This week, we saw new heights of turbulence in the tempestuous crypto world. Market capitalization plunged as the loss of confidence in a popular coin—designed to be pegged to the dollar—triggered a run that fueled widespread contagion. At this writing, the estimated value of all crypto assets stands at $1.1 trillion, down nearly 60 percent from the $2.7 trillion peak in early November. What are the broader implications for the crypto world and the traditional financial system? Do we face the prospect of the famously volatile world of crypto-assets and decentralized finance (DeFi) undermining the stability of traditional financial (TradFi) system and the real economy?

So long as all these crypto-assets remain confined to the DeFi world, they pose no threat to TradFi or to economic activity. Like the assets in a multiplayer online video game (like World of Warcraft or Final Fantasy IV), their prices can move up and down while investor/players trade, borrow and lend both underlying crypto-assets and their derivatives. Occasionally, of course, someone exchanges conventional money or assets for the crypto variety, establishing prices in terms of fiat money. But if virtually all the transactions were to remain internal to the DeFi world, the process might as well be occurring on Mars, leaving TradFi unaffected. In practice, the fact that enormous fluctuations in value are met with a global shrug (at least so far) is prima facie evidence that crypto-assets currently are systemically irrelevant.

But will crypto-assets remain so disconnected from TradFi and from real economic activity? Crypto instruments already are escaping the DeFi metaverse in notable ways. These include the use of crypto-assets as a means of payment (see our earlier post on stablecoins), as collateral for loans and mortgages, and as assets in retirement plans. Moreover, many businesses are exploring the possibility of substituting crypto and DeFi for TradFi, while banks and broker-dealers are providing clients with the ability to trade crypto-assets in an effort to protect their franchises. Consequently, it is easy to imagine how the crypto/DeFi world could infect the financial system that facilitates real economic activity.

These concerns lead us to ask two related questions: First, how will the risks arising from crypto and DeFi evolve? Second, how will regulators deal with them if and when they do? This post is the first in a series that aims to address these questions. As befits a primer, we start with the basics: characterizing crypto-assets and DeFi. In the process, we define common terms and highlight analogies between DeFi and TradFi. For readers who would like to go deeper, we link to a range of studies that provide useful background information.

In a future post, we will highlight that the problems which frequently arise in TradFi (ranging from fraud and abuse to runs, panics, and operational failure) also appear in DeFi, while the aim of DeFi to avoid any discretionary intervention renders key TradFi corrective tools (such as the court adjudication of incomplete contracts) inoperable. Eventually, we also will post about regulatory approaches that can address the risks posed by DeFi, while supporting responsible financial innovation that lowers transaction costs and broadens consumer choice.

Crypto and DeFi: The Basics

At the most fundamental level, crypto-assets and DeFi are a collection of entries in a digital database, along with the algorithms and protocols (computer code) that change those entries. Together, these form a system that replicates the TradFi use of ledgers to record transactions and ownership (a database), along with the rules and procedures for altering these records (the protocols). Built on these fundamentals, crypto-assets provide mechanisms for making payments, storing value, and transferring risk, while DeFi offers markets in which owners can buy and sell these assets.

Put differently, everything that goes on in this new financial world has analogs in the traditional one. However, there is one big difference: much (but not all) of the crypto/DeFi world is devoid of financial institutions as we know them.

Blockchain and Native Coins. Before getting to any details, we need to explain two fundamental objects in the crypto world: a blockchain and a native coin. A blockchain is a tamper-proof digital ledger that contains a set of records (see our earlier primer). The address of an individual record in this ledger may have one or more entries. In the simplest case, like the original Bitcoin blockchain, the address has only one object which specifies the number of coins native to the blockchain–in this case, Bitcoins. (We note that the blockchain technology has actual or potential applications that extend well beyond crypto to areas including logistics, real estate, collectibles, and art.)

To access their specific address on the blockchain, an owner of bitcoins uses a cryptographic key. The block records the change in the state of the system—that is, it identifies how Bitcoins move from one address to another. (Bitcoin addresses are individually distinct, similar to serial numbers on fiat currency notes.) The full blockchain is the sequence of blocks that tracks the complete history of the states as they evolve.

A native coin plays two roles. First, it attempts to mimic conventional fiat currency by serving as a means of payment, a store of value, and a unit of account outside of TradFi. Second, it is integral to the maintenance of the blockchain, which relies on costly schemes to ensure the legitimacy of each new block.

According to CoinMarketCap, there are more than 10,000 native coins today, but only a dozen have a market capitalization exceeding $10 billion. The biggest are Bitcoin and Ether, with current market cap of $583 billion and $254 billion, respectively. The large number of native coins highlights the fact that creating one entails minimal cost, while the concentration of market cap in a few instruments reflects the network externalities that are common among means of payment: broad use makes them more liquid, fostering even wider use.

In the absence of institutions that carefully authenticate the transactions on their own balance sheets, how is a change of the blockchain, such as a sale or purchase of a native coin, implemented and verified? Today, the most common scheme for obtaining the right to add a block is a proof-of-work (PoW) mechanism which requires the use of enormous computing power to solve complex, but otherwise useless, mathematical problems before allowing any update to the blockchain. The “miner” who solves the math problem records requested changes in a new block. For this recording and validation service, the miner receives compensation in the form of native coin from the person who wishes to make a transaction (such as a purchase or sale of the native coin). In some cases, new coins minted with each additional block also compensate the miners for their efforts.

PoW mechanisms in use today are extremely energy-intensive. For example, maintaining the Bitcoin blockchain alone currently has a carbon footprint equal to that of the Czech Republic, a country of nearly 11 million people (for a current estimate, see here).

Importantly, the digital ledgers used in the crypto/DeFi world have many copies, all with equal standing. That is, no single version is authoritative. We call this a distributed ledger. For the leading crypto instruments, anyone who satisfies the costly PoW requirement can update this distributed ledger. That is, they are open access and permissionless. As a result, no single agent oversees the accuracy of the ledger. In contrast, TradFi ledgers are proprietary and permissioned: for example, a bank has the sole ability to alter and validate its account records, even if it maintains multiple copies and allows some clients and contractors to view the records and submit proposed changes.

When a change occurs in a distributed ledger, the new version needs to be transmitted to everyone else that needs to know the current state, including miners around the globe who are working to make further changes and record the next set of transactions. This process of sending copies of the ledger around the world takes time, placing a physical limit on the speed at which transactions can be processed, even though this information is transmitted electronically at virtually the speed of light. And, because anyone can function as a miner, there are automatic procedures to ensure that conflicting transactions (such as instructions to transfer the same Bitcoin twice) do not get executed. Avoiding these conflicts is critical for the integrity of the crypto world, not least by preventing someone from selling an asset they do not possess.

Crypto-assets

We now extend the description of crypto-assets and DeFi. What functions do they serve, and how are they related to the TradFi system?

The Financial Stability Board (FSB) defines a crypto-asset as a private-sector digital asset dependent on cryptography and utilizing distributed ledger or similar technology. In practice, we can divide crypto-assets into three categories: those that mimic traditional financial assets; stablecoins; and those with no explicit backing whatsoever. The first category, security tokens, are digital representations—stored on a blockchain—of stocks, bonds, derivatives, and other conventional securities. A useful analogy is to depositary receipt—a claim issued by a custodian that corresponds to an underlying conventional instrument (such as an equity issued abroad) which is held in custody.

Turning to stablecoins, and again relying on the FSB’s definition, these are a “crypto-asset that aims to maintain a stable value relative to a specified asset, or a pool or basket of assets.” The most common stablecoins aim to maintain value equal to a unit of fiat currency, such as the U.S. dollar or the euro. Within this category, there are reserve-backed stablecoins that are backed by conventional instruments and algorithmic stablecoins that are typically backed by other crypto-assets.

Reserve-backed stablecoins are the liability of an issuer that maintains a balance sheet with assets of equal value. This entity’s balance sheet looks like that of a money market fund (which has no equity capital). As we discuss in an earlier post, the two largest reserve-backed stablecoins are Tether (current market cap US$79 billion) and USD Coin (US$50 billion) that are both linked to the U.S. dollar. The quality and character of their reserve assets is a subject of some debate. Tether says that much of its assets are in the form of bonds, loans and commercial paper (which are not held in the United States). In the case of Circle, which issues USD Coin, a U.S.-based accounting firm confirms each month that the reserves are primarily “cash and cash equivalents,” without revealing their precise composition.

Turning to algorithmic stablecoins, to maintain the stability of their value against a fiat currency, the supply changes automatically according to a pre-determined rule. But even within this crypto-asset class, there are various approaches to attempting to maintain a peg. At one end of the spectrum, DAI is issued by MakerDAO and collateralized by Ether (ETH), the native coin of the Ethereum blockchain. Currently, the collateralization rate for DAI is 150%, so someone depositing $150 worth of Ether can then mint or borrow a maximum of 100 DAI (equivalent to $100). We can think of this transaction as occurring on a balance sheet where assets rise by $150 worth of ETH and liabilities by 100 DAI, boosting net worth initially by $50. Now, if the value of the ETH backing falls below $150, then the collateral is automatically liquidated (with a penalty) to repay the loan, putting further downward pressure on the price of ETH. Arrangements of this type (such as margin loans) can lead to forced selling and market instability.

The algorithmic stablecoin Terra that collapsed this week relied on a different protocol (based on the crypto-asset Luna) to support the dollar peg from that of DAI and Ether. In Terra’s case, the algorithm did not require deposit of existing Luna as collateral. Instead, investors could exchange Terra for newly-minted Luna. This mechanism for supporting Terra magnifies the potential for instability: as a loss of investor confidence depresses the price of Luna, even more Luna is minted for each unit of Terra that is exchanged. The resulting plunge of Luna’s price led to an ever-larger supply, accelerating its dollar price toward zero. This death spiral culminated with Luna being worthless and the halting of the Terra blockchain on 12 May 2022.

Uncollateralized crypto-assets (sometimes referred to as “unbacked”) form the third and final category, which includes everything that is neither a securities token nor a stablecoin. In additional to the many native coins described earlier, this broad class includes utility tokens (which provide access to a specific service or product on a particular platform) and governance tokens (which are a type of utility token that confers voting power on matters associated with the blockchain). We note that some of these coins can fit into multiple categories and exhibit more than one function.

In contrast to utility and governance tokens, most uncollateralized crypto-assets have no fundamental value. They neither represent claims on future cash flows generated by a productive entity nor do they give the owner the right to any service flowing from any tangible or intangible asset. Instead, their value stems from the belief of crypto-asset holders that they can convert these assets into a fiat currency which can be used outside of the crypto world. In this sense, the valuation of such crypto-assets more closely resembles that of fine art or collectibles, rather than the fundamental value associated with conventional equities, bonds, or deposit accounts at a bank.

DeFi

Decentralized finance (DeFi) is a set of financial markets, products and systems that operate using crypto-assets and “smart contracts” built using distributed ledger or similar technology. A smart contract is a piece of code that resides on the blockchain and executes when requested.

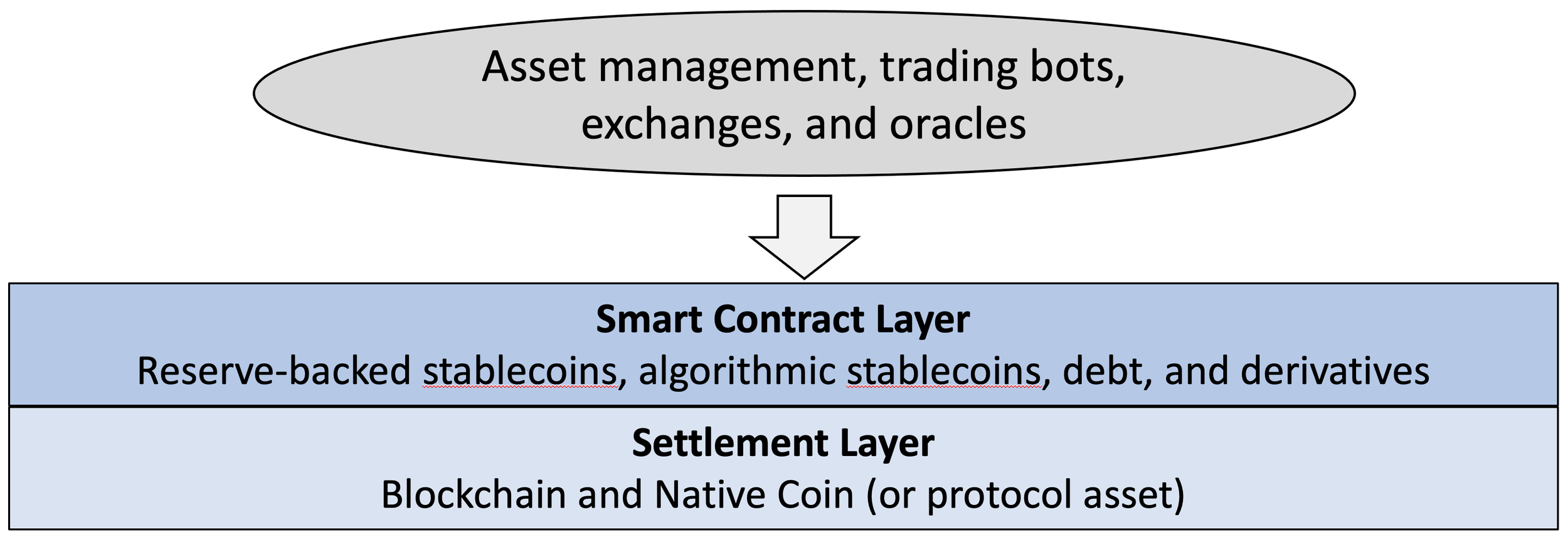

At the simplest level, we can think of DeFi as having two primary layers, as shown in the following figure. The bottom, or “settlement,” layer is simply the blockchain and its native coin. For example, Ether is the native coin of the Ethereum blockchain. Above this settlement layer lies the smart contract layer, where most pure DeFi activities occur. For example, this is where issuers like Circle and Tether mint reserve-backed stablecoins and where algorithms provide for trading, debt issuance and derivatives.

Simplified view of the DeFi world

Note: This diagram is a simplification of the IOSCO four-layer DeFi stack.

There also are a range of other activities—mostly occurring off the blockchain—that are linked to this simplified DeFi structure. These include asset management, automated trading bots, supply of data that are required inputs into conditional smart contracts, and blockchain governance arrangements (such as votes taken to determine the evolving structure of the blockchain). (In the language of DeFi, the suppliers of external data such as asset prices are known as “oracles.”) There also a range of other off-chain providers—including exchanges and app developers—who combine many of these activities to facilitate retail and wholesale access to the DeFi system.

To understand the mechanics of DeFi, it is useful to think of a smart contract as a vending machine. After someone identifies the quantity and type of the items they wish, and provides payment, the machine dispenses the desired objects. Indeed, this type of protocol is quite common even in TradFi. For example, crediting accounts with interest payments on a regular schedule requires that the bank’s (typically automated) operations receive signals on the interest rate and the date.

Ironically, however, “smart contracts” are not smart and they are not a contract. That is, they neither learn nor do they possess any of the essential elements that would make them legally binding. Instead, they are simply pieces of code (written by humans) that execute a set of operations in a nondiscretionary manner.

How big is DeFi today? While we have measures of the market value and turnover of the various crypto-assets, we do not have activity measures that correspond directly to those reported in the TradFi system. As a proxy for DeFi activity, we have the “total valued locked” (TVL) of assets that are deposited in DeFi protocols to secure transactions. One example of locked value is the market value of the Ether deposited for minting the DAI algorithmic stablecoin. For the most part, one can think of TVL as the value of collateral committed to support ongoing DeFi transactions.

The following chart shows the evolution of TVL from August 2020 to mid-May 2022 on more than 100 blockchains, ordered by their most recent TVL scale (with the largest at the bottom). We highlight two facts. First, over a period of 15 months from August 2020 to November 2021, TVL soared from $4 billion to nearly $250 billion, before plunging to $109 billion as of 13 May 2022. Second, the dominant blockchain for DeFi activity remains Ethereum, with Ether currently representing over 60% of the current total (and nearly eight times the second largest blockchain, BSC). Yet, while only 10 of the 100-plus blockchains have TVL in excess of $1 billion, the arrival since 2020 of many new blockchain entrants into the DeFi world has lowered Ether’s share over time.

DeFi: Total Value Locked (TVL), 14-day moving average, 8 August 2020 to 13 May 2022

Source: Defi Llama. The figure uses data downloaded on 13 May 2022.

DeFi is not decentralized. We conclude this primer by highlighting another irony: that decentralized finance is not decentralized.

By substituting algorithms for discretion, DeFi proponents hope to eliminate the need for any trust between counterparties or for external authorities to enforce agreements. Eliminating intermediaries would boost transactions efficiency and lower costs compared to TradFi. It also would purge the central nodes in a network that can make it more vulnerable to widespread disruption.

Attempts at decentralization are linked to several features of DeFi. These include the use of open-source code that anyone can check, a permissionless ledger with open access rights, and a system that is trustless in the sense that all transactions can be verified and unalterably stored on a public blockchain.

However, in its current incarnation, DeFi has important components that are clearly centralized. For example, while reserve-based stablecoins reside in a smart contract on a blockchain, allowing for automatic transactions, each coin is issued by a single off-chain entity on which the entire system depends.

Moreover, as Aramonte, Huang and Schrimpf note, a range of governance and technical considerations relating to scale and efficiency make it difficult, if not impossible, to decentralize finance in a sustainable way (see also Anker-Sørensen and Zetzsche and IOSCO). Where blockchains rely on specialized governance tokens to make fundamental rule changes, token acquirers (or those who implement a majority-voted change) can gain control over the assets that others hold on the blockchain. Similarly, the accumulation of massive computing power can allow individual miners (or mining pools) to impose their wishes on asset holders (say, by front-running requested transactions). Finally, the reliance of conditional algorithms on data or signals from outside the system can transfer power to the oracles that provide this information. For example, the data feeds for current market prices that a smart contract might require as a condition for code execution are often centrally controlled, leaving them vulnerable to manipulation.

Another challenge for decentralization is the lack of means for correcting DeFi errors or for protecting property rights. Legal recourse may not be available even in the case of outright theft or fraud, let alone the potentially extreme consequences of automatic transactions (such as we saw this week in the case of Terra and Luna). Against this background, meeting TradFi standards of consumer or investor protection almost surely requires moving away from pure decentralization.

The point is that our economies and financial systems require property rights and the rule of law to operate. But defining property rights is complex, and laws cannot be written to cover every possible contingency. The same goes for a smart contract. There always will be some conditions under which execution as previously agreed will not be appropriate (or even feasible). For this, TradFi relies on someone—usually a judge with the help of lawyers—to settle disputes. This suggests that true decentralization is undesirable, even if it were possible.

We conclude with the wise observations of John McMillan regarding self-regulating markets:

“In the elaborate exchanges occurring in modern economies, the state is indispensable, providing goods and services that markets would undersupply and acting in the background as market rule-setter and referee …. Spontaneous order works only when transactions are simple, and firms are small. Beyond that, the complete absence of government produces dysfunctional markets. A modern economy needs some management.”

Acknowledgements: Without implicating them, we thank Ethan Cecchetti for helping us understand crypto and DeFi technology and Richard Berner for very helpful comments.