Russian Sanctions: Questions and Answers

This post is authored jointly with our friend and colleague, Professor Richard Berner, Co-Director of the NYU Stern Volatility and Risk Institute.

With the sanctions regime currently changing each day, the post reflects information as of 8 March 2022.

INTRODUCTION

Russia’s invasion of Ukraine is altering global security and economic relationships. In this post, we focus on the financial and trade sanctions imposed on Russia.

The sanctions on Russia are the most powerful and costly punishments imposed on a major economy at least since the Cold War. Their speed, breadth and coordinated global support appear unprecedented.

Not surprisingly, the impact is immediately visible. The damage to the Russian economy and financial system includes, but is not limited to, a plunge of the ruble (by about 40 percent versus the dollar over the past month amid heightened volatility); runs on domestic banks; a sharp hike in the central bank’s policy rate; imposition of capital controls; shutdown of the Russian stock market; collapse in the value of Russian companies traded on foreign stock exchanges; removal of Russian equities from global indexes; and the collapse of Russia’s sovereign credit rating to junk status.

In the past, those targeted often found ways to mitigate the impact of the sanctions. So far, however, many countries around the world are repeatedly upping the ante by tightening and broadening the sanctions on Russia. Indeed, limiting the Russian central bank’s access to its assets abroad—that could otherwise be used to bolster the value of the ruble, steady the financial system, and pay for the invasion—is a form of financial warfare. As a result, the sanctions on Russia are among the most powerful we have seen.

There are some leaks in the sanctions (see the discussion below). But in light of the resolve of those imposing the sanctions—and the widespread public calls to further increase support for Ukraine—no one has yet come to Russia’s aid (at least, not publicly). In the current political environment, sanction-busters could themselves become targets for sanctions.

At this stage, a few conclusions seem in order. First, Russia’s strategy of accumulating foreign assets during peacetime—to finance warfare—no longer appears viable. Furthermore, there is now further reason to question the wisdom of dependence on potential rogue states for critical supplies of energy and other raw materials. More generally, the current episode is heightening perceptions of vulnerability arising from cross-border financial and economic exposure.

At the same time, the long-run impact of this financial war-fighting apparatus remains far from clear. While it is difficult to know the path ahead, pre-existing pressures on countries to slow or scale back global integration may rise substantially further. What we can say is that there is no turning back to the world that prevailed before sanctions on very big economies.

The purpose of this post is to pose and provisionally answer a series of questions raised by this new regime. From time to time, we may update the post to reflect major changes as they occur. And, should readers have any critical questions they feel we missed, please forward them to us so that we can try to answer them in future updates.

Q&A

What are the key sanctions imposed thus far on Russia?

The leading sanctions are financial. At the top of the list are the effective freezing of assets held abroad by Russia’s central bank and selected Russian commercial banks, and the exclusion of most Russian intermediaries from the SWIFT messaging system that is used to facilitate cross-border transactions among member banks. There also is a wide range of other sanctions, including potential seizure of the foreign assets belonging to selected Russian oligarchs and political leaders, as well as limits on technology exports to Russia. As we write, the United States has announced a ban on oil imports from Russia, while other countries are considering whether to widen the sanctions further, possibly including energy imports.

In theory, what makes sanctions effective?

Nephew (page 4) provides a useful guide for designing effective sanctions, including: (1) clearly identify the objective; (2) understand the target’s vulnerabilities and its ability to absorb pain; (3) develop a strategy for focusing pain and weakening the target’s resolve; (4) continuously refine the strategy; and (5) clearly state the conditions for removing sanctions.

Sanctions trigger an arms race. Once in place, the target looks for paths to evade them, while those imposing sanctions work to increase their effectiveness. Put differently, sanctions are a game in which one party looks for leaks to exploit while the other works to plug the holes. Furthermore, an essential aspect of the arms race is that the two parties seek to demonstrate their resolve in an effort to convince the other side to concede. Consequently, the most important aspect of effective sanctions arguably is a credible commitment to modify and update them as needed—that is, to do “whatever it takes.”

Have sanctions been effective in the past?

Sanctions often fail because third parties (“sanction busters”) help to undermine them (see, for example, Early). Measured in terms of the costs they impose on the target, the most powerful sanctions typically apply to rogue states where there is a widespread willingness to implement costly sanctions. In such cases, third parties may anticipate that sanction busting will trigger costly secondary sanctions (see below). And, the more countries actively support and monitor sanctions, the more difficult it becomes to conceal sanction-busting violations.

What are secondary sanctions? Should we expect them?

Primary sanctions restrict entities in countries that are imposing sanctions from engaging in economic or financial transactions with the target entity or jurisdiction. By contrast, secondary sanctions apply to entities or individuals in other countries that are not imposing sanctions.

To see what this means in the current circumstance, consider the case of companies from China or India—two countries that (as of this writing) have not joined the alliance imposing sanctions on Russia. If a Chinese or Indian company were to do business with Russia, the United States or European Union could ban that firm from doing business with their customers or suppliers, and deny it access to their financial institutions both domestically and abroad. (In the United States, secondary sanctions are enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control.)

Because of their extraterritoriality, secondary sanctions are controversial and have been used mostly to target pariah nations, including Iran, North Korea, and Venezuela. Because so many countries are imposing sanctions on Russia, the need for (and usefulness of) secondary sanctions may be limited. Indeed, the threat of secondary sanctions alone may dissuade entities in countries not imposing sanctions from helping Russia. Nevertheless, one big question remains: would the United States impose secondary sanctions on Chinese firms (see here), commercial banks, and even the People’s Bank of China should they help Russia evade the sanctions?

The United States and the European Union blocked the Bank of Russia (the central bank) from using its international reserves. How do they achieve this?

Central banks hold their foreign exchange reserves in accounts at foreign central and commercial banks, as well as in the form of securities denominated in foreign currencies. In implementing the current sanctions, governments froze the Bank of Russia’s accounts at their central and commercial banks and are preventing the sale of the securities through custodians and brokers.

While there may be some jurisdictions that will allow the Bank of Russia to transact—making payments and selling securities—we know of none that has announced their willingness to do so (at least, not yet).

What was the purpose of blocking the Bank of Russia’s use of its foreign reserves, and is it effective?

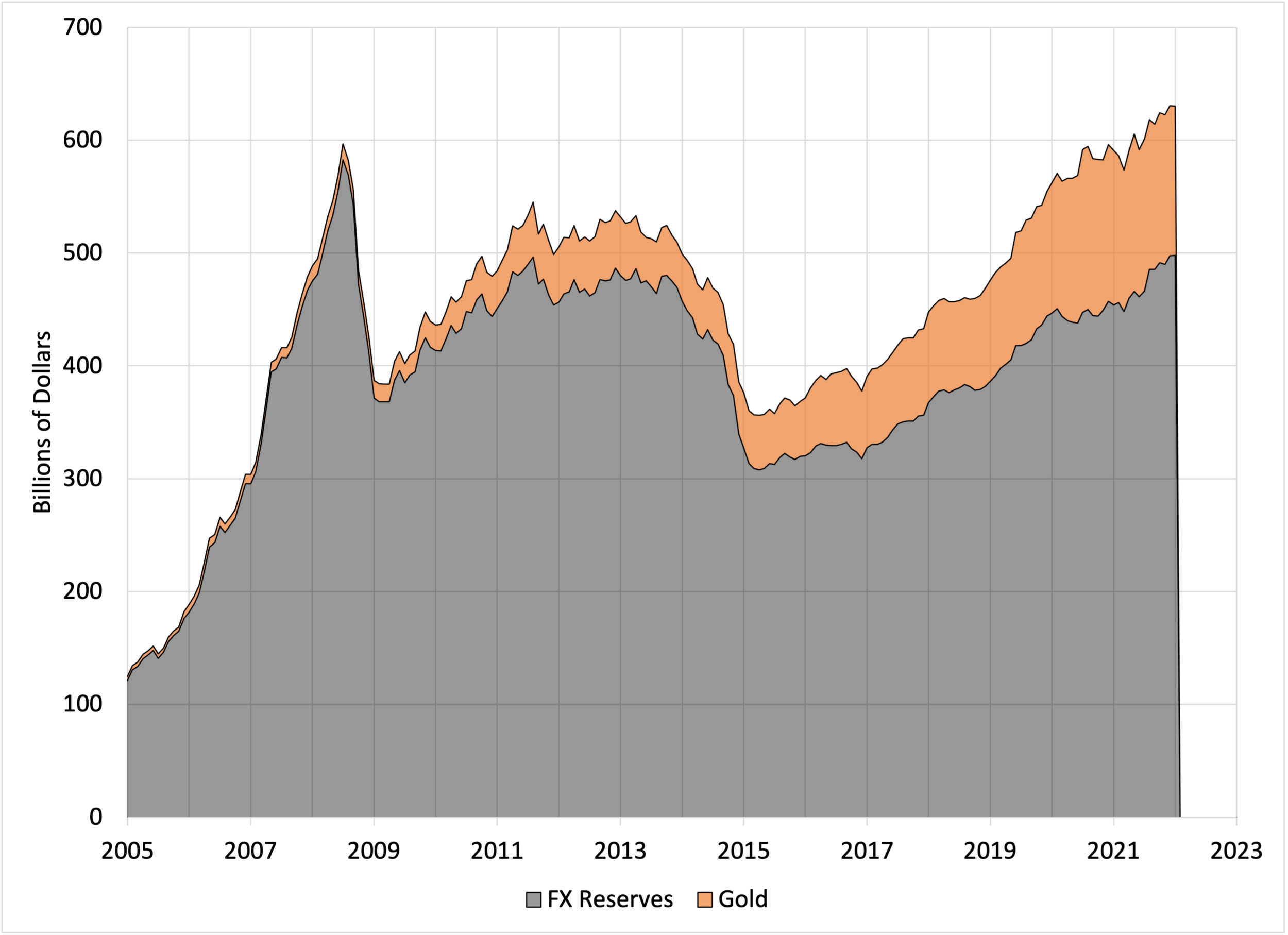

The purpose is to limit Russia’s ability to finance the war against Ukraine. Sanctions have frozen Russian assets abroad and disrupted the Russian economy and financial system. For example, the Bank of Russia accumulated more than $600 billion of international reserves (including gold) that (in the absence of sanctions) could be used to acquire goods and services from abroad (see chart).

Russia: International reserves (Billions of dollars), 2005-January 2022

Source: Bank of Russia.

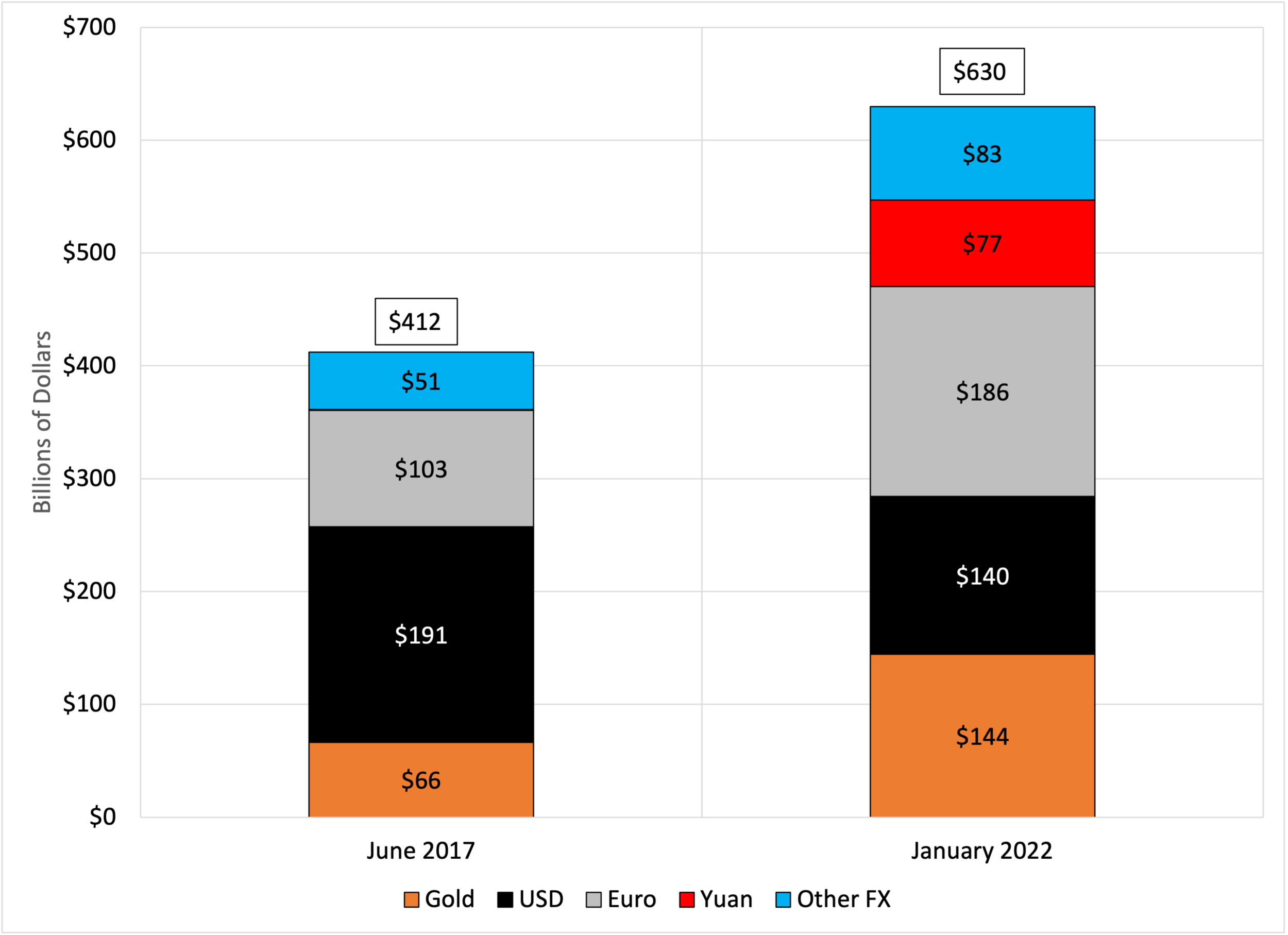

It appears that a majority of the foreign exchange reserves are now frozen. Based on the June 2021 distribution of foreign currency holdings reported by the Bank of Russia, we estimate non-yuan denominated foreign exchange holdings at $346 billion as of January 2022 (see next chart). Transactions using these holdings would have to settle on the balance sheets of the currency-issuing central banks (see following chart), but sanctions-compliant central banks will not allow this. Of course, over the past eight months, the composition of Russia’s international reserves may have shifted further toward the Chinese yuan and physical gold, continuing the trend over recent years. Nonetheless, the collapse of the ruble strongly suggests that many of the Bank of Russia’s assets abroad remain inaccessible.

Russia: International reserves (Billions of dollars), June 2017 and January 2022

Notes: In estimating the January 2022 composition of reserves, we use the June 2021 percentage weights from the Bank of Russia’s Foreign Exchange and Gold Asset Management Report (January 2022). Source: Bank of Russia and authors’ estimates.

Of course, Russia has other sources of foreign revenue it can use to acquire goods and services from abroad. Primarily due to its exports of energy and other commodities, it runs a large current account surplus. As of this writing (9 March 2022), some foreign jurisdictions, especially in Europe, remain reluctant to ban imports of Russian gas and oil. Unless foreign energy imports from Russia fall, the post-invasion surge in energy prices will further expand Russia’s current account surplus, which exceeded $100 billion in 2021. However, to the extent that governments impose secondary sanctions, the revenues from Russia’s energy sales may become inaccessible. In that case, the current account surplus would effectively be turned into frozen financial assets trapped abroad (much like the central bank’s assets).

Prior to the sanctions, commentators suggested that Russia had built a "war chest" of currency reserves to make it immune to international opinion. Has this strategy now failed?

So far, the war chest strategy has failed. Even Switzerland, a country that zealously guarded its neutrality for centuries, is imposing sanctions on Russia. There is always the possibility that some jurisdiction will allow Russian entities to transact, providing a path around the sanctions. However, if they try to do so, sanctioning governments could impose additional secondary sanctions on the entities facilitating transactions.

What tools does the Bank of Russia have to stabilize the financial system and the economy?

The Bank of Russia retains control of its domestic balance sheet, and the government more generally has important tools for financial stabilization. First, having boosted its policy interest rate sharply in support of the ruble, the central bank can raise this rate further. (Note that this will further tighten financial conditions in Russia, adding to the downward pressure on economic activity, which is already suffering from the sanctions.) Second, the Russian authorities can further strengthen capital controls, which currently restrict the sale of rubles and compel exporters to convert foreign currency revenue into rubles. Third, the Bank of Russia retains the ability to lend in rubles to commercial banks, providing the liquidity (paper currency) necessary to stem bank runs.

Russia does not have a central bank digital currency (CBDC). Had a ruble CDBC existed, would the war and sanctions have had a different impact?

In response to the war and sanctions, households and firms converted bank deposits into paper currency. Had there been a ruble CBDC, this run out of Russian banks and into CBDC likely would have been even larger and faster, as well as invisible. At the same time, to the extent feasible under the sanctions and Russia’s capital controls, foreigners would have rushed to dispose of their ruble CBDC. Since the central bank can alter supply elastically, the net result of this would likely be a large increase in CBDC

What is SWIFT, and how does it work?

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a Belgian cooperative that supports the execution of financial transactions and payments between banks worldwide. It is best known for its secure and trusted messaging system, which transmits roughly 42 million messages per day.

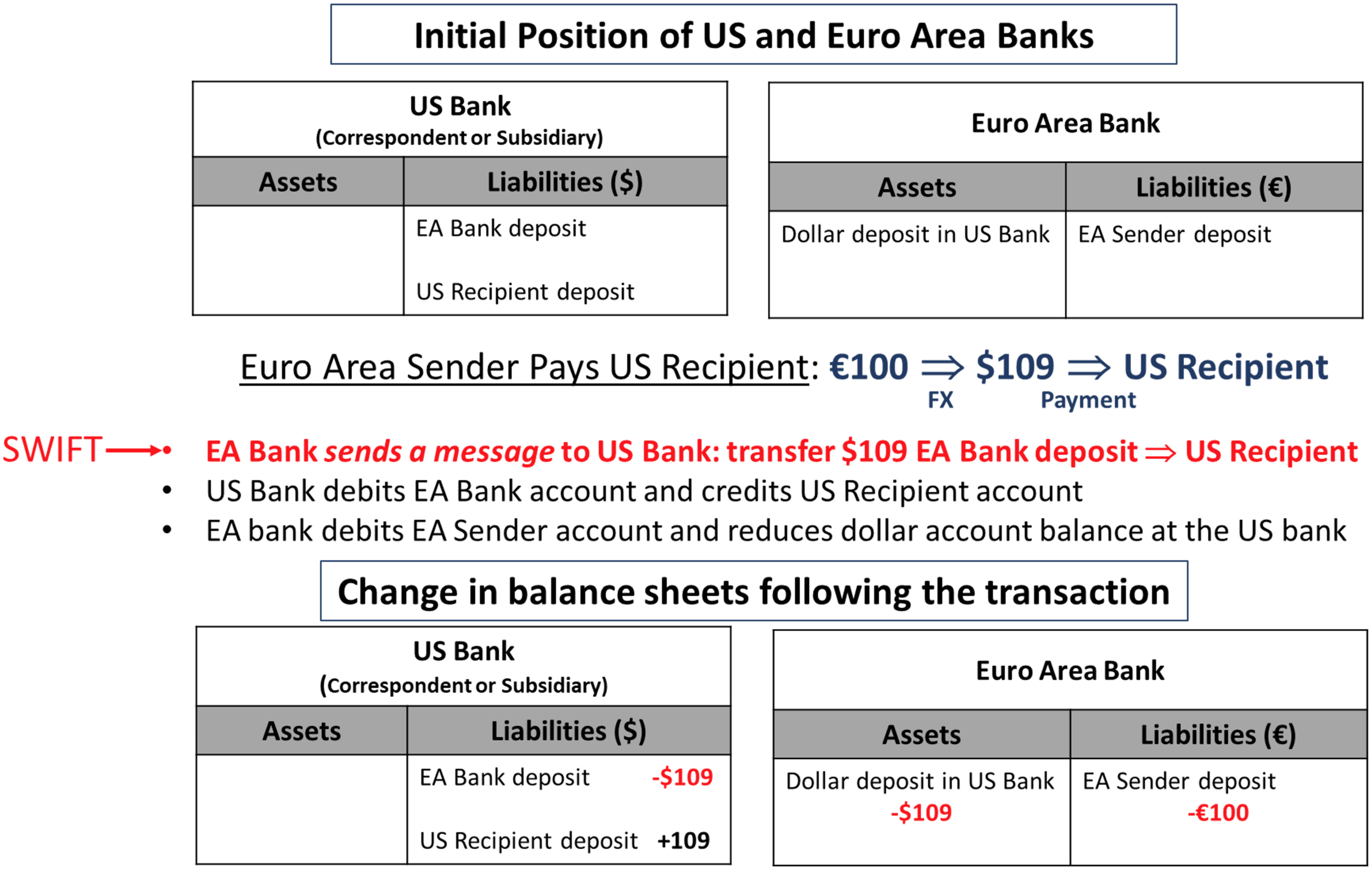

To understand the role of SWIFT in the payments system, consider a cross-border transaction where someone in the euro area (EA) wishes to make a payment to someone in the United States. The following figure displays a simple version of what happens when an EA payer instructs their bank to convert €100 into U.S. dollars and send the funds to a U.S. recipient. We simplify this by assuming both that the payer’s euro area bank has a U.S. correspondent bank or a U.S. subsidiary where it keeps an account in U.S. dollars and that the U.S. recipient has an account at that same bank.

Source: Authors.

Upon receiving the request from their customer, the euro area bank sends an instruction via SWIFT to the U.S. bank (their correspondent or subsidiary) to make the payment to the desired recipient. The U.S. bank then transfers the funds from the euro area bank’s account to that of the U.S. recipient. Meanwhile, the euro area bank debits the payer’s account and reduces the balance in their account at the U.S. bank.

Since SWIFT is solely a messaging system, one would think that there are ways around it. Indeed, banks executed cross-border payments long before SWIFT started operations in 1977. However, because SWIFT is cheap, fast, and widely trusted, it has become the dominant bank-to-bank messaging system. Most importantly, those receiving messages through SWIFT can verify the identity of the sender and ensure the instructions are genuine. So, while it is possible to switch to alternatives (maybe even using social networking and communication platforms), it would almost surely be costly and time consuming.

What does it mean to exclude a bank from SWIFT?

If a bank is kicked out of SWIFT, it is no longer allowed to send or receive messages. Because SWIFT is not able to distinguish the purpose of a transfer, an intermediary cannot be “partly” in the system: it is either in or out. However, if an excluded bank can find another bank willing to process transactions on its behalf—acting as its correspondent—then the impact of exclusion from SWIFT could be limited.

Given the importance of energy payments to Russia, how are these payments being made?

At this writing, Russian sales of natural gas and oil are explicitly excluded from the sanctions. That is, buyers of energy outside of Russia are allowed to make payments to their Russian supplier. For example, a euro area energy importer can make a transfer in euros to the account of the energy supplier at any bank outside of Russia (so long as the bank is willing to continue to process transactions and maintain an account). Since the largest Russian bank (Sberbank) and one of the primary energy sector banks (Gazprombank) retain access to SWIFT, the sanctions as currently designed to allow energy consumers outside of Russia to continue to purchase (and pay for) Russian energy exports.

Why are Russia’s energy exports so important for the effectiveness of sanctions?

Russia is a leading energy producer. In 2018, it accounted for 21% of world gas exports—making it the dominant supplier—and for 11% of oil exports. Russia’s energy lever over Europe is especially large. To see this, note first that the European Union (EU) produced only 39% of the energy that it used in 2019 (see here). Second, the majority of energy consumed came from fossil fuels, including 36% from petroleum products (mostly crude oil) and 22% from natural gas (see here). Putting these together, we infer that most of EU fossil fuels are imported.

Within the large universe of EU fossil fuel imports, Russia accounted for the largest shares of both crude oil (27%) and natural gas (41%) in 2019. (In that year, by our rough calculation, EU imports of oil and gas from Russia accounted for about 17% of total EU energy.) Importantly, it is more difficult (at least in the short run) to find substitutes for natural gas imports than for crude oil imports. Moreover, in some countries (including Germany), the reliance on Russian gas is greater than the EU norm.

While Europe aims at sharply reducing this dependency (see here), the European sanctions on Russia currently do not ban energy imports. Given the enormous size of the resulting revenue—especially now that prices have surged—this energy exclusion is undoubtedly the largest hole in the current sanctions regime. Perhaps for that reason, the jump thus far in the inflation-adjusted price of oil (see chart) remains smaller than the record spikes in 1979 and 2008 (see chart below).

Inflation-adjusted price of oil (Jan 1970=100), 1970-Mar 2022

Notes: The figure shows the ratio of the WTI oil price to the U.S. CPI. The February and March 2022 CPI figures assume a 7.5% year-to-year increase (as occurred in January 2022). The March 2022 WTI price is the price observed on 8 March 2022. Source: FRED.

As the Russian war on Ukraine persists, the popular pressure on European politicians to ban Russian energy imports is likely to intensify. A recent study using a state-of-the-art macro-sectoral model concludes that the economic cost in Germany of a halt to energy imports from Russia would be “substantial but manageable,” reducing GDP by between 0.5%-3%. This compares with the 4.5% plunge in the pandemic (see Bachmann et al).

Outside of energy, how do the sanctions affect trade with Russia?

Russia has significant influence in numerous commodity markets beyond energy. As a result, the sanctions and war-related port closures are fueling price spikes that could further damage those imposing the sanctions. For example, wheat production in Russia and Ukraine accounts for about one-third of the world’s supply. So, unsurprisingly, wheat prices are up about 50% since the invasion started. Similarly, Russia is a major producer of metals—including aluminum, copper, nickel, palladium, and zinc. Prices of those are at multi-year highs, as well.

At the same time, the sanctions are encouraging many leading financial and nonfinancial firms to reduce or exit their Russian operations (see here and here). The affected sectors include automobiles (Ford, GM and Volkswagen), aviation (Airbus and Boeing), energy (BP and Exxon), entertainment (Disney and WarnerMedia), shipping (Maersk and MSC), and technology (Apple). The unprecedented speed and breadth of these actions by private firms is consistent with the view that Russia will remain an undesirable place to do business for an extended period.

Broadly speaking, these developments affect both those imposing the sanctions and their targets. The war is further exacerbating already-strained global supply chains and diminishing or cutting off shipments from Russia and Ukraine. Voluntary pullbacks by trading firms and shippers that are reluctant to handle Russian exports are further amplifying the shock.

Aside from expanding military actions beyond Ukraine, how can Russia retaliate against those imposing sanctions?

Russian retaliation can take many forms. One often cited in the press is the possibility for cyberattacks. Following Russia’s invasion of Ukraine, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) issued a “Shields Up” warning to all organizations “to be prepared to respond to disruptive cyber activity.”

Russia already is adding to the challenges facing foreigners doing business in Russia and nonresident owners of Russian assets through limits on activity and on asset sales. For example, for entities from states that are imposing sanctions, Russia now requires prior approval of transactions that transfer title of domestic securities or real estate. Going forward, Russian entities can opt to default on external debt, which totalled $478 billion at the end of 2021 (including $62 billion of federal sovereign debt, of which $20 billion is denominated in foreign currency). But, since Russians own more foreign assets than foreigners own in Russia, it is a net creditor to the rest of the world (see Milesi-Ferretti). Ordinarily this creditor position is a sign of financial well-being. With effective sanctions, however, it can be a source of vulnerability as foreign governments can limit access to Russian assets abroad – which is exactly what they are now doing.

Can crypto provide a means to evade the sanctions?

Many people, including several U.S. senators, are asking whether crypto assets could facilitate Russian evasion of the sanctions. So far, two leading crypto exchanges (Coinbase and Binance) have rejected calls for a ban on Russian users. However, this reluctance to support widely popular sanctions invites greater scrutiny and regulation of these “on- and off-ramps” that allow transfers between the crypto world and the ”traditional” financial system. In addition, at this stage, the crypto infrastructure is unlikely to be sufficiently scalable to provide a large escape hatch from the sanctions. For example, while the traditional financial system processes trillions of dollars of payments daily, bitcoin transactions typically run below $10 billion. So, while it may be possible for individuals to transfer small amounts (say, tens of thousands of dollars), it seems extremely unlikely that crypto assets can provide an avenue for very large transfers.

Are there systemic risks arising from the sanctions or from retaliation?

The history of sanctions is they affect both those imposing the sanctions and the target.

For example, severing financial ties with Russia could damage financial institutions outside Russia. In absolute terms, the largest financial exposures to Russian appear to be those of French and Italian banks, while Austrian banks were most exposed relative to their total assets. (These comparisons are based on the September 2021 observations from Table B4 of the BIS Locational Banking Statistics.) Over the past month, one measure of systemic risk for European financial institutions—the NYU Volatility and Risk Institute’s SRISK, which projects the aggregate capital shortfall conditional on a large equity market plunge—shows a rise of 26% to $1.55 trillion. However, this total remains well below the level at the height of the 2011-12 euro-area crisis.

Going forward, the continued closure of markets for Russian equity, combined with debt defaults, could have a further effect, but the impact remains uncertain.

If the sanctions stay in place, what will be the impact on Russia's economy and people?

Unless Russia can evade the sanctions, the longer they are in place, the greater the economic cost. For example, important sectors of the Russian economy, including the technology sector, rely on imports that currently are not available. In the long run, a Russian economy in autarky—completely cut off from the rest of the world—will have lower income, productivity and growth.

Could a similar strategy be used against the Fed or ECB by its enemies in future?

The success of the current strategy relies on global cooperation and coordination. If the entire rest of the world were to sanction the United States or the euro area, it would have a large impact. However, both the U.S. and the euro-area economies are far more diversified than the Russian economy, so they would likely adapt to isolation more easily than Russia. Moreover, because it runs a large current account deficit and has large net liabilities to foreigners, the cost of attempting to isolate U.S. economy would fall to a much greater extent on foreigners than the cost of isolating Russia.

At the same time, one vulnerability for the United States is its large government budget deficit. If the United States was financially cut off from the rest of the world, it would have to find a way to finance this deficit internally or shrink it rapidly. Either outcome could prove painful.

Acknowledgement: We thank Tim Phillips (VOXEU) for posing nearly one-half of the questions we address here. Tim’s videocast is available here.