Improving U.S. Healthcare and Coverage

“We’re going to have insurance for everybody.” People covered under the law “can expect to have great health care. It will be in a much simplified form. Much less expensive and much better.” President Trump, Washington Post, January 15, 2017.

We see health as a basic human right. Every society should provide medical care for its citizens at the level it can afford. And, while the United States has made some progress in improving access to care, the results do not justify the costs. So, while we agree with President Trump’s statement that the U.S. health care system should be cheaper, better and universal, the question is how to get there.

In this post, we start by setting the stage: where matters stand today and why they are unacceptable. This leads us to the real question: where can and should we go? As economists, we are genuinely partial to market-based solutions that allow individuals to make tradeoffs between quality and price, while competition pushes suppliers to contain costs. But, in the case of health care, we are skeptical that such a solution can be made workable. This leads us to propose a gradual lowering of the age at which people become eligible for Medicare, while promoting supplier competition.

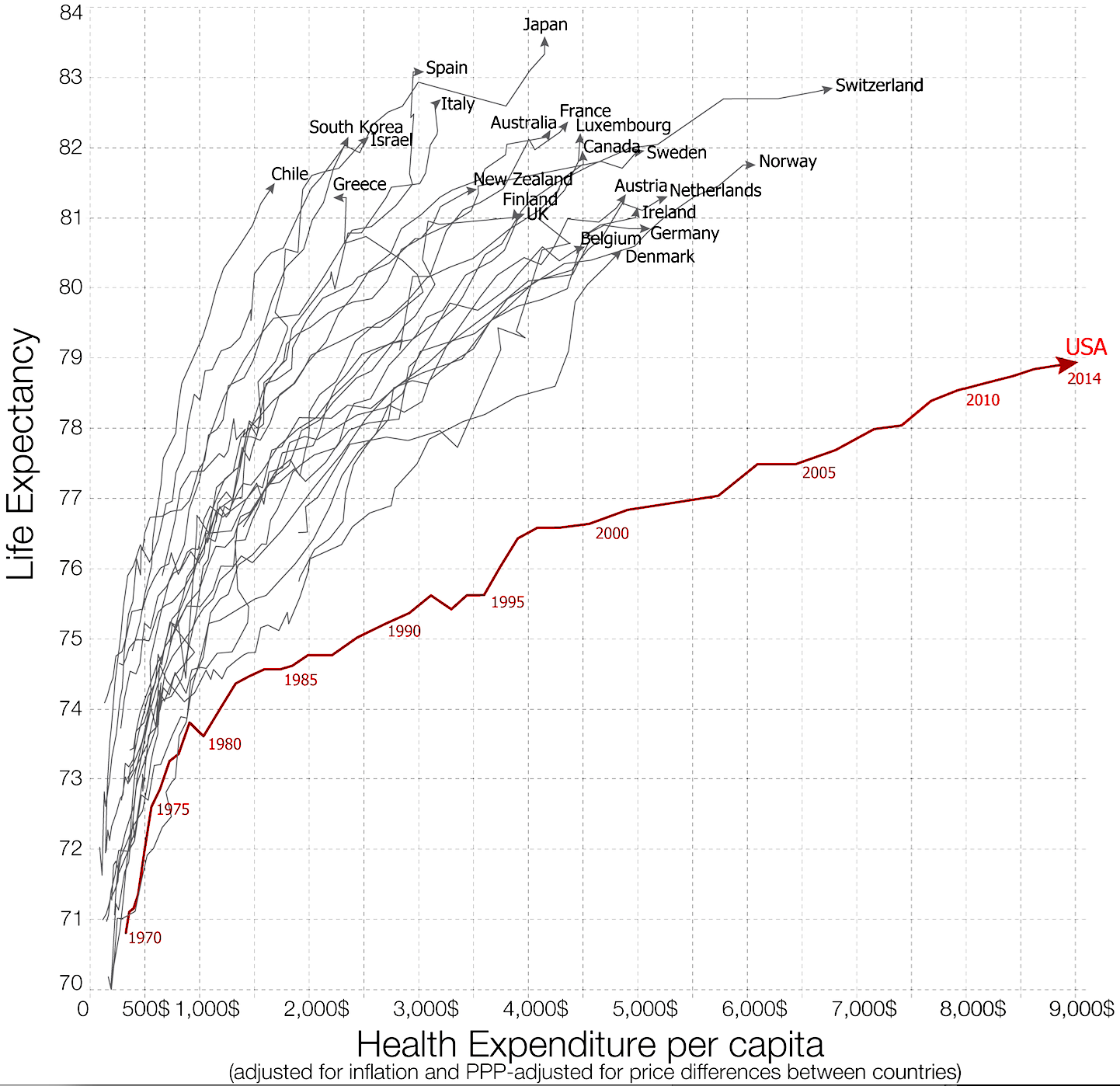

Before getting to the details of our proposal, we begin with striking evidence of the inefficiency of the U.S. health care system. The following chart (from OurWorldInData.org) displays life expectancy at birth on the vertical axis against real health expenditure per capita on the horizontal axis. The point is that the U.S. line in red lies well below the cost-performance frontier established by a range of advanced economies (and some emerging economies, too). Put differently, the United States spends more per person but gets less for its money.

Life Expectancy and Health Expenditure per capita, 1970-2014

Source: Esteban Ortiz-Ospina and Max Roser, Financing Healthcare, 2017. Published online at OurWorldInData.org.

To measure the degree of inefficiency, we focus on the 2014 observations (the endpoints of the lines in the first chart) for a larger set of 43 high-income countries. These data are plotted below. The dashed line shows the simple logarithmic relationship between life expectancy and real per capita health spending for the 42 countries excluding the United States. The red dot shows the United States, which spends $9,402 per person to obtain life expectancy at birth of just under 79 years. Not only is this 40 percent more than the next highest country in the sample (that’s Luxembourg), it is nearly 4 times what other countries spend to obtain this same longevity!

Life Expectancy and Health Expenditure per capita (2011 international dollars, PPP-adjusted), 2014

Sources: World Bank and authors' calculations.

It really doesn’t matter how you measure U.S. health care outlays, you will come away with the same conclusion: the U.S. system is extremely inefficient compared to that of other countries. Today, for example, health expenditures account for more than 17% of U.S. GDP. This is more than twice the average of the share in the 42 other countries shown in the figure, and more than 40 percent higher than the next highest (which happens to be Sweden at 12%).

Before continuing, it is worth looking at how people in the United States currently pay for their health care. In 2015, employer-provided plans covered 45% of the population, while insurance purchased directly by individuals accounted for an additional 13%. Next comes the government: the combination of Medicare (13%), Medicaid (16%) and the military (4%), sums to 33%. As others have noted, the number of uninsured has fallen significantly in the last few years as roughly 20 million people have obtained coverage either through the expansion of Medicaid or by purchasing policies through the exchanges created by the Affordable Care Act (ACA). Even so, roughly 9 percent of the population—nearly 30 million people—remains uninsured.

The conclusion is clear: in addition to being expensive and ineffective, the U.S. health care system is far from universal. For a country that prides itself at being at the cutting-edge technologically, this is both tragic and unnecessary. We look forward to seeing how the Congressional Budget Office will score the current proposals being considered by the Congress, but the criticism from governors and providers suggests that it will leave many more people uninsured—the opposite of President Trump’s stated goal.

So, what is to be done? Starting with basic principles, it is essential to understand why it is extremely difficult to fashion a predominantly market-based solution for health care that provides universal coverage. As with any form of insurance, health insurance is plagued by adverse selection and moral hazard.

Consider adverse selection first. If, as everyone seems to agree, we want anyone to be able to purchase health insurance regardless of whether they have preexisting health conditions, then setting a price at the average cost per person will lead only the less healthy to buy insurance. Raising the premium as the health status of the covered pool deteriorates (relative to the population norm) just leads to the infamous “death spiral” for private health insurance. In short, if the healthy do not participate, health insurance cannot be provided affordably. (As an aside, this is the logic behind the common view of experts that any system that requires insurers to cover everyone at a common premium—regardless of their health status—must be paired with compelling incentives for everyone to enroll.)

Moral hazard in health care has two components. First, there is the standard problem that insurance makes people behave differently. Here, absent properly structured co-pays and deductibles, the insured will tend to overconsume health care, again driving up the costs. But it is also difficult for people to make informed choices about health care. When services are complex and bundled, the supplier can impose charges in ways that patients have difficulty anticipating or understanding, limiting their ability to compare cost and quality. More office visits and more procedures drive up prices.

To understand the severity of the information problem in health care, compare the challenge of purchasing a new car with that of replacing a hip. These are both expensive and complex. When it comes to the car, you have lots of different models with dozens of options—all-in-all, hundreds of choices. But at least you can easily find information about safety, performance and reliability. Then, once you narrow your choices, you can take a test drive.

With the operation, there are likely hundreds of options as well. You may be able to pick from among a number of hospitals, select from scores of surgeons using a variety of procedures, and choose from implants made by dozens of companies. Insurance company data reveals that these decisions have clear financial consequences. For example, in the Boston area, the cost of a hip replacement can vary from $18,000 to $74,000. So your decisions matter both for your well-being and for your wallet. But how are you going to decide? Can you really get the information you need to make an informed choice? Will you be able to judge if an extra $10,000 or $20,000 is worth it? A test drive is out of the question (especially when you’re hobbling around), and if you are insured, you are unlikely to pay the higher cost directly.

On top of adverse selection and moral hazard, health care also is affected by free riding. Because many illnesses are contagious, we all benefit when others are vaccinated or treated promptly. But, people usually don’t consider the benefit to other people in deciding whether to seek care. What this means is that society has strong incentive to subsidize fundamental care for those who can least afford it.

We could go on with additional examples that highlight the challenges inherent in designing a purely competitive market solution to the problem of providing health care: large hospitals have power to set prices in local markets; patents give pharmaceutical firms monopolies; licensing requirements, professional societies and health sciences schools restrict the number of providers; providers and insurers price services not outcomes; and products of health services are increasingly bundled and complex. Yet, facing these exact same challenges, other countries have succeeded in doing better. So, the bottom line is clear: compared to other advanced economies, U.S. health care costs more, is less effective at boosting longevity, and limits access.

Looking around the world, the healthcare delivery systems that have advanced longevity most at lowest cost—those at the top left of the first plot or to the left of the dotted line in the second—tend to be universal and with a substantial government role that establishes a statutory standard of insurance. At one end of this spectrum, Britain’s National Health Service is both the sole payer and provider—analogous to the workings of the U.S. Veterans Administration. Other systems offer a combination of statutory and private components: in the case of Germany, the former is several times larger than the latter. Our view is that the provision of universal care in the United States will require that the government assume a larger role than it has thus far.

To move in that direction, we propose building on the success of Medicare—one of the most popular federal programs. More specifically, we propose gradually lowering the age at which people are eligible for Medicare, while tracking cost and performance, and using the government’s role as insurer to promote competition among providers (much as private insurers try to do). It shouldn’t take too long to see if we can shrink the gap between where we are today and those countries at the cost/efficiency frontier.

Not only could a Medicare expansion reduce cost, improve effectiveness, and broaden access, but making the covered population younger and healthier should render the program more sustainable. As a side benefit, reducing the burden on employers of providing health care likely would make the U.S. economy more dynamic. First, by reducing the marginal cost of adding a worker, it promotes employment. Second, because the fixed cost of providing insurance imposes a greater burden on small firms, a Medicare expansion levels the playing field.

Mr. President, if you are serious about insuring everyone, and making that insurance cheaper, simpler and better, this is your chance. Take a program that Americans already like, and offer it to more people.