Liquidity Runs

"We do not want to face Bear."

Email from a Goldman employee to a hedge fund manager,

March 11, 2008 (Financial Crisis Inquiry Report, p. 288)

Despite mixed evidence, concerns about a decline of bond market liquidity persist. The typical worry is that a sudden decline in bond demand will cause prices to plunge and have serious knock-on effects.

Naturally, the issue merits attention: episodes in which market liquidity disappears rapidly can be disruptive (witness the flash crashes and flash rallies in various equity and bond markets in recent years). However, these incidents tend to be fleeting. Instead, from the perspective of financial stability, funding liquidity is the greater source of vulnerability. One reason is that, if counterparties start to worry about the borrowing capacity of a leveraged intermediary that relies on wholesale funding, then conditions can shift from a good equilibrium (with plentiful funding) to a bad equilibrium (a “sudden stop”) almost instantly. (We are reminded of Dornbusch’s dictum: “The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.”)

And, when a sudden stop reflects a loss of confidence by wholesale creditors in an intermediary’s solvency, it is nearly impossible to reverse. Indeed, if the financial system as a whole is experiencing a capital shortfall, the loss of funding liquidity tends to be contagious. And, if there is insufficient capacity to support the combined balance sheets of the healthy and stressed intermediaries, damage to an interconnected institution will fuel concern about its counterparties and lead to the drying up of funding more broadly (see, for example, here and here).

Recent developments again highlighted the importance and fragility of funding liquidity. Documents released last month—five years after the Financial Crisis Inquiry Report—substantiated the Report’s account of the origins of the March 2008 run on Bear Stearns (then the fifth largest U.S. investment bank). According to the Report, the run began with the efforts of Bear’s clients to “novate” derivatives contracts—that is, to transfer exposure to Bear from one counterparty to another. In normal times, derivatives novation is routine, but (absent perfect multilateral netting) it is not feasible for everyone to escape contractual exposure to a specific counterparty, let alone to do so quickly. And, as the opening quote of this note indicates, as of March 11, 2008, Goldman Sachs no longer wished to accept novations or other contractual assignments from others that would cause it “to face Bear” as a counterparty.

The news that one investment bank no longer wished to accept the risk of dealing with Bear spread almost instantly, so that within a few days Bear’s funding dried up completely. As the chart below shows, Bear’s liquidity pool plunged from $18 billion (around which it had ranged for some time) to $2 billion within three days. It fell further on Friday, March 14, just before JPMorgan (buttressed by a nonrecourse loan from the Federal Reserve) guaranteed Bear’s contracts over the weekend.

Bear Stearns Liquidity Pool (Billions of U.S. dollars), March 2008

Source: SEC Chairman Cox Letter to Basel Committee, March 20, 2008.

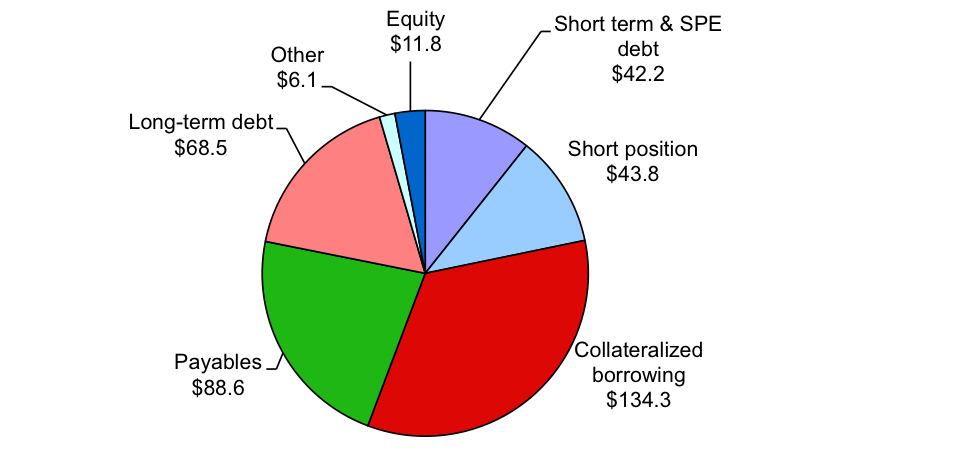

Aside from the speed of the collapse, there are at least three important lessons to draw from the Bear episode. First, reliance on short-term funding makes a firm eminently runnable. As the following chart shows, in Bear’s case its liquidity pool of $18 billion was a mere fraction of its collateralized borrowing (itself, only a portion of its wholesale funding) of over $130 billion. In such a circumstance, as soon as creditors stop rolling over daily repos and short-term loans, the firm becomes illiquid immediately.

Bear Stearns Liabilities (billions of dollars), End-November 2007

Source: 2007 Annual Report of Bear Stearns.

Second, the willingness to run on Bear reflected its (not uncommon, but nevertheless remarkable) lack of capital. Importantly, the “run point” on an intermediary—the size of the negative shock to assets that triggers a run by wholesale creditors—likely is smaller than its equity capital, especially if the firm is dependent on wholesale funding and if some of its funded assets are relatively illiquid. At the end of November 2007, Bear reported book equity of only $11.8 billion against U.S. GAAP assets of $395.4 billion, for an unweighted leverage ratio of 3.0% (see chart below). Because of its $13.4 trillion in gross notional derivatives positions, this already meager capitalization is surely overstated (see here).

The third lesson is that—when clients and creditors become unwilling to roll over derivatives, repo, and other positions—the larger the gross funding needs and the weaker the capitalization of the financial system as a whole, the more difficult it will be to find a substitute counterparty. The reason is that intermediaries are averse to risk concentration, all the more so in a period of widespread financial stress when capital is scarce. This is presumably why Goldman’s risk managers eventually rejected new Bear-facing contracts. And, with a system-wide capital shortfall of nearly $800 billion at the time (as measured by NYU Stern’s Volatility Lab’s aggregate U.S. SRISK), it would have been difficult to find a firm willing to assume Bear’s positions even if they had been easy to value.

In recent writings, we’ve highlighted two key reforms that we believe will make the financial system more resilient to a loss of funding liquidity. The first is to shift transactions—for derivatives, securities lending, and wholesale funding transactions like repo—to a central clearing party (CCP). To avoid a race to the bottom among CCPs, the model of a single public-utility CCP probably is appropriate for each of these markets. Such a monopolist CCP would have the ability to set collateral and margin requirements adequate to keep the financial system safe. It also would have the ability to monitor and ensure the capitalization and liquidity of its counterparties. In contrast, the current tri-party clearing mechanism in the repo market creates incentives for the two clearing banks that can be destabilizing in a period of financial stress.

The second is to set capital requirements on banks and bank-like financial intermediaries at levels that make them resilient to large shocks: that is, to raise their collective “run points” high enough to make a financial crisis unlikely. Since the crisis, capital requirements on banks have risen sharply, with the largest internationally active banks (“global systemically important banks” or G-SIBs) also required to issue a substantial volume of bail-in-able long-term debt (adding to “total loss-absorbing capital”).

Yet, to make the financial system safe, we have argued consistently (see here and here) that capital requirements ought to be substantially higher. And, again, recent research (in this case, a March 2016 IMF Staff Discussion Note) buttresses this view. As of 2019, Basel III common equity capital requirements for global systemically important banks (G-SIBs) will range from 8% to 10.5% of risk-weighted assets, including a minimum of 4.5%, a capital conservation buffer of 2.5% and a G-SIB surcharge of 1.0% to 3.5% (we exclude the countercyclical buffer of 0.0% to 2.5% that is unlikely to be used in some jurisdictions). However, even merely to absorb the losses and avoid bank insolvency in 90% of past OECD banking crises, the IMF calculates that bank capital would need to be closer to 30% of risk-weighted assets (see chart). Since total assets are commonly twice risk-weighted assets, this translates into an unweighted leverage ratio of 15% — a far cry from the Basel III standard of 3%!

Share of OECD Banking Crises Without Creditor Losses vs. Risk-weighted Capital Ratios

Source: See Figure 3 in Dagher et. al. Benefits and Costs of Bank Capital, IMF Staff Discussion Note, March 2016.

Naturally, as capital requirements on banks rise, there is an incentive to shift systemic risk to shadow banks. For that reason, the rules will have to anticipate inevitable efforts at circumvention. In this context, the idea of a tax on leverage is intriguing, but—as with most mechanisms to promote financial stability—the devil is in the details and the enforcement. For example, how should one measure and tax the leverage associated with derivatives positions?

The bottom line: we should continue to track developments and ensure that, even in the worst of times, financial markets can continue to function without public support. But in the end, as highlighted again recently by Duffie, market liquidity is a product of funding liquidity. When intermediaries have high levels of capital, and the entire system is sufficiently well capitalized to absorb an intermediary that comes under stress, funding will remain plentiful, markets will remain liquid, and the financial system will be safe.

Acknowledgement: We thank our friend, Hyun Song Shin, for his 2008 slide presentation on “Financial Regulation in a System Context,” and for directing us to the data for the charts in that presentation depicting the 2007 balance sheet and the 2008 liquidity pool of Bear Stearns.