Clinton versus Trump on Financial Regulation

Will the U.S. Presidential election have an impact on financial regulation? The answer depends on who becomes President, the priorities of the winner, and the inclinations of the Congress. That said, we thought it would be useful to examine what the candidates say they will do. To summarize, we find Republican nominee Trump’s call to “dismantle Dodd-Frank” deeply troubling. By comparison, our differences with Democratic nominee Clinton are relatively minor.

Let’s start with Donald Trump. It is difficult to identify more than general statements regarding nominee Trump’s views on financial regulation. His website contains the following statements:

- Put the job-killing regulation industry out of business.

- Issue a temporary moratorium on new agency regulations.

We find mention of the financial industry only in interviews that form the basis for news reports. A recent example from late September is a story reporting nominee Trump’s comments in May about Dodd-Frank. Elsewhere, he added: “Dodd-Frank has made it impossible for bankers to function. It makes it very hard for bankers to loan money for people to create jobs.” We have not found any plan providing details about nominee Trump’s proposal to alter Dodd-Frank.

Turning to Hilary Clinton, her website lists proposed reforms. The major ones are:

- Impose a risk fee on large financial institutions.

- Downsize and breakup firms that are too large and risky to be managed effectively.

- Strengthen oversight of shadow banking.

- Hold bank executives accountable for their institution’s losses.

- Impose a high-frequency trading tax.

- Strengthen the Volcker rule.

We are tempted to simply conclude that we have a good sense of what Clinton would like to do if she can, but no clear sense of what Trump is contemplating. Rather than leaving it there, we will defend Dodd-Frank against Trump's claim that it is a "very negative force," and then turn to a brief discussion of Clinton's proposals.

Before proceeding, it is worth making two general points. We believe that government has a key role to play in making both financial institutions and the financial infrastructure more resilient so that the system is less crisis prone. And, we favor simplifying regulation and streamlining the nation’s cumbersome regulatory apparatus. On the first of these, we see the possibility of continued improvements to financial market structure and securities design (see here). And on the second, we believe that some of the complicated apparatus that currently surrounds capital regulation could be replaced by a simple, but much higher, leverage ratio (see here).

Turning to Dodd-Frank, on the occasion of the fifth anniversary of the passage of the act, we wrote about its successes and shortcomings. The former included:

- The push to increase capital and liquidity in the banking system.

- The designation of systemically important financial intermediaries (SIFIs), both bank and nonbank.

- Enhanced supervision, including rigorous stress tests, for the largest banks and nonbank SIFIs.

- Improvements in resolution procedures for insolvent institutions.

- Improvements in market infrastructure to promote resilience, including a shift of derivatives trading from over-the-counter (OTC) transactions to central counterparties (CCPs).

Has Dodd-Frank made it more difficult for some borrowers to obtain loans? Has it made it more difficult for bankers to run their businesses? Yes and yes. But, at least to some extent, these were intended consequences of the reforms. Before the crisis, it was too easy to borrow, so debt increased to unsustainable levels. The fall in house prices led to defaults, initiating the crisis among highly levered intermediaries. Not only that, but financial firms’ internal risk management systems were clearly inadequate (a point made eloquently by the 2008 report of the private-sector Counterparty Risk Management Policy Group).

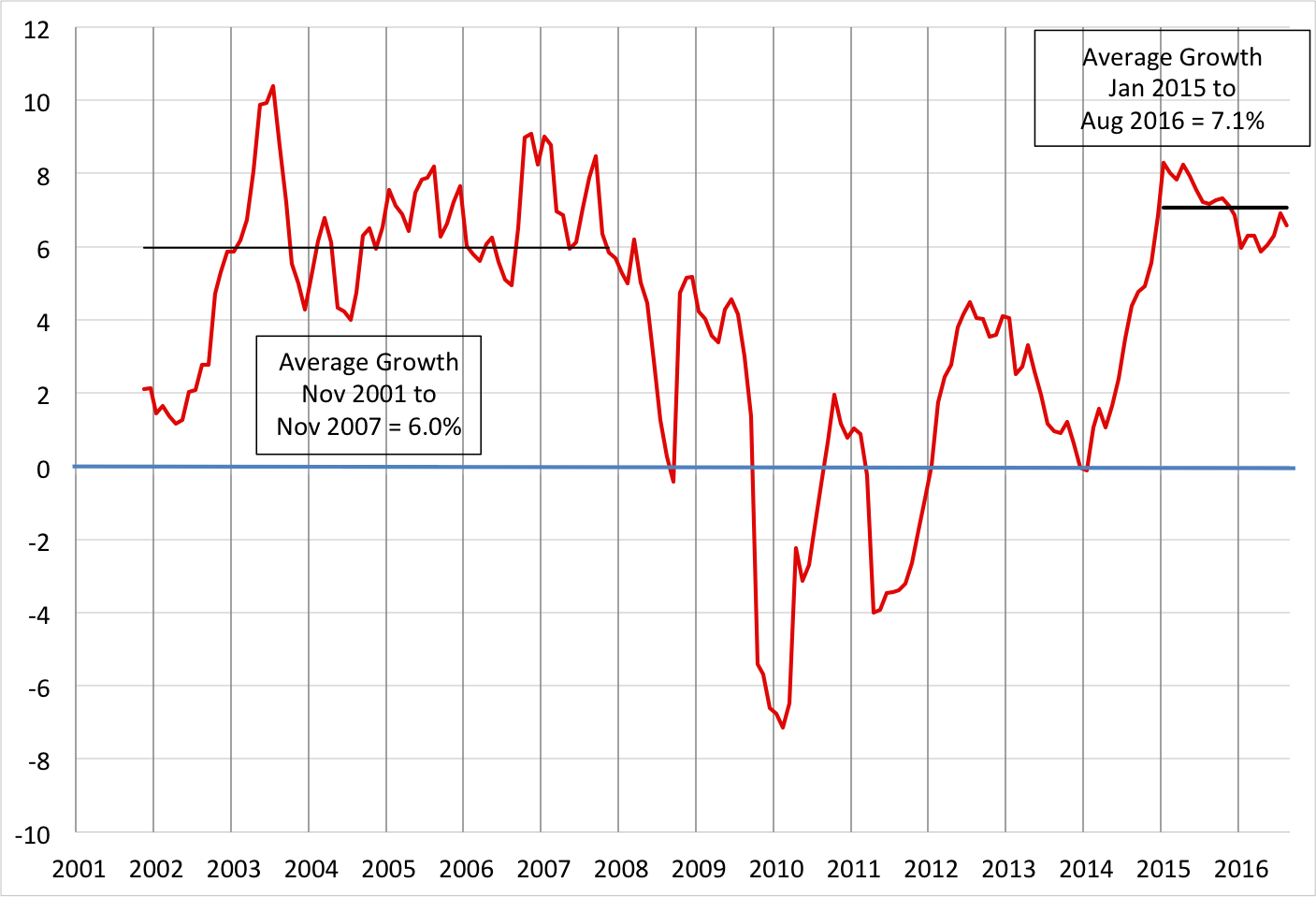

What about the costs of the reforms? Contrary to nominee Trump’s claims, enhanced regulation is not preventing solid growth of U.S. bank credit. To be sure, there was an extended period of deleveraging and weak credit growth in the aftermath of the financial crisis. Yet, as the following chart shows, since the beginning of 2015, bank credit adjusted for inflation has risen on average by 7.1% from a year earlier, somewhat above the 6.0% average growth rate during the previous cyclical expansion (from the November 2001 trough to the November 2007 peak). We are reminded of what we wrote in a previous post: healthy banks lend to healthy borrowers; weak banks lend to weak borrowers (if at all). Put differently, as the U.S. banking system has gotten safer, lending capacity and the willingness to lend have both recovered. As one of us argued several years ago, the impact of the new regulations on credit supply is smaller than even the lowest estimates put forth prior to the implementation of the financial reforms.

Bank credit adjusted for inflation (percent change from a year ago), November 2001-August 2016

Source: FRED2.

But even if the Dodd-Frank reforms were very costly, financial crises are so damaging that we would expect the benefits of enhanced regulation to far exceed the costs. For the United States, one study estimated the losses from the 2007-09 crisis at 40 to 90 percent of one full year’s GDP.

So, we remain steadfast in the belief that Dodd-Frank has made the financial system safer than it was in 2007. Probably, much safer. But still not safe enough.

Turning to nominee Clinton’s proposals, these reflect a much deeper and more nuanced understanding of the risks remaining in the U.S. financial system today. We should also note the difference between these proposals and her primary rival Bernie Sanders’ call for breaking up banks and restoring a Glass-Steagall separation between commercial and investment banks without addressing shadow banking.

On the specifics, we view nominee Clinton’s proposal to levy a fee on large, risky institutions, as equivalent to an increase in capital requirements. But the FDIC already collects revenue from banks in the form of deposit insurance premiums that are intended to be risk based. And, while we can understand the desire to obtain additional revenue from banks (presumably in anticipation of the public costs of bank failure), we view it is as more effective to require that systemic banks have larger equity capital buffers as a form of self-insurance against large shocks.

Related to the risk fee is the suggestion to break up banks that are too big or too complex to manage. The impetus for this proposal is presumably the view that when systemic banks run into trouble, officials will face enormous pressure to bail them out. We agree that banks can become too large and too complex, generating costly spillovers. But rather than fight over where to draw the line that delineates those that are too big from those that are not, we believe that higher capital requirements will achieve the desired outcome. Either systemic banks will remain large and be self-insured with a bigger equity capital buffer, or they will decide to shrink because the costs of that buffer exceed the benefits of being large and complex. In either case, both individual institutions and the system as a whole will be safer, and the Dodd-Frank commitment not to use taxpayer funds for bailouts will be more credible. These outcomes, rather than imposing an arbitrary constraint on size, ought to be the policy goals.

On shadow banking, we share the Clinton view that U.S. financial regulation must address systemic risks that arise outside the traditional banking arena. Here, we would go significantly further than Clinton proposes. Regulation based on the legal form of the intermediary—rather than on its economic function—leaves the financial system vulnerable to regulatory arbitrage in which funds migrate to intermediaries with lower capital and liquidity requirements. The solution is to shift the focus of regulation away from institutions and toward financial activities and functions. We need a system in which every institution providing a banking service (transforming liquidity, maturity and credit) faces equivalent rules, whether or not it happens to be a chartered bank (see, for example, here).

We also agree that bank executives should be forced to face the consequences of their decisions. Historically, top-level employees of financial institutions have been far too insulated from poor performance, whether it comes from low returns on assets or fines for malfeasance. This should stop. The question is how. On top of the fair and vigorous prosecution of the law, we have argued for compensation schemes akin to partnerships that create greater downside risk for managers.

Regarding a financial transactions tax (FTT), we view the costs as likely to outweigh the benefits. Last October we addressed three questions regarding Clinton’s FTT proposal. Will an FTT raise substantial revenue? Will it channel resources to more socially productive uses? And, will it (as some advocates claim) reduce market volatility? We still suspect the answer to these questions is no. Should an FTT be put in place, trading likely will shift (where feasible) to untaxed jurisdictions. In addition, firms will shift from equity funding that is taxed to debt that is not. These changes would limit FTT revenue while diminishing market liquidity and increasing reliance on debt and bank finance. As a result, we worry that systemic resilience would go down, not up. If the objective of an FTT is to reduce high-frequency trading, we prefer solutions that involve auctions and delays (see here).

We have similar doubts about the Volcker Rule. The motivation behind the rule is to keep institutions that attract insured deposits from using this government-supported source of funding to engage in high-stakes speculative activities. Unfortunately, we know of no reliable means to distinguish between risk-taking for customers and risk-taking for a trading firm’s own account. As a result, any rule that limits proprietary trading—such as a safe-haven cap on trader positions, which may be the simplest way to implement the Volcker Rule—inevitably limits market-making capacity and market liquidity. In our view, appropriate capital requirements are a more efficient tool for managing systemic risk arising from speculative trading positions.

To summarize, we find nominee Trump’s vague remarks about dismantling Dodd-Frank woefully inconsistent with the continuing and profound need to make our financial system safe. The crisis has surely convinced most observers that we cannot rely on self-regulation alone to keep the financial system safe. What we need is a system that makes both institutions and markets resilient. Here, we view nominee Clinton’s proposals as being on the right track.