In Defense of Regulatory Diversity

Guest post by Lawrence J. White, Robert Kavesh Professor in Economics, NYU Stern School of Business

The U.S. regulatory landscape--especially with regard to financial regulation—is maddeningly complex. It is easy to make a case for a drastic simplification, and the authors of this blog have done so here. But there is value in diversity—including regulatory diversity. Consequently, with regard to the regulatory framework, as is true of most other areas of political economy, we need to consider the costs as well as the benefits of any proposed changes.

Let’s start with the undeniable complexity of U.S. financial regulation: Consider the following array of agencies and jurisdictions (an alphabet-soup glossary appears at the end):

- There are four federal regulators of depository institutions—the OCC, the Fed, the FDIC, and the NCUA—plus one or more regulators in each of the 50 states.

- There are two federal regulators of securities and similar financial instruments—the SEC and the CFTC—plus a regulator in each of the 50 states.

- Insurance regulation is the responsibility of the states, so there are 50 state regulators, but there also is a Federal Insurance Office (FIO) that monitors the sector, and represents U.S. interests internationally.

- Pension fund regulation is the responsibility of two federal agencies—the PBGC and the DOL—plus the 50 states.

- The regulation of housing finance is the responsibility of the FHFA, HUD, and the CFPB, plus the 50 states.

- Consumer fraud in financial products is the primary responsibility of one federal agency—the CFPB—but the other federal financial agencies also play a role, as do the FTC and the 50 states (including their attorneys general).

- And there are quasi-governmental and self-regulatory organizations—FINRA, FASB, PCAOB, and the MSRB—that also have regulatory powers, especially with respect to securities and accounting.

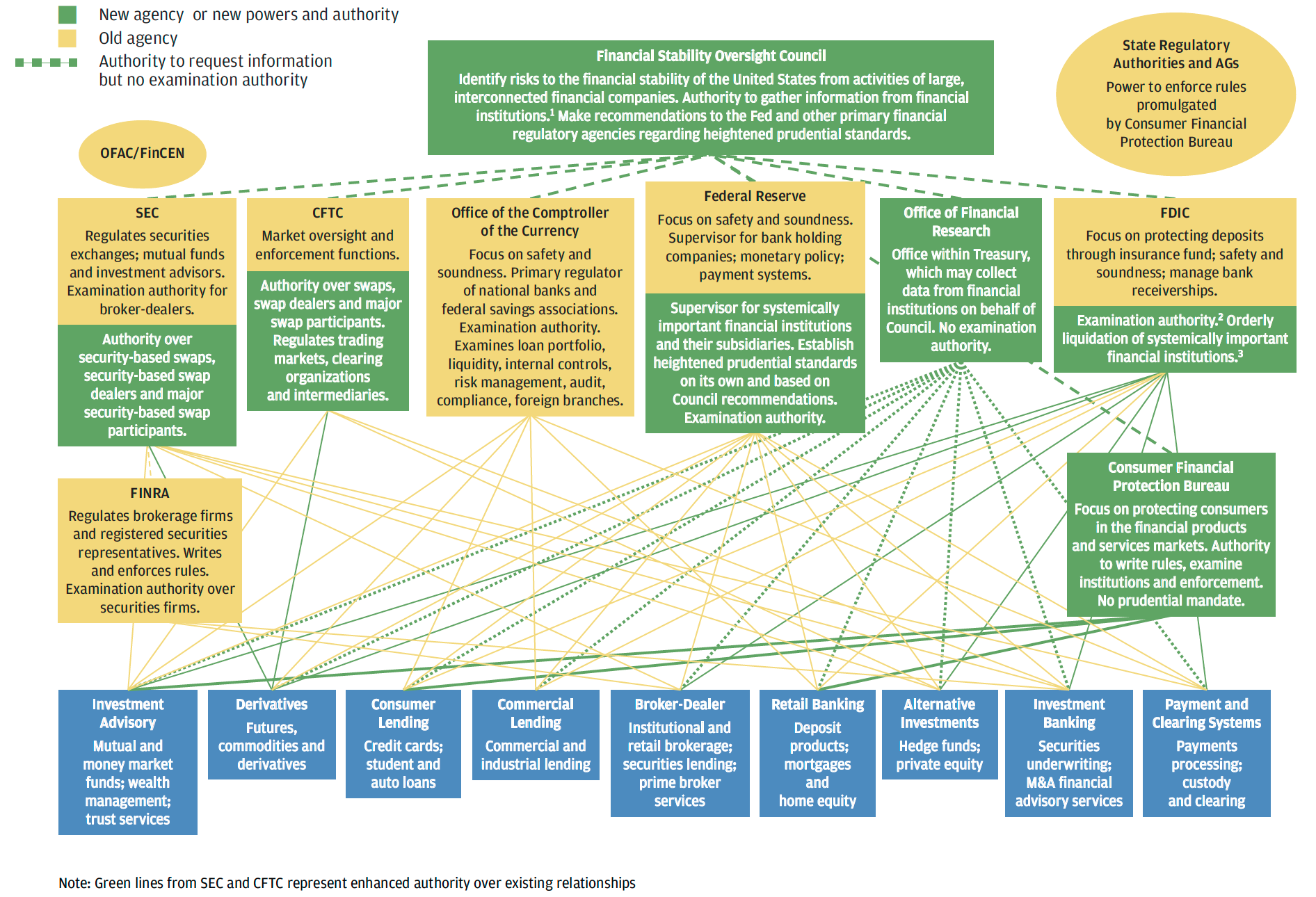

Periodically there are efforts to try to capture this complexity in diagrammatic form. A few years ago Jamie Dimon, the CEO of JPMorgan Chase, made famous the following diagram that portrays just the financial regulatory agencies that confront a large bank holding company.

Typical U.S. Regulatory Network for a Large Bank Holding Company

Source: JPMorgan Chase, Annual Report Letter to Shareholders, March 30, 2012, p. 20.

It is easy to consider this complex array of agencies and jurisdictions and responsibilities and conclude that life would be far simpler—and better—if the structure of the regulatory landscape were considerably simplified, with far fewer agencies. Perhaps one could consider the other limit. The current British regulatory structure has only three financial regulators: the Bank of England that, through the Prudential Regulation Authority and the Financial Policy Committee, ensures the safety and soundness of financial firms, as well as monitoring and addressing systemic risk; the Financial Conduct Authority that enforces proper market conduct and protects consumers; and the Pensions Regulator that ensures that pension schemes are run properly and safely.

Wait! Not so fast!

Of course there are potential advantages to simplification. Regulatory decisions could be made faster, especially in a crisis, when policymakers need timely access to sensitive, proprietary information, and must coordinate actions both domestically and internationally. There would be fewer “turf wars” that can delay decisions. There would be less duplication and redundancy and less need for coordination among separate regulatory agencies (including less need for coordinating agencies, such as the FSOC that was created by the Dodd-Frank Act of 2010). Regulatory costs would decrease, both for government (and thus for taxpayers) and for regulated firms. And there would be fewer opportunities for a race to the bottom, whereby a financial services firm tries to avoid (or reduce the burden of) regulation by “forum shopping” among regulators with parallel responsibilities who must compete for regulatees (their fee-paying clients). There also would be fewer incentives for one regulator to impede competition from financial firms under a different regulator.

But there are also potential downsides. To see this, let’s really go to the limit: Suppose that there were only a single regulator for all of the financial system. And suppose someone has a new idea for the kinds of financial services that could be made available, or for how certain services can be more effectively delivered to users.

With a single regulator, there is an obvious risk: If that regulator has the authority to reject the idea and does so before it is implemented, the game is over. There is no place else for the innovator to turn (except, perhaps, to regulators in another country). But with multiple regulators, there is an increased chance that—if the idea is worthwhile—one or more of the regulators will see the merit in the idea.

In essence, an important assumption that underlies the potential benefits to simplification is that regulators will “get it right”: that they won’t make mistakes. By contrast, the argument for multiple regulators is an argument for diversity: that in a world where mistakes can be made, having some diversity can reduce the costs of error and increase the likelihood that worthwhile ideas will be able to take root.

The federalism that is constitutionally enshrined in the United States—in which the central government and the 50 state governments share sovereignty—is just such a vehicle for regulatory diversity. It certainly adds to complexity—not only for financial regulation but for many other areas of economic policy. For example, roads and traffic safety are the responsibility of the FHWA, the NHTSA, and the 50 states; employment policies are the responsibility of the DOL, the EEOC, the NLRB, and the 50 states; and the list goes on…

But, as Justice Louis Brandeis wrote, with federalism “[a] state may, if its citizens choose, serve as a laboratory, and try novel social and economic experiments without risk to the rest of the country.”

The idea that diversity can have substantial value for financial regulation is not just an artifact of abstract theorizing. There are a number of important, real-world instances where the presence of multiple financial regulatory agencies allowed good ideas to flourish (and where the presence of only a single regulator would have squelched--or at least significantly delayed--the implementation of the idea) and/or helped hasten the demise of bad ideas. Here are four examples:

- In the 1970s, the U.S. financial system developed a rich array of new exchange-traded financial instruments (largely new kinds of options and futures) that provided financial market participants with better means to diversify and hedge. It was no accident that Chicago-based financial firms, under the regulatory auspices of the CFTC, developed many of these tools. Previously, innovators in Chicago had promoted exchange-traded futures for commodities. However, the SEC was hostile to the new financial products, which competed with the stocks and bonds traded by the New York firms it regulated. Had there been no regulator other than the SEC, innovators could not have introduced these new instruments as quickly or as effectively.

- Competition among regulators also helped households earn a market return on their savings. Regulation Q, the part of the Banking Act of 1933 that required the Fed to set ceilings on deposit interest rates, began to bite seriously in the 1970s. However, the NCUA placed no restrictions on the interest that credit unions could pay to their depositors. About the same time, the SEC allowed a new type of short-term fund—the money market mutual fund, which was a close substitute to deposits—to take root. The competition from these alternatives likely hastened the demise of Reg Q.

- Since 2009, stress tests have become an important part of U.S. (and European) prudential regulation of large banks. However, it was a wholly different financial regulator—the OFHEO (predecessor to FHFA)—that introduced stress tests, beginning in the mid-1990s, as part of the supervision of Fannie Mae and Freddie Mac. (Parenthetically, OFHEO may well have absorbed the idea of stress tests from the major credit rating agencies, which employed such tests for determining the creditworthiness and thus the rating of the corporate bonds that they rated.)

- During the 1990s and early 2000s, U.S. regulators struggled with the implementation of the “Basel II” capital framework for large banks. The Fed advocated allowing the large banks to develop their own risk models (under regulatory oversight) that would determine their capital requirements. The OCC and the FDIC had substantial reservations about the low capital levels that were likely to result. The two agencies’ opposition delayed the U.S. implementation of Basel II, and probably averted what might have become an even greater financial debacle in the wake of the sub-prime mortgage securities meltdown of 2007-2008.

The important point in all of this is that structural simplification for the American financial regulatory landscape is not a “no-brainer.” Diversity has value and needs to be taken into consideration in any discussion of regulatory simplification.

I will offer two final points: First, many observers of insurance regulation (including the present author) believe that a federal insurance charter (and federal insurance regulator) should be an option for insurance companies. But adding a federal regulator would add to the complexity, duplication, and redundancy of the regulatory structure. Should the federal charter be squelched solely because it would add to regulatory complexity?

Second, consider a modern passenger jet airplane: Such aircraft have duplication and redundancy of systems deliberately designed into them, despite the extra costs that are involved. But in a world of error and mistakes, airline passengers are surely safer as a consequence.

The modern financial system is at least as complex—and as worthy of protections against failures—as a modern jet airplane.

Note: Professor White’s previous guest post was Ninth Anniversary of the GSEs' Conservatorships: Not a Time to Celebrate.

GLOSSARY

- CFPB: Consumer Finance Protection Bureau

- CFTC: Commodity Futures Trading Commission

- DOL: Department of Labor

- EEOC: Equal Employment Opportunity Commission

- FASB: Financial Accounting Standards Board

- FDIC: Federal Deposit Insurance Corporation

- Fed: The Federal Reserve System

- FHA: Federal Housing Administration

- FHFA: Federal Housing Finance Agency

- FHWA: Federal Highway Administration

- FINRA: Financial Industry Regulatory Authority

- FIO: Federal Insurance Office

- FSOC: Financial Stability Oversight Council

- FTC: Federal Trade Commission

- HUD: Department of Housing and Urban Development

- NCUA: National Credit Union Administration

- NHTSA: National Highway Traffic Safety Administration

- NLRB: National Labor Relations Board

- OCC: Office of the Comptroller of the Currency

- OFHEO: Office of Federal Housing Enterprise Oversight

- PBGC: Pension Benefit Guarantee Corporation

- PCAOB: Public Company Accounting Oversight Board

- SEC: Securities and Exchange Commission