Free Riding in Finance: A Primer

“The problem of the ‘stability commons’ is that anybody who could deplete the [financial] system’s resilience needs to be within the broad scope of the regime for stability.” Paul Tucker, October 2015.

Many features of our financial system—institutions like banks and insurance companies, as well as the configuration of securities markets—are a consequence of legal conventions (the rules about property rights and taxes) and the costs associated with obtaining and verifying information. When we teach money and banking, three concepts are key to understanding the structure of finance: adverse selection, moral hazard, and free riding. The first two arise from asymmetric information, either before (adverse selection) or after (moral hazard) making a financial arrangement (see our earlier primers here and here).

This primer is about the third concept: free riding. Free riding is tied to the concept of a public good, so we start there. Then, we offer three examples where free riding plays a key role in the organization of finance: credit ratings; schemes like the Madoff scandal; and efforts to secure financial stability more broadly.

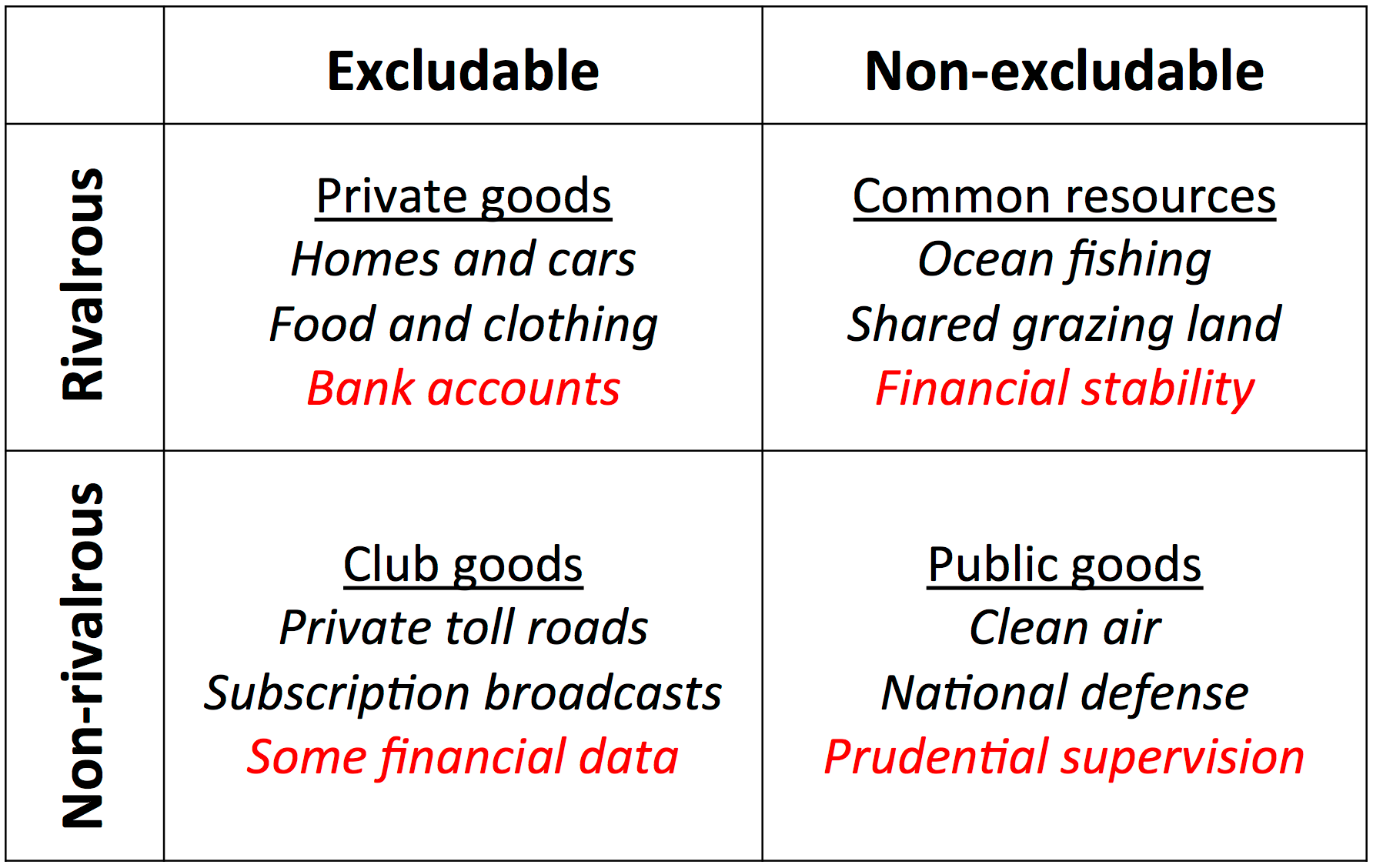

In the simplest models of supply and demand, the goods exchanged share two key attributes: they are rivalrous and they are excludable (see table below). You can only consume a rivalrous good once. For example, when one of us (Steve) eats a slice of pizza, the other (Kim) can no longer eat that same slice. Put differently, a rivalrous good is used up in the process of consumption, so it is not available for re-sale. An excludable good is one the seller can prevent someone from consuming without paying. A slice of pizza qualifies here, too. Private, competitive, markets usually supply goods that are both rivalrous and excludable.

Private, public and quasi-public goods: four combinations of excludable and rivalrous

Source: Authors; inspired by Table 18.1, Tyler Cowen and Alex Tabarrok in Modern Principles of Economics, and by the definition matrix in Wikipedia.

Pure public goods are at the opposite end of the spectrum: they are neither rivalrous nor excludable. For example, when one person breathes, the impact on the earth’s atmosphere is so small that it has no effect on anyone else’s access to air. In addition, given the abundance of atmosphere, no one can impose a fee on breathing (in contrast to science fiction stories in which oxygen may be scarce). Unlike private goods for which they can charge a price, private vendors have no incentive to supply a public good since they will receive no compensation.

Unsurprisingly, there also are goods that have only one of the two attributes. Such quasi-public goods fall in two categories: club goods and common resources. Private vendors will supply non-rivalrous goods if they can exclude those who do not pay from consuming them. Classic examples of such club goods include private toll roads, internet services and satellite broadcasts. In contrast, non-excludable goods that are rivalrous suffer from the tragedy of the commons: private incentives lead to undersupply or, conversely, to overuse that depletes or degrades the good’s value. For example, by the mid-19th century, when Melville published Moby-Dick, the decimation of the whale population in the Atlantic had led New England whalers to scour the south Pacific for their targets.

Free riding occurs when goods are non-excludable. A free rider is someone who consumes a good without paying for it. Free riding diminishes the private incentive to supply any non-excludable good. The conventional remedies for this common-property problem are either privatization or government regulation.

So, how does this all relate to the world of finance? Intermediaries willingly provide financial services that are both rivalrous and excludable. These include a wide range of deposit and broker accounts, insurance contracts, and loans. In some cases, where excludability is feasible, firms also supply non-rivalrous financial goods. A prime example is the consumer reporting companies (such as Equifax, Experian and Transunion) that sell their data and credit scores to various providers of household credit (see our recent post). Another is firms like CoreLogic that sell detailed information about individual mortgages to the originators, traders and acquirers of complex mortgage-backed securities. Like most information, these firms’ products retain their integrity regardless of the number of people who get ahold of them.

However, financial services that are non-excludable create potentially serious problems. And, importantly, technological innovation changes the nature of some services, leading some that were once largely excludable to become non-excludable.

We now turn to three examples where free riding affects financial services.

Credit ratings. Information is central to finance. It is vital for allocating resources to their most productive use; for pricing and distributing of risk (including the management of adverse selection); and for ensuring that incentives are aligned once financial arrangements are in place (that is, for limiting moral hazard).

Importantly, information is non-rivalrous. Aside from episodes of Mission Impossible, the U.S. television show from 40 years ago (reprised as a series of movies since the mid-1990s), information does not self-destruct five seconds after its first and only play. Instead, the nature of information—its content and quality—is generally unaffected when one person uses it.

Credit ratings illustrate both the critical role of information in finance and the impact of free riding. Credit rating agencies have been selling their opinions about bonds for more than a century. By influencing the willingness of wealth holders to invest, these assessments of default risk (and conditional guidance about recovery) affect the cost of borrowing. In some cases, regulations also limit intermediaries’ ownership of low- or un-rated bonds.

From 1909, when John Moody started the business, until the 1970s, credit rating agencies sold their reports directly to buyers. This investor-pays strategy relied on excludability: their willingness to supply credit ratings required that the agencies could prevent non-payers from exploiting their assessments. The technology of distributing ratings products on paper (in books, newsletters and the like) made this possible.

Beginning in the early 1970s, however, the industry shifted to the current issuer-pays model. In a list of potential causes of this shift, White cites excludability first: “[T]he rating agencies may have feared that their sales of rating manuals would suffer from the consequences of the high-speed photocopy machine … which would allow too many investors to free ride by obtaining photocopies from their friends.”

The “issuer pays” model maintained the incentive for credit rating agencies to produce ratings information. But, in the process, it fed a potential conflict of interest that undermined the quality and usefulness of some of those ratings (see our earlier posts here and here). For example, taking all the asset-backed securities (and collateralized debt obligations) rated AAA between 2005 and 2007, fewer than 20 percent were still investment grade by June 2009. Arguably, the relatively small number of issuers (according to White, roughly a dozen firms accounted for 80 to 90 percent of residential mortgage-backed issues), combined with the fact that these issuers could shop for ratings, fed a bias toward high ratings (see, for example here and here).

Madoff Scandal. One of the few positive aspects of the financial crisis of 2007-2009 is that the scramble for liquidity exposed Bernie Madoff’s decades-old Ponzi scheme (see our earlier posts here and here). The size of the scheme was astonishing: at the time of its collapse, investors believed they owned more than $60 billion. As of this writing, recoveries have reached $11 billion.

A respected member of the financial community, Madoff had triumphed repeatedly over the efforts of regulators to detect any misbehavior, despite numerous red flags. One reason that the fraud persisted for so long is that Madoff’s investors accepted that his firm (through an affiliate) maintained custody of the assets he claimed to hold. Had an independent entity been required to safeguard and certify the presence of the assets, it would not have been possible for Madoff to pay early investors out of funds coming from new investors. The existence of an independent custodian—a high-volume, low-cost business service generally provided by large banks—is critical to avoiding exactly this type of fraud.

Aside from their misplaced trust in Madoff, you may wonder why investors tolerated such a scheme without closer monitoring, especially when the cost of doing so (via an independent custodian) would have been modest. The answer is free riding.

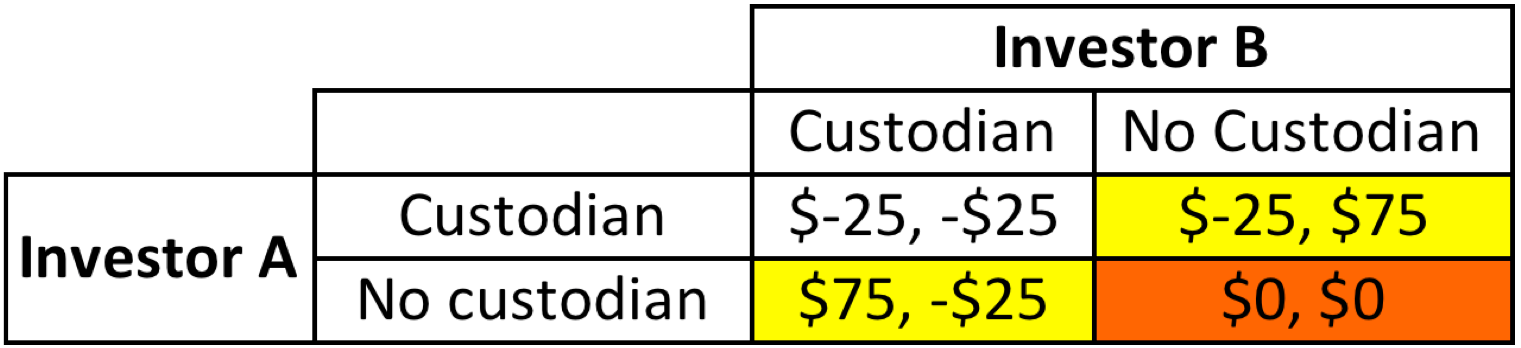

To see the problem Madoff’s clients faced, consider a simple example with only two investors (A and B) in a fund. Suppose the expected benefit of having a custodian is $75 for each of them, and that the cost of a custodian is $100. Suppose also that the investors cannot collude directly to share the cost and that the fund—run by Madoff—does not hire a custodian.

The matrix below shows the expected net payoffs (benefits minus cost) to each investor in the presence or absence of a custodian. In each of the four cells, the first number is the net payoff to investor A, the second to investor B. The first row shows the net payoffs if investor A hires a custodian. The second row shows the net payoffs if investor A does not hire a custodian. The first and second columns show the same things for investor B. For example, in the top left cell (-$25, -$25), both investors hire a custodian: each investor pays $100 and receives a benefit of $75, so the net benefit is -$25 in both cases. The two cells in yellow illustrate the problem of free riding: each investor benefits if the other one hires a custodian, but neither has sufficient incentive to do so. In a game with this simple payoff matrix, the equilibrium, in orange in the lower right, is where no one pays for a custodian!

Payoff Matrix in a Two-Person Investor Game

Note: Yellow highlights free riding. Orange highlights the equilibrium outcome. Source: Inspired by Table 35.1 in Hal R. Varian, Intermediate Microeconomics: A Modern Approach, 6th Edition, 2003.

We should note that in a repeated game with only a few participants, where there can be side payments between investors as well as signaling that reveals who intends to hire the custodian, the equilibrium could be more favorable. But, such an outcome is far less likely in the presence of thousands of investors who lack a low-cost mechanism for coordination.

This kind of free riding is one reason that regulators require mutual funds (organized under the Investment Company Act of 1940) to employ an independent custodian to verify the existence of a fund’s assets. In effect, the custodial requirement substitutes for the coordination mechanism that investors lack. Had Madoff been running a mutual fund rather than a broker-dealer, we doubt that the fraud could have persisted.

Financial stability. It is typical to think of financial stability as a public good freely available to all. But, as Tucker points out, it is a depletable resource suffering from the tragedy of the commons. While intermediaries benefit greatly from financial stability, they have incentives to act in ways that degrade it for others, and they have little reason to internalize the costs that the resulting instability imposes on others. That is, they free ride on the commons of financial stability.

Examples of behavior that lowers the resilience of a financial system abound. Left to themselves, intermediaries tend to minimize equity funding, favoring short-term wholesale debt that is runnable. Firms with explicit or implicit government backing—including too-big-to-fail players, insured intermediaries, or those able to obtain rainy-day guarantees—attract low-cost funds as their creditors will expect to be rescued in bad times. (According to the FRB Richmond’s Bailout Barometer, the federal safety net covers 60 percent of the U.S. financial sector, fueling overfunding of risky activities.) Over-the-counter contracts allow large derivatives traders to conceal risk concentrations. And, clearinghouses that compete for clients by lowering margin requirements engage in a potentially destructive race to the bottom.

Ostrom’s Nobel Prize-winning work highlights the possibility of private mechanisms for governance of the commons. In practice, however, there is little evidence that self-regulation by the financial industry has been, or is likely to be, sufficient to contain these various threats to financial stability. Arguably, the enormous incentives for circumvention—combined with techniques for risk concealment—exceed the capacity of private enforcement to secure financial resilience, leaving government as the most viable response. Much as they can preserve public grazing lands or air quality by restricting or taxing behavior that degrades these resources, regulators and supervisors can guard financial stability against free riding.

Importantly, the global integration of finance creates an additional challenge. In the same way that preserving the integrity of ocean fishing necessitates international treaties, securing financial resilience requires that national regulators coordinate to limit circumvention outside their jurisdictions. That is, we need a mechanism to guard against a global version of free riding.

Conclusion. Like adverse selection and moral hazard that arise from information asymmetry, free riding poses serious problems both for providers of financial services and for governments wishing to secure financial resilience. Rules and practices—such as the role of independent custodians in asset management—continue to evolve to limit the impact of free riding. In theory, technological progress that lowers information costs helps overcome information asymmetries. However, the distortions arising from free riding likely will persist so long as there are fixed costs to producing financial information, and the resulting information is not excludable.

The tragedy of the financial stability commons poses a particularly important challenge that, in a globally integrated financial system, requires an internationally coordinated response.