The Map is the Message: Regional Feds versus Euro-area NCBs

Some time ago, we wrote about how the Fed and the ECB’s governance and communication were converging. Our focus was on the policy, governance and communications framework, including the 2% inflation objective, the voting rotation, post-meeting press conference, prompt publication of meeting minutes, and the like.

But important differences are built into the legal design of these two systems. Perhaps the most important one is the contrasting roles of the regional Federal Reserve Banks and that of the National Central Banks (NCBs). Reflecting their cross-state design, the Reserve Banks routinely compete to advance the understanding of the U.S. economic and financial system as a whole. By contrast, to a large extent, the central banks of the euro-area member states remain focused on their national economies and financial systems.

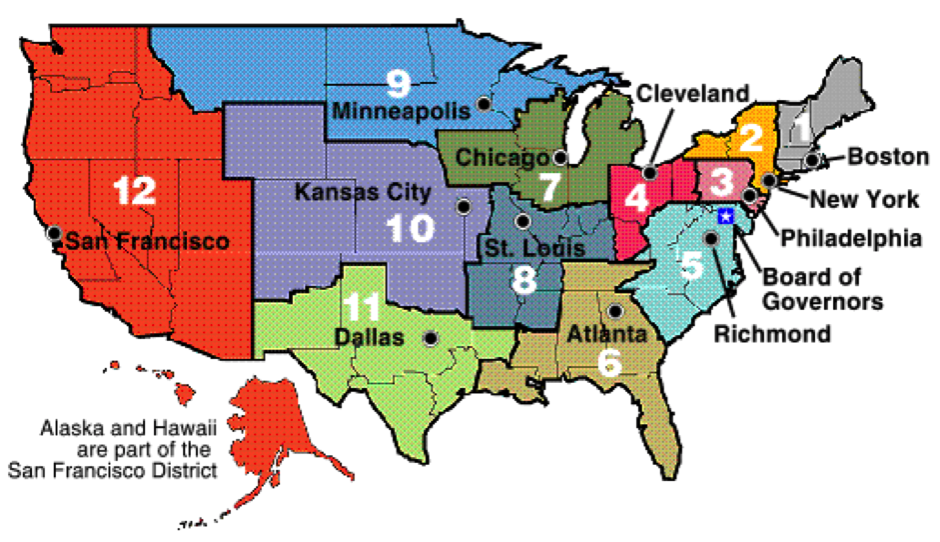

To understand this difference, where it comes from and why it is important, all we need to do is look at the following two maps:

Source: European Central Bank.

The first shows the Federal Reserve district lines—unchanged since their creation in 1914. The districts differ greatly on every key dimension, including geographic size, population, income, and financial concentration. But most importantly, no district’s boundaries coincides with that of a single state. The Federal Reserve Bank of New York, for example, serves all of New York State as well as northern New Jersey, a small slice of southwestern Connecticut, Puerto Rico, and the Virgin Islands. In fact, with the exception of the FRB San Francisco, all of the districts include parts of states. (Within states, the lines are along county boundaries.)

The original purpose of this arrangement was to ensure that no person or group could obtain preferential treatment from a Reserve Bank—nor could it be captured by the government and people of a single state or group of states. Indeed, the creation of the Federal Reserve System was a milestone in the struggle between the states and the federal government for primacy in economic and political affairs. It was part of a wave of progressive legislation that advanced federal authority, including the 16th Amendment to the U.S. Constitution, which allows the Congress to levy an income tax without apportioning it among the states.

The map of the Federal Reserve System contrasts sharply with that of the Eurosystem. School children would quickly recognize that the boundaries of the National Central Banks’ jurisdiction coincide with political boundaries. This is a natural feature of the design of European Monetary Union: as a club in which countries are members. As such, the map shows nation states, not districts.

But this feature also incorporates a key weakness that has concerned observers from the beginning. The Governing Council of the European Central Bank is composed of the six members of the Executive Board plus the governors of the NCBs of each of the (currently 19) euro area countries. While the NCB governors do not technically represent their countries, serving on the Governing Council in their personal capacity, observers wondered whether they would they forsake their national interest in favor of that of the euro area as a whole. Or, would the policy be that of the median country? With Germany accounting for 29% of euro-area GDP, larger than that of the 15 smallest countries combined, this concern persisted despite compelling evidence that the Governing Council in practice eschewed regionalism (see the discussion in this 2004 CEPR report.)

To be fair, in 1998, many people felt that European Monetary Union would never get off the ground. But it did, and for the first decade it was quite successful. The widely shared anti-inflationary culture of central banking was sufficient from the start to prompt NCB presidents to think about the euro area as a whole (see our discussion here). They understood how critical it was for a new, untested central bank to ensure the credibility of its commitment to price stability. As Robert McTeer, former President of the Federal Reserve Bank of Dallas, puts it: “[D]oves don’t go to central banker heaven; only hawks need apply.”

In the United States, the concerns of the Federal Reserve Banks—their Presidents and research staffs—are squarely focused on improving national policy. Each and every regional bank has a significant capacity to produce state-of-the-art research. Not only that, but over the years, there has been a useful increase of specialization that improves the efficiency of the System as a whole.

Here is a very partial list: The FRB St. Louis provides economic data access through FRED. Philadelphia surveys professional forecasters on economic conditions, and maintains a real-time database. San Francisco focuses on the Pacific-bordering economies, and has developed innovative wage and productivity measures. Kansas City organizes the marquee Economic Symposium at Jackson Hole , while Chicago sponsors the Banking and Structure Conference. Dallas is working on the impact of globalization and, like others, has introduced useful new data measures (in their case, the trimmed mean PCE price index). Following the financial crisis, Chicago, Cleveland, Kansas City, and St. Louis all developed measures to assess financial stress and financial conditions. Cleveland processes all the checks cleared through the System. And, of course, New York manages the system’s balance sheet, conducting all the Fed’s open-market operations.

But specialization does not imply a lack of competition. For example, a recent Wall Street Journal story described how New York had recently started to publish a nowcast of GDP that is in competition with Atlanta’s GDPNow. Both measure the current level of GDP and are available well before the Bureau of Economic Analysis publishes even its preliminary estimate. Will one of these turn out to be more accurate and drive the other out of business? Possibly. Regardless, the existence of an accurate real-time measure of U.S. economic activity will almost surely improve the quality of national policy decisions.

Now, the euro-area NCBs also are improving their research capacities. But their primary responsibility remains gathering local data and monitoring what is going on within their national economies and financial systems. For the most part, it falls to the staff of the ECB in Frankfurt to coordinate all of this, with an eye toward the euro area as a whole.

More important, the lingering nation-state institutional apparatus provides insurance for national governments against a setback if the monetary union were to fall apart. The issue is one of time consistency, not of the ECB or the NCBs, but of the Maastricht Treaty itself. As we have written before, the goal of European Monetary Union has to be a truly pan-European financial system. But to achieve this in a time consistent fashion, European governments must eliminate their ability to renege.

Put differently, to make the system time consistent, governments ought not have a simple means of re-starting national currencies and domestic monetary policy operations. Outside monetary union, the Bundesbank should be no better able to serve the central banking needs of Germany than the FRB San Francisco would be to meet the needs of Oregon, when it is also designed to serve Alaska, Arizona, California, Hawaii, Idaho, Nevada, Utah, and Washington.

Meeting this objective means taking a series of actions that would be extremely costly and time consuming to reverse. All of them would focus on eliminating and consolidating national institutions into euro-area versions. First, there is data. Since the Federal Reserve districts do not coincide with political boundaries, there is little data (and even less timely data) for what is going on in those districts. And, there certainly is no district statistical service. By contrast, the preponderance of national data in the euro area provides a focal point for local politicians and policymakers—and, naturally, the national central banks then follow. Eliminating that temptation requires doing away with country-level data and national statistical agencies all together.

Second, as we described in an earlier post, having a system in which intra-European cross-border capital flows remain stable in periods of stress requires that major banks in the euro area be euro-area banks rather than national banks (or, even worse, national champions!). The authorities have taken measures to create a common regulatory system, and the Single Supervisory Mechanism is a big step toward a unified supervisory framework. (They also have begun transferring the burden of bank resolution to the Single Resolution Mechanism.) But just as they still have the fallback to national monetary authorities, individual countries can retreat to national regulators and supervisors, making it possible to renege under stress. Here, time consistency requires the dismantling—however gradual—of the national regulatory and supervisory authorities.

And finally, there are the national central banks themselves. Again, to make the system truly time consistent, authorities need to take steps so that they cannot rely on national institutions in times of stress. One solution would be to mimic the structure of the Federal Reserve System. That is, replace the national central banks with regional banks whose boundaries do not coincide with those of existing nation states.

No one expects these various national institutions—especially the NCBs—to be abolished any time soon. Considering the uncertainties about the future of the monetary union and the euro, we can’t imagine any Prime Minister or Governor agreeing to the dissolution of their own national central bank in favor of a regional version analogous to a Federal Reserve System district bank. But this institutional insurance, while valuable locally, raises doubts about how the policymakers will behave in future episodes of stress.

By simply adapting the existing NCBs and adding a coordinating body in the form of the ECB, the Maastricht Treaty created a Eurosystem in which national officials, who are surely doing their best to focus on the common good of the euro area as a whole, must occasionally look out the window of the NCB buildings and wonder if the day will come when they once again have to go it alone.

To escape the tempting song of the Sirens, Odysseus had himself tied to the mast. In similar fashion, future architects of an evolving Eurosystem may wish to re-think the structure of the NCBs to make their commitment to a permanent system clear to anyone who looks at a map.