The Fed's Price Stability Achievement

“We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. […] The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.” Open Letter to Ben Bernanke, The Wall Street Journal, November 15, 2010.

Over the past decade, critics of all stripes have assailed Federal Reserve monetary policy. At one end of the spectrum, some argued that the Fed’s expansionary balance sheet policy risked currency debasement and high inflation. While the authors of the letter above sought merely to influence ongoing policy, others called for replacing the Fed altogether, and restoring the Gold Standard. And then there were those promoting oversight over monetary policy operations that would significantly curtail central bank independence.

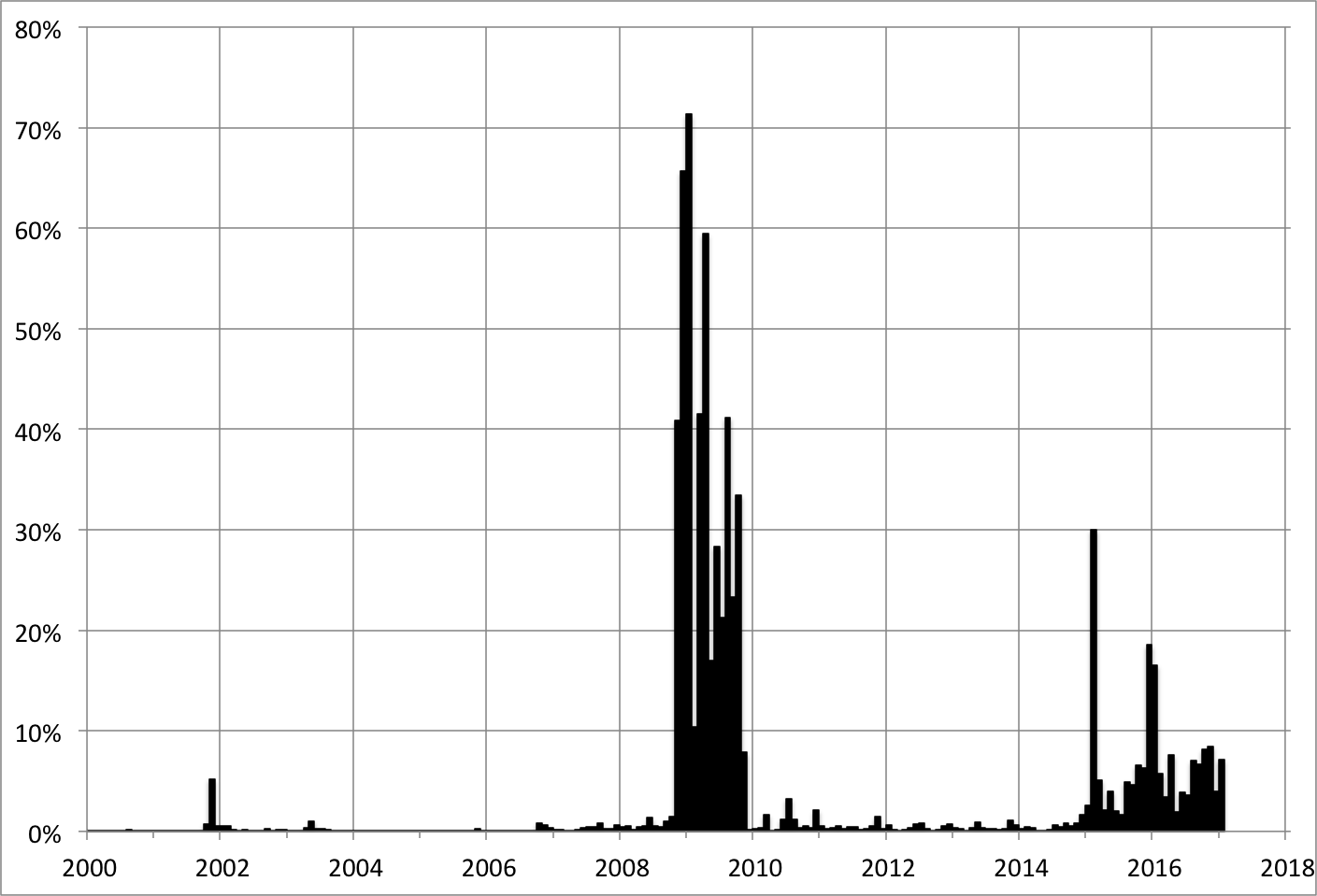

At the other end, yet another set of critics worried about outright deflation: according to monthly averages from Google Trends, since 2004, U.S. searches for deflation were twice as frequent as those for hyperinflation. Some economists called for a higher inflation target. Squarely in the second camp, officials inside the Federal Reserve System developed deflation probability trackers like the one depicted below (here is another from the Federal Reserve Bank of Atlanta).

Deflation Probability, 2000-January 2017

Note: This is a model-based estimate of the probability that the year-to-year percentage change of the price index of personal consumption expenditures will fall below zero over the next 12 months. Source: Federal Reserve Bank of St. Louis.

These diverse perspectives form the backdrop to this year’s report for the U.S. Monetary Policy Forum (USMPF) that we co-authored with Michael Feroli, Peter Hooper, and Anil Kashyap. In that paper, we document that the trend in U.S. inflation has been remarkably low and stable since the early 1990s. Importantly, this period includes: the largest financial crisis (and the deepest, most prolonged economic downturn) since the Great Depression; the long episode of near-zero policy interest rates; the unprecedented expansion of the Fed’s balance sheet; and the Fed’s radical efforts to substitute for the crisis collapse of private financial intermediation, including massive support for residential finance. Against this volatile backdrop, we view the evidence of price stability as an extraordinary policy achievement to be celebrated—and certainly not cause to limit Fed authority or shift personnel in a manner that would diminish the central bank's effectiveness.

The central findings of the USMPF paper are two-fold. First, according to a simple statistical model, trend inflation as measured by the price index of core personal consumption expenditures (PCE)—that is, excluding food and energy—has fluctuated between 1.2 percent and 2.3 percent over the past 20 years. Since the mid-1990s, our measure of the inflation trend averaged 1.7 percent, a mere three-tenths of a percentage point shy of the FOMC’s 2 percent target for overall PCE inflation. Second, in this stable, low-inflation era, once we account for this trend, it is very difficult to improve inflation forecasts. In particular, neither changes in measures of labor slack nor movements in inflation expectations help predict shifts in the trend or temporary deviations from it.

To be sure, this doesn’t mean that monetary policy is powerless to influence inflation. Even with a limited search, we found two notable measures that both influence trend core PCE inflation and can be affected by monetary policy: the Chicago Fed Financial Conditions Index and the trade-weighted dollar. However, since FOMC communication is dominated by references to indicators of inflation expectations and labor market conditions, these results suggest that the FOMC should be more eclectic in its descriptions of inflation and possibly in its internal analysis as well.

While the USMPF report is titled Deflating Inflation Expectations, we do not conclude that expectations are unimportant. In fact, quite the opposite: the failure of measured inflation expectations to help forecast changes in inflation is probably a side effect of monetary policy’s success in stabilizing them. It is fair to say that, since the Volcker era that ended in 1987, the Fed’s symmetrical response to inflationary and deflationary shocks has served to anchor inflation expectations, eliminating the sort of variability that can be used in standard statistical analysis. In practice, this means that, unless they are unaccompanied by supporting evidence from other economic and financial indicators, surprises in surveys of inflation expectations ought not trouble policymakers.

Returning to the report, our findings bear on one of the most hotly debated monetary policy subjects of the day: should the FOMC should allow inflation to overshoot the 2 percent target temporarily? The paper suggests that, with inflation’s trend (estimated in the fourth quarter of 2016 at 1.53 percent) both below the FOMC target and very sticky (or persistent in statistical terminology), some overshooting probably will be needed to get the trend back to 2 percent. But, given how close we now are to the target, and the likely dynamics on the way there, the scale of the needed overshoot is almost surely both modest and temporary (less than one-half percentage point for a year or two).

The point is that the stickiness of the trend can be both a friend and an enemy. Because of inflation’s persistence, policymakers can afford to wait until they are confident that inflation will rise, because it is unlikely to shoot up without warning. If, however, they allow inflation to overshoot the target for too long or by too far, monetary policy would need to exercise considerable and sustained restraint to lower it to target. That is, if the inflation trend were to rise above 2 percent, getting it back there may require policy sufficiently tight that it would raise the risks of a recession.

But there is also a much larger sense in which it is important for the Fed (and for the rest of us who benefit from price stability) to remain vigilant. In his comments on the report, Jeffrey Lacker, President and CEO of the Federal Reserve Bank of Richmond, cautioned about the possibility that some combination of events and political actions could undermine the current monetary policy regime. President Lacker focused on the factors that led to the Great inflation of the 1970s (a topic addressed by the first USMPF paper in 2007 that was the precursor to the 2017 paper). He highlighted “striking parallels” between the current environment and that of the mid-1960s: a history of low inflation, tightening resource use, a political hostility to the policies of the central bank, a gradual central bank response to building risks, uncertainty about the degree of monetary policy restraint, and the possibility of a sudden shift to fiscal stimulus. He also noted two differences: the central bank’s greater recognition today of the need to preempt inflation and the decades-long political support for central bank independence.

It is the latter that we view as the greatest threat to the Fed’s ability to maintain price stability. Unlike the ECB—whose legal independence is anchored in the Maastricht Treaty—the independence of the U.S. central bank is not based in the Constitution. In fact, it is not even codified in the Federal Reserve Act. As we recently wrote, the version of independence that supports the current monetary policy regime in the United States emerged since 1980 in no small part as a consequence of the self-restraint of a sequence of Republican and Democratic Administrations. By avoiding direct criticism of monetary policy and by selecting experienced chairs regardless of party affiliation, U.S. Presidents since Jimmy Carter and Ronald Reagan (who appointed and reappointed Paul Volcker) have helped secure the long-run benefits of having monetary policy designed and implemented by experts largely unburdened by partisan motivations and short horizons.

Over this same period, rather than interfering in monetary policy setting, Congress has been content to assess the broad outcomes of policy in terms of the Fed’s legally mandated objectives (price stability and employment), leaving both the strategic aspects of specifying quantitative targets and the tactical implementation of operational instruments to the central bank experts. It is probably no accident that this episode of legislative self-restraint largely coincided with the Great Moderation—the 20-plus-year period beginning in the mid-1980s—that was characterized by stable inflation, stable economic growth, and (aside from greatly increased transparency) little monetary policy experimentation.

As President Lacker’s remarks imply, it is important not to take these supportive political conditions for granted. Considering the Fed’s impressive price stability achievements over recent decades—in the face of extraordinary disturbances—a loss of Fed independence would be a tragedy not only for the United States, but for the world.