Negative Nominal Interest Rates and Banking

“By and large our negative interest-rate policies have been a success. We haven’t seen the distortions that people were foreseeing. We haven’t seen bank profitability going down; in fact, it is going up.” Mario Draghi, Comments at the Peterson Institute, Washington D.C., October 12, 2017. (at 36 minutes of the Session on Monetary Policy)

The financial crisis of 2007-2009 taught us many lessons about monetary policy. Most importantly, we learned that when financial systems are impaired, central banks can backstop both illiquid institutions and illiquid markets. Actively lending to solvent intermediaries against a broad range of collateral, purchasing assets other than those issued by sovereigns, and expanding their balance sheets can limit disruptions to the real economy while preserving price stability. We also learned that nominal interest rates can be negative, at least somewhat.

But in reducing interest rates below zero―as has happened in Denmark, Hungary, Japan, Sweden, Switzerland and the Euro Area―policymakers face concerns about whether their actions will have the desired expansionary effect (see here). At positive interest rates, when central bankers ease, they influence the real economy in part by expanding banks’ willingness and ability to lend. Does this bank lending channel work as well when interest rates are negative?

In normal times, interest rate reductions have two complementary effects that promote lending. First, banks’ net worth rises because their assets are longer maturity than their liabilities. Second, by driving up asset values and improving business prospects, accommodative policy improves the creditworthiness of potential borrowers. This increase in both the supply and the demand for loans boosts lending and spurs real activity.

Why should there be any sort of asymmetry at zero? Banks run a spread business: they care about the difference between the interest rate they charge on their loans and the one they pay on their deposits, not the level of rates per se.

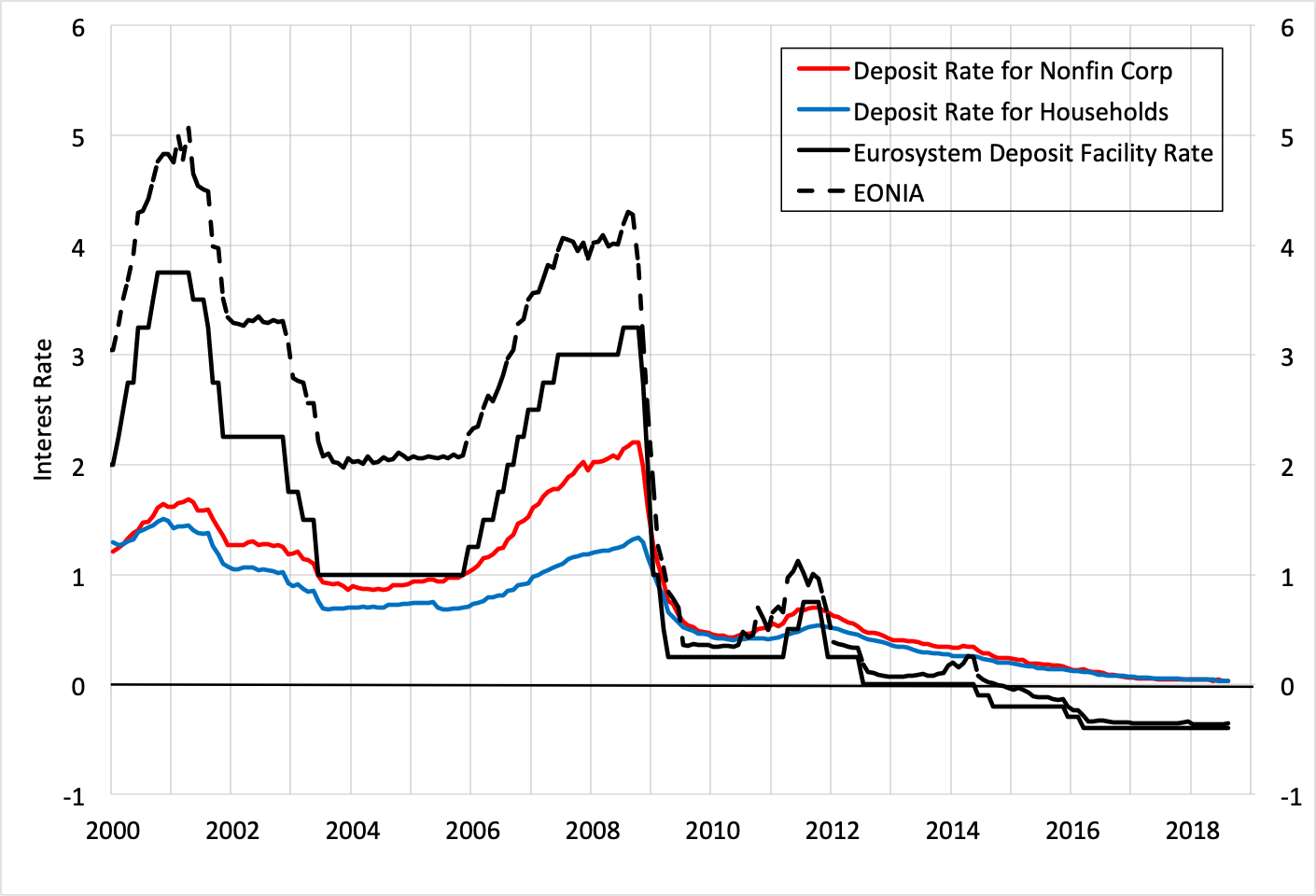

In practice, however, zero matters because banks are loathe to lower their deposit rates below zero. Their reluctance is apparent from the following chart, which shows the configuration of various interest rates for the euro area starting in 2000. Prior to 2008, these data exhibit what we would label as the textbook case. The interest rate banks pay their corporate depositors (the blue line) is slightly higher than what they pay households (the red line). But both of these are below the rate that the bank can obtain by depositing funds overnight at the central bank (the solid black line), which is less than what banks get for lending to other banks overnight (the dashed black line). Then comes the crisis and the spread between the deposit rates and the overnight interbank lending rate disappears. And, when the ECB implements its negative interest rate policy in 2014, lowering the rate banks receive for deposits at the central bank below zero, the spread becomes negative. From an individual bank’s perspective, what used to be a profitable business of taking corporate or household customer deposits and either simply placing the proceeds at the central bank or lending it to another bank, now results in a loss.

Key euro-area interest rates, 2000-August 2018

Source: European Central Bank (including private deposit rates).

Looking at this, one might think that a shift to negative rates would drive the whole transmission mechanism into reverse. That is, rather than promoting bank lending―which requires that banks attract funds―pushing the policy interest rate below zero would cause intermediaries to shrink their balance sheets in order to reduce their losses. The more negative the policy rate, the more contractionary the policy.

More generally, as we outline in an earlier post, people may react to negative nominal interest rates differently from how they do to positive ones: in particular, sufficiently subzero nominal rates can drive people to accumulate cash, shrinking bank balances. They also could view negative policy rates as a signal of central bank desperation, damaging consumer and business sentiment, and reducing private spending. Yet, looking at the jurisdictions that have implemented negative nominal rates, there is little evidence of these perverse responses. So, why do banks hesitate to set their deposit rates below zero? Perhaps people simply do not like negative nominal interest rates, and banks are reluctant to damage their customer relationships.

This brings us to the fundamental question: does negative nominal interest rate policy work? To answer this, we must ask what happens to bank profitability and bank lending when policy rates decline below zero. With regard to profitability, Lopez, Rose and Spiegel compare banks in jurisdictions with positive and negative interest rates over the period from 2010 to 2016. They find very little impact on profitability: while net interest income falls, banks are able to make it up with higher non-interest income and from the favorable impact of lower interest rates on the value of their assets. (Lopez et al. also confirm that the more dependent a bank is on deposits as a source of funds, the worse it fairs when policy rates turn negative. See here and here.)

The following chart provides a summary view of this process. Net interest income for euro-area banks (the red line) is relatively steady at 1.2 percent of total assets from 2009 to 2014. But then, following the ECB’s shift to a negative rate policy (see the previous chart), net interest income falls to 0.8 percent of total assets. Even so, the return on assets appears to be relatively steady (at least in these annual data).

Euro-area banks: net interest income and return on assets (percent of total assets, annual), 2007-17

Notes: From 2007 to 2009, the chart shows fourth-quarter readings; from 2010 to 2013, it is the average of second- and fourth-quarter readings; from 2014, it is the average of all four quarters.

Source: European Central Bank.

We should note that the actual cost of negative interest rates to the banks depends critically on the details of how the policy is implemented. Most central banks that lowered their policy rates below zero have done it in a way that ensures the average interest paid on excess reserve holdings remains above the marginal rate that influences banks’ behavior. For example, when the Bank of Japan (BoJ) introduced its "Quantitative and Qualitative Monetary Easing with a Negative Interest Rate" policy in 2016, policymakers (following the lead of the Swiss National Bank) implemented a three-tier system in which only a relatively small fraction of banks’ reserve holdings actually faced a negative rate. Given the structure of the BoJ’s policy, the average rate paid on Japanese banks’ excess reserves probably was positive. (One can interpret this approach as paying a negative rate on all reserves to influence banks’ willingness to lend, but offsetting the impact on their profits with a lump-sum subsidy.) In the case of the ECB, where the negative rate is applied to all bank reserves in excess of the reserve requirement, this difference between the average and marginal rates is small (see here).

The fact that banks have found ways to maintain their profitability under these conditions is one thing, increasing lending is another. Starting with individual banks, in a study of Spanish banks, researchers conclude that negative rate policy does not alter their supply of credit. Looking at euro-area banks, ECB researchers find that the greater the reliance on deposit funding, the more risk a bank takes on, but the less their lending increases. The first of these―the increase in risk-taking―is, of course, an intended consequence of monetary policy easing.

What is the impact of negative rates on aggregate lending? Here, we see less support for the policy’s effectiveness. To understand why, consider the following chart. Note that euro-area bank credit (the red line) as a percentage of GDP peaked in 2009-10 at 106 percent, and has since fallen steadily to 89.7 percent in the first quarter of 2018 (the latest reading). To be sure, since 2013, aggregate lending has increased by about 5 percent, but nominal GDP rose by 15 percent. Nonbank sources of funding helped fuel that economic expansion, so that total credit to GDP has fallen only very slightly in recent years.

Euro-area credit to the private nonfinancial sector (percent of GDP), 2000-2018 Q1

Source: BIS.

Of course, we don’t really know why euro-area bank credit has grown so slowly. It could reflect weak demand. Nonfinancial corporations are already carrying debt that exceeds 100 percent of GDP—well above the levels in either the United States (73 percent) or the United Kingdom (84 percent). Or, it could be that supply remains weak. Here, changes in regulation may be playing a role. First, euro-area supervision has shifted from national authorities to the ECB’s Single Supervisory Mechanism, perhaps reducing the ability and willingness of banks to evergreen bad loans (see here). Second, regulatory efforts to improve banks’ capitalization may temporarily inhibit lending. And third, new liquidity requirements encourage greater reliance on deposit funding, which is more costly when policy rates are negative.

This all brings us back to Mario Draghi’s comment at the start of this post. We can readily verify that bank profitability is unaffected by the ECB’s negative interest rate policy. Moreover, euro-area real growth has averaged nearly 2 percent over the past five years so, when it comes to the big picture, the ECB’s policy has been a success. Yet, bank lending has risen substantially less than nominal GDP, consistent with some weakening of the bank lending channel at negative rates.

We draw several lessons from this experience. First, modestly negative nominal interest rates are not catastrophic for banks. Lenders can adjust. But there is surely a limit, an effective lower bound, imposed by the cash constraint (see our earlier discussion). In small open economies like Switzerland or Sweden, central bank deposit rates are at -0.75 percent and -1.25 percent. But the ECB stopped at -0.40 percent, and the Bank of Japan at -0.10 percent. Scale economies in cash management may be greater in large economies.

What about the Fed? Despite the confidence of some observers (see here), we have little sense of what would happen if the U.S. monetary policymakers were to try to lower rates below zero. It is unclear whether they could go even as far as the ECB. To be sure, despite subzero rates on the sovereign debt of several countries, Europeans generally have not resorted to cash. But would Americans be as compliant? What about the U.S. banks? Will they be as nimble in shifting their sources of revenue? Are their customer relationships of sufficient importance to maintain the supply of loans? And, what about the spillovers from Fed policy? How would foreign central banks and governments react should the issuers of the world’s reserve currency drive interest rates below zero?

We and the Fed can only learn the answers if and when the U.S. policymakers actually push rates below zero. In our view, that remains a risky experiment.

Acknowledgment: We thank our friend, Vítor Constâncio, for helping us to understand the mechanics of the Eurosystem’s negative interest rate policy.