 vintage reading for GDP in the second quarter of 2014, namely $17,328.2 billion. At the start of 2017, the value of the bond principal would be $106.747 for each $100 of face value, based on the end-2016 vintage reading for GDP in the second quarter of 2016 ($18,450.1 billion), while the coupon would be $2.13 (see table below). An indicative term sheet for such principal-indexed bonds was produced by the Bank of England in November and has been put out for comment by the International Capital Market Association.

GDP-linked bond examples: principal-indexed vs. coupon-indexed

Note: GDP readings are December vintage for the second quarter of the year. So, for

1 Jan 2015, the GDP shown is the December 2014 release for the second quarter of 2014.

In the alternative structure for GDP-linked bonds, the coupon is set equal to the nominal GDP growth rate plus a fixed premium, while the principal does not vary. We will call these GDP-coupon-indexed bonds. To see how they work, again assume that at the beginning of 2015 the Treasury issued a $100 face value bond. But, now, the principal is fixed and the coupon is the sum of 2% plus the annual growth rate of nominal GDP (measured with a six-month lag). Because nominal GDP grew by 2.51% over the year to the second quarter of 2016 (based on end-2015 vintage data), the coupon payment at the start of 2017 would be $4.51.

One difference between these two structures is the timing of payments. In the first, the bulk of the compensation for nominal growth occurs at maturity, while in the second a larger proportion comeswith the periodic coupon payments. Put differently, GDP-principal-indexed bonds have longer duration as their payments are back-loaded relative to the GDP-coupon-indexed bonds. This difference does not affect the government’s primary balance (that’s the government deficit or surplus excluding interest payments) for a given debt-to-GDP ratio.

However, a key purpose of issuing GDP-linked bonds is to provide the government with a cyclical cushion, allowing it to limit debt service when revenues are low. From this cash-flow perspective, the two structures are quite different. To see why, suppose that the government has debt equal to 100% of GDP during a recession when nominal GDP has fallen by 2%. With GDP-principal-index bonds that pay a 2% coupon, the government will owe bondholders 2% of GDP. With GDP-coupon-indexed bonds that pay a 2% premium over nominal growth, debt service will be zero.

This may seem like magic, but it is not. In the first case, the bondholders lose 2% of their principal, which equals 2% of GDP. That is, for the GDP-principal-indexed bonds, the coupon payment exactly offsets the loss in principal. The debt-to-GDP ratio is unchanged. In the second case, since the bond principal does not vary, with a 2% decline in GDP, the debt-to-GDP ratio goes up by 2%.

What this means is that a government that issues GDP-coupon-indexed bonds has an option. In a deep recession, authorities can either use their primary surplus (assuming they have one) to keep their debt-to-GDP ratio constant by buying back bonds. Or, they can allow the debt-to-GDP ratio to rise automatically, and use the revenue that otherwise would have been used to service the debt for expansionary fiscal policy. Which of these is more attractive will depend on how financial markets price this option.

So much for the technical details. What about the obstacles? For example, could a government game this GDP-linked debt structure in the short run or the long run? It seems highly doubtful that a government would intentionally depress the economy to reduce its debt service. And, if investors believe that growth will be persistently weak, they will charge a corresponding premium to a sovereign that issues GDP-linked debt.

Another roadblock could be the price. Debt managers might find the risk premium that investors demand to be too high. For advanced economies, most estimates of the likely premium are in the range of 150 to 300 basis points. Unsurprisingly, for emerging market economies the numbers are much larger, and can easily exceed 500 basis points (see here).

In our view, the biggest obstacles are associated with the computation of the GDP index itself. First, the government will have an incentive to pressure national statistical agencies to lower the reported level of nominal GDP. Absent strongly independent institutions, investors may shun GDP-linked issues. Second, there are the inevitable data revisions, on which we focus in the remainder of this post.

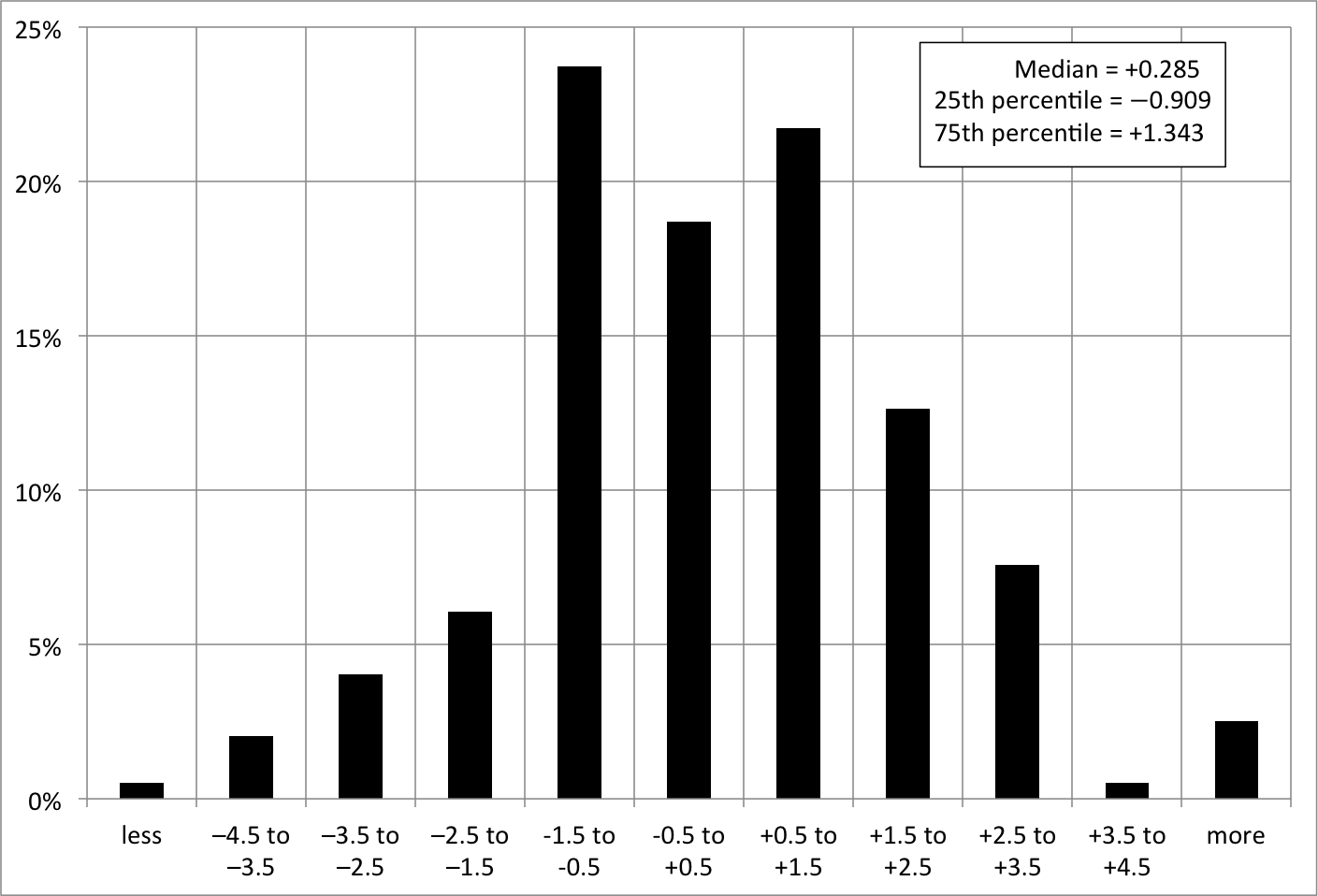

Data revisions are of two types: there are the regular, periodic changes that result from the inclusion of more accurate information, and there are infrequent changes in methods. The first of these results from the arrival of tax data that improves the quality of wage data, surveys that improve estimates of the population, changing seasonal factors, and the like. While these occur all the time, they can be quite large. To see this, we used the real-time dataset maintained by the Federal Reserve Bank of Philadelphia. The first chart below is a histogram of the revisions from the third release of GDP—that’s the one that published three months after the end of the quarter—to the most recently available estimate. Fully half of these revisions exceed one percentage point (at an annual rate), either up or down. This seems like a big number.

Frequency distribution: size of revisions in quarterly seasonally adjusted annualized growth of nominal GDP, 1965-2014

Note: Revisions are measured as the difference between the one-quarter seasonally adjusted growth at an annual rate measured from the third release (normally three months after the end of the quarter) to the release using the current value. Each bin contains the fraction of 198 quarters with growth revisions that are in the specified range. Source: Federal Reserve Bank of Philadelphia, and authors’ calculations.

From the Treasury’s perspective, the key benefit of GDP-linked bonds comes from times when GDP falls significantly, such as the final quarter of 2008. However, such large turning points are precisely when early-vintage readings of GDP are most likely to be revised. Indeed, the following chart displays the evolution of successive vintage estimates of the nominal GDP growth rate from the third to the fourth quarter of 2008, starting with the first vintage in early 2009 and continuing to the most recent vintage in December 2016. In January 2009, the Bureau of Economic Analysis (BEA) reported that fourth-quarter nominal GDP had contracted at a 4.05% annual rate. A month later, this was revised to -5.77%. Six months following the end of the quarter, the estimate stood at -5.37%. By mid-2011, over two and one-half years later, the estimate was -8.43%. Finally, in mid-2013, it was revised for the sixth time to its current level of -7.78%. These revisions seem important, as they would have fed directly into the value of GDP-principal-indexed bonds.

Vintage estimates of seasonally adjusted, annualized nominal GDP growth for the fourth quarter of 2008, 2009-2016

Source: Federal Reserve Bank of Philadelphia, and authors’ calculations.

In addition to these regular revisions, every so often there are large revisions based on fundamental changes in methodology. For example, in 2013, the BEA altered the classification of research and development—including intellectual property and software—in its comprehensive revision of the U.S. national income and product accounts. Formerly treated as intermediate inputs and hence ignored, they were reclassified as investment, which is a final good. This adjustment raised the level of GDP on average by about 3.2%. Specifically, as of the second quarter of 2013, nominal GDP in the fourth quarter of 2010 was estimated to have been $14,735.9 billion. Following the revision, the number rose to $15,231.7 billion. At the time, Treasury debt held by private investors totaled $9.964.5 billion, or 62% of GDP. If this had all been GDP-principal-indexed bonds, the value of government debt would have jumped by $325 billion.

The solution proposed for data revisions of using a six-month lag seems inadequate even excluding methodological shifts. While it might be appealing to lengthen the lag, given that most recessions are less than 12 months from peak to trough, this would reduce the cyclical benefits to the Treasury. As for the comprehensive data revisions, one idea is to maintain two sets of estimates, one under the old methodology and one under the new. But this is likely to be confusing to many, and may invite skepticism about the quality of the data, especially over long periods of time.

That brings us back to where we started. We see clear benefits to a government from issuing GDP-linked bonds, especially the type where coupon payment rates vary with nominal growth. But establishing investor confidence in these instruments will require a better approach to the obstacles posed by data revisions and changes in methodology. This seems like an excellent challenge for economists and finance practitioners alike.