Banking the Masses

Just three years ago, the World Bank estimated that 2½ billion adults (15 years and above) had no access to modern finance: no bank deposit, no formal credit, and no means of payment other than cash or barter. Stunningly, the Bank now estimates that even as the global population has increased, the number of “unbanked” has dropped by 20 percent. Between 2011 and 2014, 700 million adults have gained at least basic financial access via banks or mobile phone payments systems.

This spectacular progress is clearly welcome. The rise of “financial inclusion” – the access by lower-income households to banks and the payments system – is near the top of the list of transformational global technological advances that governments are encouraging. Few consumer products have ever diffused so rapidly, especially among the world’s poor.

Still, we have a very long way to go. While roughly 62% of adults have basic financial access, for many that link remains tenuous and under used. Broadening and deepening the financial network likely will remain a challenge for a generation.

Why should we care? The answer is that financial access promotes both economic equality and economic growth.

Think about all the things that banks do for us. They provide us with low-cost access to a sophisticated payments system that facilitates transactions. They safeguard our funds and provide convenient accounting for transactions and balances. They reward us with interest for parting temporarily with our savings. They combine our individual savings together for allocation to the most efficient uses. By diversifying our assets they help us manage risks. And, when the system functions properly, they screen and monitor investment projects to pick and sustain the ones that have the highest return for both individual investors and society as a whole.

In short, financial access lowers transactions costs for people who wish to make payments, to save, to borrow, or to manage risks. And, it allows countries to mobilize domestic savings effectively.

Economists have emphasized how lower transaction costs are key to spurring economic growth at least since Nobel Prize winner Douglass North focused on it in the 1960s. An effective means of payment broadens the markets for goods and services, encouraging a more efficient division of labor across a wide range of activities. People without access to banks or other intermediaries typically must pay with cash or in kind. This is both inconvenient and risky. Barter is clearly inefficient, and cash can be stolen.

In the 21st century, banks are no longer the only providers of access to the payments system. Mobile phone companies are competing actively to facilitate transactions in much of the emerging world, especially where bank branches are few and far between. While their impact so far is modest overall (only 2 adults out of 100 have mobile phone payment accounts), they are transforming the payments mechanism in some of the world’s poorest regions. In sub-Saharan Africa, for example, 12 out of 100 adults use their mobile phones to access the payments system.

Beyond payments per se, people have powerful reasons to save. Saving allows us to smooth consumption in the face of income variation that might come from the loss of a job or a poor harvest. It provides resources in the case of emergencies like an illness. And it lets us pay for exceptional expenses like a wedding or a funeral. The poor, for whom short-term income volatility can be devastating, have particularly compelling reasons to save.

Yet, according to the World Bank, only 56 of 100 adults reported saving over the past year; and, less than half of these did so through a bank or financial institution. Saving outside of the banking system frequently offers low risk-adjusted returns: in some poverty-stricken parts of the world, families may hoard cash or acquire livestock, but face calamity if their cash is lost or cattle perish. No wonder people welcome bank deposits when low-cost accounts are available.

For those who have no savings, but with fairly bright income prospects, borrowing is an alternative method for financing a new business or for smoothing consumption when income varies. According to the World Bank, 42% of adults borrowed over the past year. But, outside the high-income world, most borrowers obtained funds from their family and friends. This small pool limits the mobilization and diversification of savings. One reason is that banks find it costly or impossible to judge the creditworthiness of the unbanked, limiting the availability of “micro-loans.” As financial access grows, and banks can track savings and spending patterns, the information needed to undertake responsible lending is more likely to become available, helping to increase the supply of (and lower the risk premia on) small business and consumer loans.

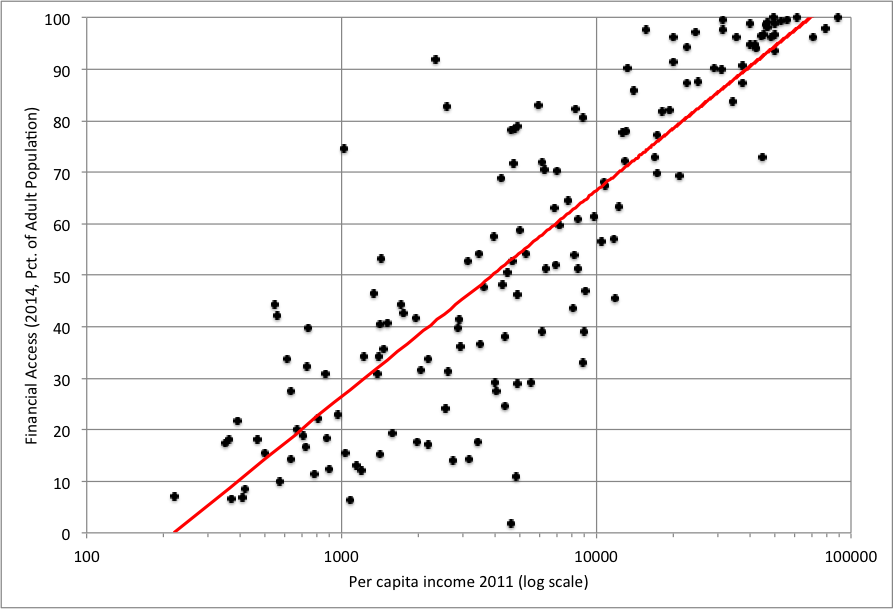

So, where is financial access most advanced? Unsurprisingly, in high-income countries. For example, in the United States, as of 2014, nearly 94 out of 100 adults have a financial account (up from 88 in 2011). More broadly, as the chart below shows, the correlation between log income and financial access is very high (about 0.86). Causality probably goes in both directions here. Not only does financial deepening boost economic growth, but high incomes and wealth naturally create demand for services that the financial system works to meet.

Financial Access (2014) and Income per capita (2011, in U.S. dollars) in 155 countries

Source: World Bank Findex 2014.

In the developing world, the scale of financial access varies sharply. Looking at the next chart, we see that it ranges from nearly 70% in East Asia to less than 15% in the Middle East. Islamic attitudes toward traditional (western) banking activities may partly explain the latter (see here).

It is worth noting that in sub-Saharan Africa access to financial services via mobile phones seems to be making a large difference. In four sub-Saharan economies, more than 30% of adults have access via mobile phone payment accounts, some of which also are linked to banks (like Kenya’s M-Shwari which builds on the M-PESA).

Financial access by region and account type (2014)

Source: World Bank. Access is measured as the share of adults with a banking or mobile phone payment account, or both. The regional data are for developing economies only. All high-income countries are grouped together, regardless of geography.

So, where are we headed? Both technology and policy point to further sharp gains in financial inclusion in coming years. Mobile service providers are spreading out both geographically and across business lines: The GSM Association’s Mobile Money for the Unbanked (MMU) tracker currently shows more than 360 live and planned deployments in Africa, Latin America and Asia, including a sharp rise in credit based on the application of new credit scoring models that take advantage of mobile operator data.

At the same time, governments are actively promoting financial access to encourage savings and economic growth. The most dramatic example is India’s groundbreaking biometric identification project that already has registered more than 850 million people since inception in 2009, and includes the creation of a free, no-frills bank account for every registered resident who wants one. Based on the World Bank survey, nearly 155 million Indian adults gained basic financial access over the past three years, second only to the increase in China of about 170 million adults.

To be sure, such rapid gains in financial access are not without risk. Two concerns are most prominent: the first is about consumer protection. The lack of financial literacy among the newly included makes them ripe targets for unscrupulous fraudsters. To ensure long-run credibility, guarding consumers will be both critical and particularly challenging until the newly enfranchised gain a better understanding of how finance works.

The second concern is about the potential abuse of the technology. Creating rules that invite competition in the payments system (like the broadening entry of mobile phone firms) promotes financial inclusion and efficiency, but can facilitate money laundering and other forms of criminality (think of the online black market for drugs and other contraband known as Silk Road). Finding a sustainable balance between regulatory flexibility and effective law enforcement will not be easy.

But these are surely good problems to have. They are the type of problems that arise whenever a financial system is working as it should – helping people to make payments, manage risks, and save. The benefits of this progress ought to surface eventually in higher incomes and increased wealth, especially for the poorest of the poor. That’s got to be good news.