Can Margin Requirements Improve Financial Resilience?

Eight years after the financial crisis began, the regulatory reforms it spawned continue apace. Over the past year, regulators introduced total loss absorbing capacity (TLAC) and the liquidity coverage ratio (LCR) to make banks more resilient. And, with an eye toward strengthening market function, authorities continue to push for central clearing of derivatives (CCPs).

Overlapping with these goals—and extending to nonbanks—is the recent move to establish standards for margin requirements in securities transactions: that is, the maximum amount that someone can borrow when using a given security as collateral.

In this post, we will explain the role of margin requirements and why regulators are spending their time and energy to alter them. Our view is that higher margin requirements can be helpful in controlling the buildup of systemic risk, but that other mechanisms for improving financial resilience (like higher capital requirements and the shift of trading to central clearing parties) are more effective.

If there is one thing that we learned (again) from the crisis it is that high leverage poses risks to the financial system. Economists generally extol the virtues of financial intermediation—the act of channelling resources from those who have them (savers) to those who can use them most productively (issuers of debt or equity). But there is a tendency for the users of funds to amass too much debt. And when the intermediaries themselves rely too heavily on debt—especially short-term debt—it makes the entire system fragile.

Financial intermediaries – banks, insurance companies, pension funds and the like – borrow in a variety of ways. Some of these, like taking deposits or issuing bonds, are straightforward. Others, like short-term repurchase agreements and securities lending transactions are less transparent. Recently, the members of the Financial Stability Board (FSB), which includes the United States, agreed to a set of international standards for the setting of margin requirements on the second of these. And press reports indicate that the Federal Reserve is considering changes in order to meet these new standards.

Many investors are familiar with the margin requirements that limit borrowing to purchase stock. Through Regulation T, the Federal Reserve Board caps that borrowing at 50% of the market value of a stock. That is, if you wish to purchase $1,000 worth of stock, you can borrow up to $500 from your broker to do it.

We should mention that the term “haircut” is used interchangeably with margin. These two ratios are identical: the minimum margin is the fraction of the value of the asset that must be funded with cash, while 100% minus the haircut is the fraction of underlying collateral that can be borrowed.

Collateralized borrowing is a risky business: if the value of the asset pledged to secure a loan falls, the borrower is likely to face a “margin call”—requiring that they sell the asset or put up cash to reduce the loan to the permissible limit. To see what can happen, assume that you purchased $1,000 in stock with a $500 loan and the margin requirement is 50%. If the value of the stock now falls to $900, then the maximum borrowing declines to $450. At this point, you will face a margin call: you need to send your broker $50 immediately. If you don’t, the broker (who holds the shares in custody just in case this happens) has the authority to sell the shares to recoup the entire $500 loan, sending you the remaining $400 (or whatever is left).

Consider how this scenario plays out if it is initiated by a large, sudden decline in the equity market. Falling stock values will prompt many margin calls to investors. And, into this falling market, investors are forced to pony up cash to meet the margin requirement or their brokers are forced to sell. This sale presumably drives prices down further, prompting additional margin calls and further price declines. This is a fire sale.

As if this weren’t bad enough, there is a second powerful influence that aggravates fire sales. A large sudden fall in prices mechanically increases widely used measures of risk. For example, adding one very large negative observation to the computation of the standard deviation of stock returns raises the estimated dispersion of returns. As risk metrics increase, lenders become more cautious, demanding more collateral from borrowers by raising haircuts. This forces more sales, further exacerbating the price collapse.

These spirals—falling prices that lead to margin calls and forced sales that precipitate additional price declines, triggering further margin calls—were a feature of the financial crisis. A few numbers help to show what happened. Lending inside of the financial system peaked in mid-2008, when primary dealers reported total repurchase agreements (overnight, continuing and term) of roughly $4.5 trillion. And securities lending, another form of collateralized borrowing, had reached $2.5 trillion globally. (Economists at the New York Fed have recently published a comprehensive discussion of U.S. repo and securities lending markets. You can find it here.)

But then the self-reinforcing doom loop got going. Asset prices fell, haircuts rose, and forced sales ensued. Markets became illiquid, valuations uncertain, and counterparty risk concerns rose sharply. As a result, collateralized lending among financial intermediaries collapsed. By the beginning of 2009, securities financing had plunged by half: primary dealer repo dropped below $2.5 trillion and securities lending was just over $1 trillion.

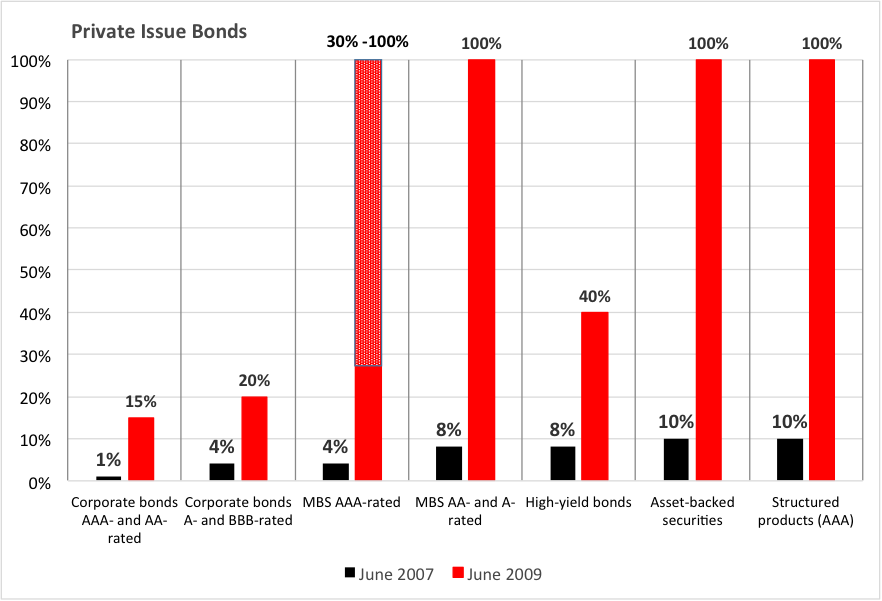

A sharp rise in the haircuts that dealers and banks imposed on borrowers added fuel to the fire. The following two charts, drawn from a BIS study published in early 2010, shows how haircuts rose during the crisis. Note that the vertical scale in the two panels is dramatically different, with haircuts on medium-term U.S. agency debt (which is government guaranteed) shown in the top panel rising from 1% to 7%, and those on AAA-rated structured products in the bottom panel jumping to 100%, implying that these customized securities were no longer accepted as collateral.

Indicative Haircuts before and during the Financial Crisis: Government Guaranteed Issues (Top Panel) and Private Issue Bonds (Bottom Panel)

Source: Committee on the Global Financial System. The role of margin requirements and haircuts in procyclicality. CGSF Report No 36, March 2010.

These surging haircuts—the repo market equivalent of a run on bank deposits—came at the worst possible time. By making funding all but impossible, they forced financial market participants to sell assets that had already fallen in price and for which there were few buyers. Put another way, the financial system functioned in a strongly procyclical manner: as asset prices fell, lenders retrenched, triggering fire sales, driving prices even lower. (See academic discussions of these market dynamics here and here.)

The question for authorities is whether there is a way to keep this run on repo and securities lending from recurring (for example, if bank counterparties worry about banks’ widening losses on loans to energy producers). For banks, the approach has been to strengthen capital and liquidity requirements. According to the New York Fed study, the U.S. unweighted leverage ratio, which sets a minimum capital requirement of 5% of total assets, already is reducing repo activity. And, liquidity requirements (especially the net stable funding ratio) are poised to reduce securities lending activity. So, things appear to be going in the right direction (although we believe that capital requirements remain well below the level needed for making the financial system safe).

The new international standards put forth by the FSB a few months ago are designed to address the securities financing transactions of nonbanks. Commonly known as “shadow banks,” these include money market funds, hedge funds, other asset managers, and similar entities that do not face the new, more stringent capital and liquidity requirements for internationally active banks established under Basel III.

The idea is that we can reduce both overall leverage and the procyclicality of the system by raising minimum haircuts. Will it work?

It might, but we are cautious for two reasons. The first is the fact that financial intermediaries often invent clever ways to borrow if that is what they really wish to do. This is true even of households: if someone strongly wishes to borrow to purchase stock, they can usually get a home equity loan, or (if they are truly desperate) a cash advance on their credit card.

Beyond that, unless the minimum haircuts in good times are set at the level that the market itself will impose during a crisis—that is, so high that a range of securities would simply not be eligible collateral—the system will remain procyclical. It is always important to keep in mind that, while regulations bind in good times, market discipline binds in bad times.

So, short of banning the use of even AAA-rated structure credit instruments or certain asset-backed securities as collateral for loans, we should continue to look for other solutions—in addition to higher margin requirements.

Another means to boost resilience is to force all repo and securities lending to be centrally cleared. Tri-party repo is a version of this today, with a clearing bank acting as the central counterparty. If central counterparties (CCPs) were converted into not-for-profit utilities with public backstops, margins could be set based on longer-term estimates of valuation risk than are commonly used today. That is, the CCP could set margin requirements and haircuts on a through-the-cycle basis, reducing the amplification that is naturally created by the dynamics of forced sales. Such a public utility CCP also would reduce counterparty risk, which contributed greatly to the spike of haircuts after the Lehman failure in 2008.

Of course, the CCP would itself be systemic, but since everyone knows this in advance, regulators can focus their attention where it is most needed. This is precisely the logic of the Financial Stability Oversight Council in designating eight CCPs as financial market utilities.