Assessing Housing Risk

Housing debt typically is on the short list of key sources of risk in modern financial systems and economies. The reasons are simple: there is plenty of it; it often sits on the balance sheets of leveraged intermediaries, creating a large common exposure; as collateralized debt, its value is sensitive to the fluctuations of housing prices (which are volatile and correlated with the business cycle), resulting in a large undiversifiable risk; and, changes in housing leverage (based on market value) influence the economy through their impact on both household spending and the financial system (see, for example, Mian and Sufi).

In this post, we discuss ways to assess housing risk—that is, the risk that house price declines could result (as they did in the financial crisis) in negative equity for many homeowners. Absent an income shock—say, from illness or job loss—negative equity need not lead to delinquency (let alone default), but it sharply raises that likelihood at the same time that it can depress spending. As it turns out, housing leverage by itself is not a terribly useful leading indicator: it can appear low merely because housing prices are unsustainably high, or high because housing prices are temporarily low. That alone provides a powerful argument for regular stress-testing of housing leverage. And, because housing markets tend to be highly localized—with substantial geographic differences in both the level and the volatility of prices—it is essential that testing be at the local level.

We begin by demonstrating the importance of housing as a key asset and the widespread reliance on mortgage finance. Since 1980, the market value of real estate has ranged between 26 percent and 38 percent of U.S. household net worth, with an average of 32 percent (see chart, black line). As of mid-2018—the latest reading—that share was 27 percent, near the low end of the range. Over the same period, mortgage finance (as a fraction of total value, red line) varied widely, from a low of 25 percent in 1983 to a high of 57 percent at the height of the crisis in 2009, with an average of 37 percent. It is important to keep in mind that if housing prices are unsustainably high—say, relative to disposable income and the cost of financing—then a low leverage ratio need not imply a safe level of debt.

Real estate assets (at market value) as a share of household net worth and the ratio of real estate assets financed by mortgages (percent), 1980-2Q 2018

Note: These measures include nonprofit organizations, as well as households. Source: Financial Accounts of the United States, Table B.101.

Because of dramatic differences in wealth levels and asset holdings across the distribution of wealth, averages understate the importance for housing (and housing-related leverage) for much of the population. The following table shows the shares of various assets in net worth in 2016 for households in different parts of the U.S. wealth distribution. While the principal residence accounted for less than 8 percent of the net worth of the top 1 percent, it was over 60 percent for those middle-class households between the 20th and 80th percentiles. Importantly, this latter group is highly leveraged, with debt (typically in the form of mortgages) equal to nearly 60 percent of net worth. Even these figures understate the weight of housing in the net worth of middle-class families: for the 90 percent of those between the 50th and 75th wealth percentiles who owned their primary residence in 2016, the median house value ($169 thousand) represented 88 percent of median net worth ($192 thousand)! That is, middle-class families typically concentrate their wealth in a highly undiversified, illiquid asset—their home.

Assets as a share of U.S. household net worth and the ratio of debt to net worth for households ranked by wealth (percent), 2016

Source: Tables 7 and 8 in Wolff (based on the 2016 Survey of Consumer Finances).

Against this background, many observers view housing-related credit developments as a key source of risk to the financial system and to the overall economy. In their study of 17 advanced economies since 1870, Jordà, Schularick and Taylor conclude that financial instability is “increasingly linked to real estate lending booms,” giving housing finance a “central role in the modern macroeconomy.” And, looking at data for the past 150 years, Richter, Schularick and Wachtel identify credit and housing price booms associated with rising loan-to-deposit ratios as useful warnings of systemic crises. By contrast, as one of us emphasized over a decade ago, equity booms are less threatening.

As a result, housing price developments are now a common feature of country-wide risk assessments. For example, Pavilidis et al exploit the International Housing Price Database of the Dallas Fed to identify periods of “exuberance” that they suggest are prone to subsequent busts. Furthermore, they see global factors as contributing to the synchronization of these episodes in the 2000s.

Following in this same spirit, we can use the Dallas Fed database to identify countries where average housing prices are well above their historic norms. In the following chart, we plot the ratio of house prices to disposable income for 23 advanced and emerging economies, as well an aggregate. Note that several countries (including Ireland, Spain and the United States) which exhibited a relatively high ratio back in 2006 (red bars)—shortly before the crisis—later experienced house price plunges that threatened their financial systems. As of the latest reading (2018 Q2), the house price-to-disposable income ratio (black bars) exceeds its long-term average by more than two standard deviations in New Zealand, Canada, Luxembourg, and Australia. These four cases surely warrant (and have received) the attention of banking regulators.

National ratios of housing prices to disposable income: standard deviations from the long-term mean, 2006 Q4 and 2018 Q2

Note: The database indexes housing prices and disposable income to 2005=100 for each country. Each bar shows the difference between the national ratio of house prices to disposable income and the average of that ratio since 1975, all divided by the standard deviation of the ratio. A positive (negative) number means the ratio is above (below) its long-term average. The aggregate measure weights each country by its 2005 PPP-adjusted real GDP. The countries are ranked by their 2018 Q2 ratios. Source: International House Price Database, Globalization Institute, Federal Reserve Bank of Dallas, and authors’ calculations.

At the same time, it would be wrong to conclude that a “normal” ratio—close to zero in the chart above—implies stability. Especially in large countries, like the United States, a nationwide average can be misleading because local housing markets are quite segregated, with large and persistent differences in both the level and volatility of prices. Consequently, assessing housing risk in large economies requires a disaggregated approach.

To better understand both macroeconomic threats and systemic risk, Fuster, Guttman-Kenney and Haughwout (FGH) take this insight a big step further and examine the resilience of individual household net worth to house-price shocks. Using an extraordinary micro-level database that includes carefully constructed measures of leverage at the household level, they analyze how loan-to-value (LTV) ratios vary when house prices decline in ways that are calibrated to match local historical patterns. These stress tests assess the ability of household balance sheets to withstand plausible, but severe, local housing price setbacks. The idea is that, when combined with income strains (say, due to unemployment or illness), negative equity (where the loan exceeds the value of the home) substantially raises the likelihood of delinquency and default.

The following chart from FGH illustrates the importance of disaggregation: it shows the mean LTV values (including second liens associated with a principal mortgage) across four U.S. regions. Values above 100 mean that the mortgage loan is bigger than the value of the house, so the owner has negative equity. The relatively high volatility of housing prices in the “sand states”—Arizona, California, Florida, and Nevada—shows up as a substantial fluctuation in the LTV ratio (black line). At the start of the period, the LTV ratio in the sand states is the lowest of the four regions. Then, following the collapse of home prices, from 2008 through the third quarter of 2012, it is the highest. (In 2009, weighted by loan balances, about one-half of sand-state homes in the FGH sample were “under water!”) Since the latter half of 2015, a larger rebound of sand-state house prices again depressed the mean LTV below that in other regions. Once again, the message is that, if house prices are unsustainably high, then a low LTV is not sufficient to avoid financial and economic disruptions.

Mean LTV by region, 2005 2Q-2017 1Q

Note: Above 100, the loan exceeds the market value of the home, a condition of negative equity. Source: Chart 5 in Fuster, Guttman-Kenney and Haughwout, “Tracking and Stress-Testing U.S. Household Leverage,” Federal Reserve Bank of New York Economic Policy Review 24, no.1, September 2018. Reproduced with permission.

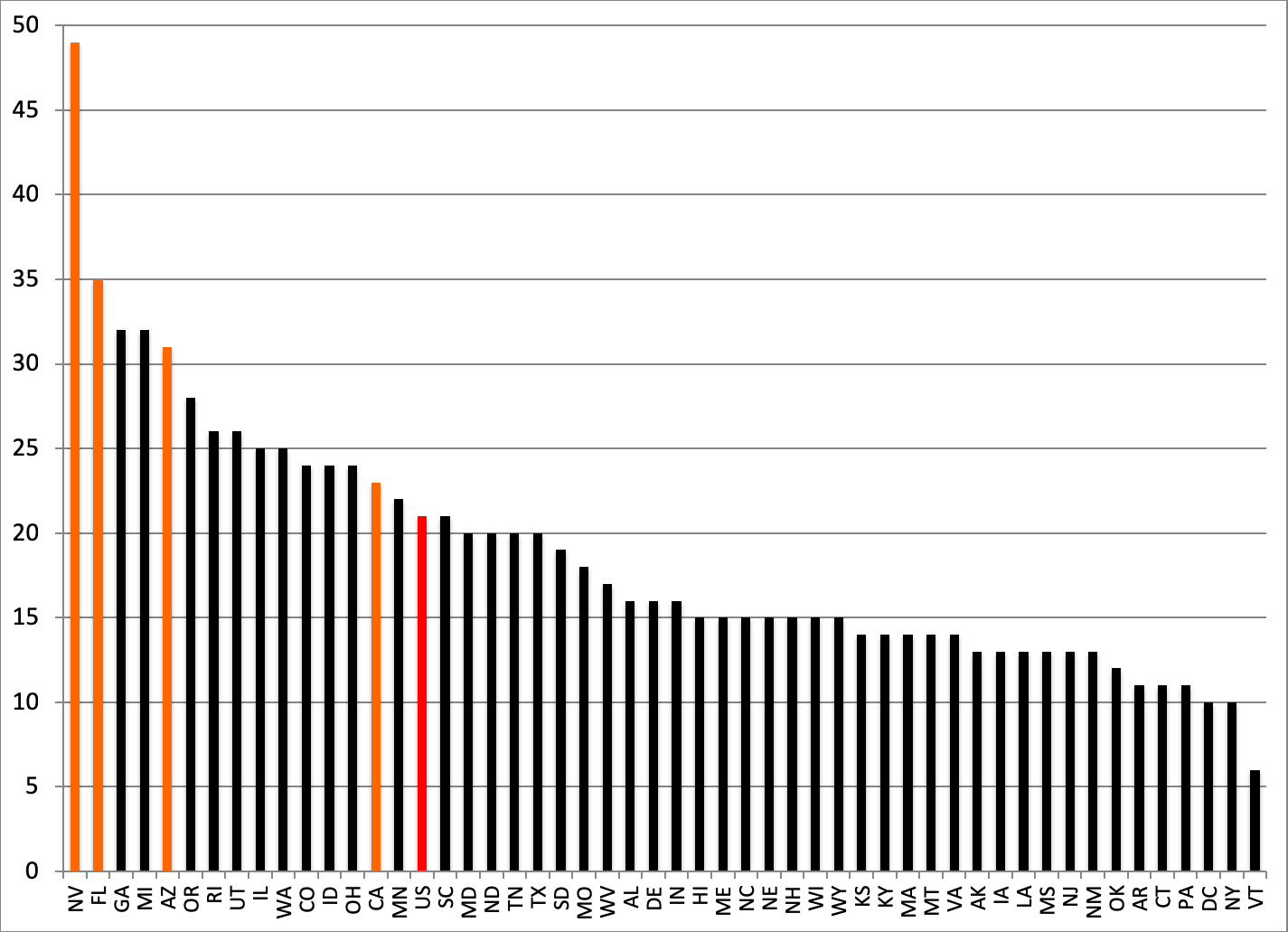

FGH go on to ask what would happen if U.S. housing prices were to fall substantially again in ways consistent with local experience—say, by dropping back to levels observed four years ago. The impact of this simple reversal is reported in the chart below. Perhaps unsurprisingly, FGH find that the fraction of borrowers in negative equity would again surge, with shares exceeding the national average (shown in red) in 15 states. And, once again, the sand states (shown in orange) fair quite poorly.

Stress test: fraction of borrowers in negative equity if local house prices revert to level four years earlier (2017 first quarter)

Source: Based on Table 3, Panel B in Fuster, Guttman-Kenney and Haughwout.

So, what’s the bottom line? As a consequence of high leverage, housing is a recurring source of financial and economic risk. Importantly, in large national economies, tracking housing risk requires taking a disaggregated approach that accounts for geographic disparities in the level and volatility of house prices, as well as potential differences in both financing methods and the net worth of households. In the crisis, the lack of data that would have allowed both regulators and lenders to track such risk added immensely to the uncertainty that plagued the financial system.

With the benefit of hindsight, we can now see the central place housing plays in any financial stability policy framework intent on ensuring resilience of both lenders and borrowers. Not only has data improved markedly (thanks to the Federal Reserve Banks of Dallas and New York), but researchers are developing tools to perform stress tests not only on banks, but on other intermediaries, and on households. While there is still much to do, this alone is surely helping to limit both the probability and severity of financial crises.